The Nigerian Deposit Insurance Scheme had an event yesterday, which I was due to attend. Unfortunately, I had to skip town in a hurry, but a colleague attended on my behalf. The NDIC is one of those understated, but very important organisations in Nigeria. It was set up as a safety net for depositors in 1988 following the liberalisation of the banking sector and the reforms that followed.

Times have changed, and in our time, managing the risks associated with emerging technology without stifling innovation has become a major theme amongst regulators and policymakers. This is why the NDIC has established an ‘Innovation and Fintech Unit’ to work with emerging technology and provide solutions to improve the safety of depositors and the banking system.

To identify and insure non-bank deposit taking institutions licenced by CBN and other agencies, there is an ongoing engagement with the relevant regulatory agencies on how to actualise that within the limits of legal provision.

The NDIC says it is modernising its data collection and analysis through the use of fintech solutions/tools (Regtech and SupTech) to handle the following business processes better than currently being done: Risk Based Supervision (RBS), Monitoring Compliance, Premium Administration, Early Warning Signals, Stress Testing, Analysis of insured institutions’ performance etc.

Advertisement

Fintech is, in many ways, the future, and Nigeria’s emerging fintech scene has raised more than $600 million in funding. Last year it attracted 25 percent ($122 million) of the $491.6 million raised by African tech startups in 2019—second only to Kenya, which attracted $149 million. This year we all heard about PayStack and their exit. This gives you an insight into where fintech can go.

Nigeria offers significant opportunities for fintechs across the consumer spectrum, notably within

SME and affluent segments and, increasingly, in the mass-market segment. Fintech is still relatively young, and has serious growth potential because up to 40 percent of our population is financially excluded.

From yesterday’s event, I have a few recommendations to make:

Advertisement

Nigeria is in dire economic straits at the moment, but regardless of the impact of the current shock, there is a need to ensure that researchers and planners have the proper data to monitor and study fintech and big tech credit platforms.

Complementary efforts to bring fintech and big tech lenders into the fold of official regulatory reporting should continue apace, but regulators need to be a lot more careful about regulatory overreach as that can hurt the sector a lot more. One big risk from the regulatory point of view is the fact that our various agencies sometimes sing from different hymn sheets. This has to change.

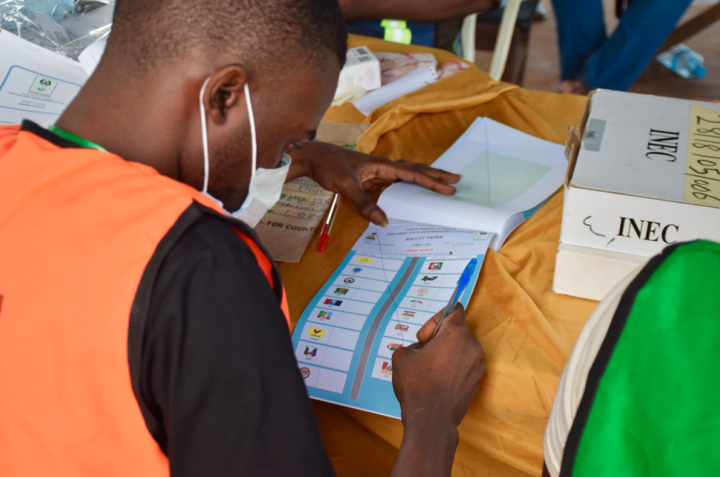

The regulatory effort must recognise two things – first, the process of collecting required regulatory data, from KYC to risk based transaction monitoring must be fully digitised and low cost. Fortunately, there are government institutions that have built silos of the required infrastructure for this, and fintechs like CredEquity that have aggregated these and can quickly deploy to help NDIC achieve this digitised coverage. Hence the framework will need to be less about the documents/artefacts like slips, bills, ID cards and focus on the information they contain and which are stored in databases.

Second, because these information points are in silos and are not centrally connected at government level, in order to achieve regulatory sufficiency (so we do not trade accuracy and completeness for digitisation or ease) aggregators as previously suggested are needed.

Advertisement

There is a need to facilitate skills development, and ensure competitive pay in order to attract and retain quality talent.

As regulatory oversight increases, a thorough understanding of financial services in the Nigerian context, particularly in compliance, is becoming a prerequisite for success. Most fintech have a technology background but limited experience in financial services and will need to ensure that they develop or acquire these competencies.

For the NDIC to effectively deliver on its mandate of consumer protection, it has to go beyond setting rules and actively create a body of knowledge and relationships built on a synergy between the traditional banking institutions and the unfolding fintech scene. This mix of relationships and insight is what would enable it to set the best framework for all parties involved.

Bankers cannot afford to operate at the high-risk range venture capitalists and visionaries typically operate in. They really should play safe and offer predictability that secures the economy. It takes a lot of time and scaled activity to know exactly how secure a new technology or market direction is and that risk should be carried by a sector that is somewhat detached from the core to keep the economy safe if things go bad.

Advertisement

Fintech companies have a better view of the needs and nature of the newer generation and their business patterns so they will be important in shaping the future of banking. Traditional Banking might appear to be staid but that conservative approach is why some banks have been around for over a century. Banks simply cannot afford to be wiped out with the ease that a software company can so what works best is a detached collaboration that brings the best of both worlds so a better future can emerge safely.

Banks should take equity stakes in fintech companies but understand that the conservative approach that serves them well in traditional banking could be a hindrance to adequately exploring the newer opportunities. So they can invest, offer institutional memory but deliberately limit how much influence they exert on the decision-making process so the visionaries can deliver.

Advertisement

The process of actively encouraging this synergy is what would give the NDIC the insight to create a platform of regulations that helps it achieve its goals.

Nwanze is lead partner at SBM Intelligence

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment