Oil prices are spiking to fresh highs, after the Organisation of Petroleum Exporting Countries (OPEC) reached an historic oil cut in Vienna on Wednesday.

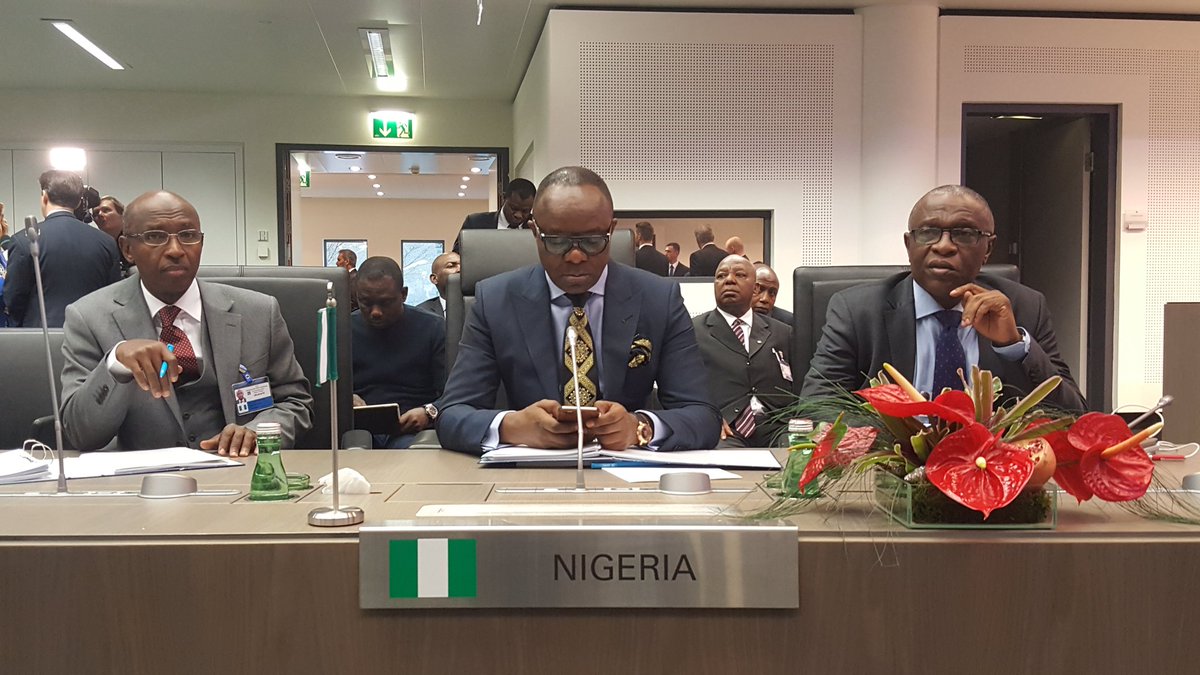

At the meeting, Ibe Kachikwu, minister of state for petroleum resources, said Nigeria needs oil prices at the mid 50s, adding that the the healthy oil price for Nigeria is from $54 to $56.

“I mean, if we have a Santa Claus day, then 60. But frankly, looking more to mid-50s,” he had said.

Less than 48 hours after Kachikwu’s remarks, Brent crude, the international benchmark for oil, rose by over $2 to $54 per barrel on the international market.

Advertisement

“Wednesday’s agreement has truly changed the landscape for oil over the coming years, putting a floor of $50 a barrel under oil prices,” Sam Wahab, director of oil and gas research at Cantor Fitzgerald Europe, told UK Guardian.

“It means 2017 will likely see prices around the $55-$60 a barrel mark, and we may yet see further jumps in prices as soon as next week if the non-Opec members also agree a production cut at their meeting on Friday 9 December.”

In the same breath, Kachikwu expressed worries about a surge of Shale oil production, which may affect prices, negatively, in the days ahead.

Advertisement

“If the prices are high, the incentive for shale production to begin to clobber back is also high. I think we are at a point where we have modestly been able to set a cap on a production but not excessively,” the former NNPC boss told Bloomberg.

“Apart from the OPEC cut, I am worried that when we make a cut and get the normal price there is the possibility of shale production limping up again.So how do we converge everyone producing oil?

“I believe that until we get Russia, US producers and some understanding with the consumers, we might not get a solution.”

Advertisement

Add a comment