Market capitalisation on the Nigerian Stock Exchange crossed N16 trillion at the close of trading on Wednesday, the first time the market would hit such.

Also, the All-Share Index rose by 830.52 points or 1.89 percent to close at 44,885.24 compared with 44,054.72 achieved on Tuesday.

Mobil Oil led the gainers’ table with N16.50 to close at N216 per share. Dangote Cement came second with a gain of N13 to close at N273, while Guinness appreciated by N5.70 to close at N119.70 per share.

Betaglass added N2.69 to close at N56.56, while Conoil increased by N1.97 to close at N41.38 per share.

Advertisement

Conversely, Nigerian Breweries led the losers’ chart, shedding N3.44 to close at N146.05 per share.

NASCON trailed with a loss of N1.10 to close at N21, while Zenith International Bank declined by N1.01 to close at N33.50 per share.

Cadbury depreciated by 80k to close at N15.31 while Dangote Flour Mills dipped 39k to close at N15.95 per share.

Advertisement

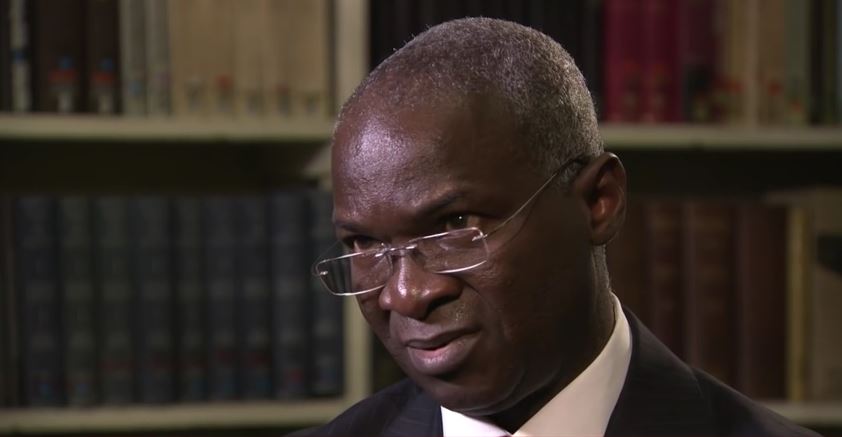

Commenting on the growth recorded by the market in 2017, Aliko Dangote, president of the Dangote Group and former chief executive officer of the NSE, said the bourse has the capacity to record double growth.

Dangote attributed the growth on the market to efforts made by the executives and policies of the government, especially the investors and exporters window.

“You can see the market doubling by the end of this year because the fundamentals are right. Our shares before were worth N25 billion, Dangote Cement alone. We still have enough to catch up,” he told Channels TV in an interview.

“The devaluation brought everybody down. Naira value, yes but in dollar terms, we still have a lot to catch up on. The market has just started and I won’t be surprised if by the end of the year I see the Nigerian Stock Exchange going another 50, 60 percent this year alone. It is possible.”

Advertisement

Add a comment