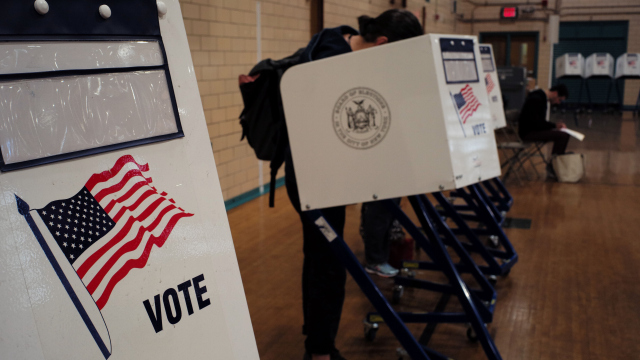

November 8, the US election day cannot be classified as a good day for the Nigerian Stock Exchange as it recorded a loss of N180 billion at the end of the trading day.

The market, which has been on a losing streak since the beginning of November, has recorded a total loss of 285 billion naira so far.

The market capital at the close of the trading day on November 7 was N9,255,798,205,287.80 and closed at 9,075,668,695,206.97 as traders offloaded positions at the market.

Guinness maintained it’s spot at the top of the gainers chart adding N2.5 to trade at N88.5 per share.

Advertisement

Dangote Cement led the losers chart, losing N8.42 on every share to trade at N164.01 per share.

Other gainers on the chart being Nigerian Breweries, Glaxosmith, Eterna and CAP PLC while Dangote Cement was followed by Forte Oil, Lafarge Africa (WAPCO), Okomu Oil palm (OKOMUOIL) and UACN on the losing side.

It is unclear if the US election, which is affecting markets across the world, is responsible for the losses recorded in the Nigerian market.

Advertisement

Checks by TheCable revealed that the Nigerian bourse, lost N33billion, after the Federal Bureau of Investigation (FBI) cleared Hillary Clinton, the US Democratic candidate of any criminal deeds, with respect to her private e-mails server.

According to Hussein Sayed, chief market strategist at FXTM, “the S&P 500 reacted as if a Clinton win looks more certain, surging by more than 2% and ending the 9 days losing streak, its longest in more than three and a half decades”.

“With almost 24 hours remaining to the election results, investors today seem to sit on the sidelines. The U.S. dollar is moving in a very narrow range and Asian equities are flat.”

Advertisement

Add a comment