Oando Plc says it was involved in the closure of a $925 million accordion agreement arranged and coordinated by the African Export-Import Bank (Afreximbank) for Project Gazelle, a crude oil-backed facility.

In business, an accordion feature allows organisations to increase their line of credit if needed, often to obtain more working capital or emergency cash.

In August 2023, the Nigerian National Petroleum Company (NNPC) Limited said it secured a $3 billion emergency crude repayment loan.

The loan was facilitated under a special purpose vehicle (SPV) known as Project Gazelle by Afreximbank to support the naira and stabilise the foreign exchange (FX) market.

Advertisement

In the deal, Nigeria pledged a total of 164.25 million barrels of crude oil — at 90,000 barrels per day — starting from 2024 to repay the loan.

In January, the NNPC received an initial disbursement of $2.25 billion of the agreed $3 billion under the crude oil prepayment facility – expecting to get a second tranche.

On June 6, Afreximbank said it arranged an additional disbursement of $925 million under the crude oil-backed facility — bringing the total current funded facility size to $ 3.175 billion.

Advertisement

In a statement dated June 7, Oando said it was party to the “successful closure of a $925m accordion arranged and coordinated by African Export-Import Bank (Afreximbank) for Project Gazelle”.

“The accordion arrangement saw a contribution of US$550m by Oando Trading, a subsidiary of Oando PLC. The balance $375m was raised by other parties to get a total disbursement amount of US$925m,” Oando said.

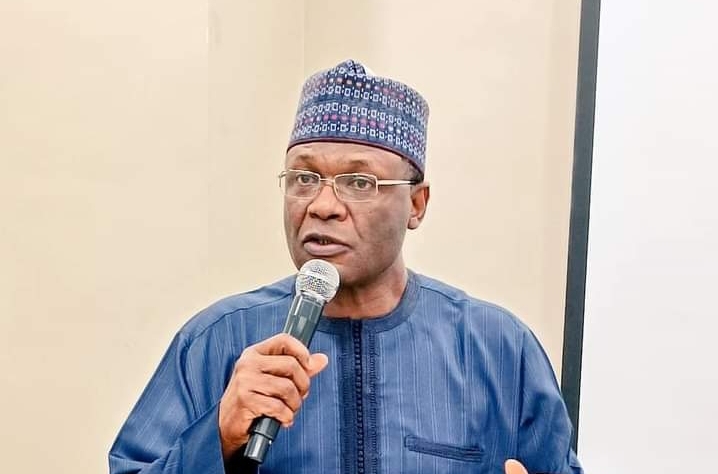

Speaking on Oando’s participation, Wale Tinubu, the company’s group chief executive officer (GCEO), said the successful completion of the deal signifies another victory for the company and the country as a whole.

“The transaction further reinforces Oando’s ability to create value and the Company’s status as the indigenous partner of choice in Nigeria,” he said.

Advertisement

“As a proudly indigenous company our ambition has always been to use our platform to support the sustainable development of the nation. Against this backdrop, Project Gazelle will be instrumental in realizing the Federal Government’s efforts to boost the country’s socioeconomic indices.”

Tinubu said Afreximbank as lead arranger would continue to support African corporations.

Add a comment