The presidency says the federal government is not experiencing any system issue delaying coupon payments to savings bondholders as claimed in reports on Friday.

A bondholder receives a coupon — known as an interest payment for investments in bonds — from the date of the bond issuance until the date of maturity.

Earlier today, a report said the federal government failed to pay coupons on two savings bonds on time and blamed the delay — being the second in two months — on system and processing issues.

The report also said the delayed payments are coming at a time when the government is under pressure from its rising debt burden.

Advertisement

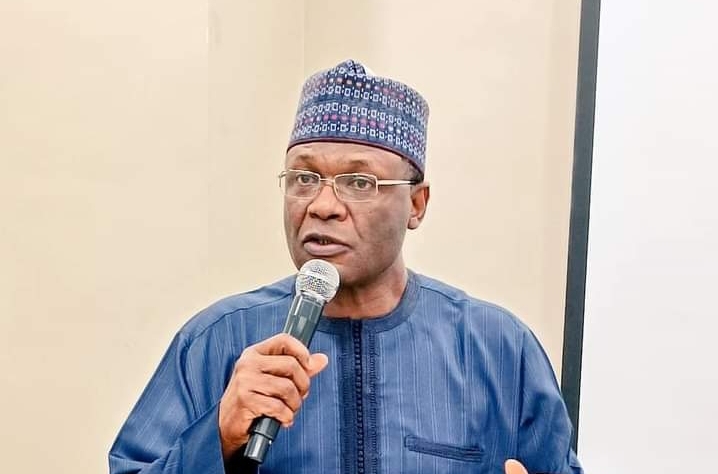

However, Bayo Onanuga, special adviser on information and strategy to President Bola Tinubu, said the report is “inaccurate”.

According to Onanuga, the government does not have any financial payments issues causing delays in servicing debts.

He also said the country was sufficiently liquid to meet all financial obligations.

Advertisement

“Nigeria has sufficient liquidity to meet all its financial obligations, and there is no default or delay in servicing our debts,” Onanuga said.

“According to Nigeria’s Finance Minister and Coordinating Minister of the Economy, Mr Wale Edun, the country currently owes no outstanding payments.

“Additionally, the Director General of the Debt Management Office, Ms. Patience Oniha, confirmed that, as of September 19, the Central Bank of Nigeria has successfully processed all due payments.

“The payment scheduled for today, September 20, is also being processed on time.”

Advertisement

Onanuga also said “any suggestion of systemic financial issues causing delays in bond payments is unfounded”.

The DMO usually issues savings bonds on behalf of the federal government every month.

The bonds are usually a two-year or three-year bond with coupon payments scheduled quarterly.

The initiative, introduced in 2017, is aimed to diversify Nigeria’s borrowing sources and offer retail investors an opportunity to earn income by investing in government securities.

Advertisement

On the government’s part, generated capital are used to support the fiscal policies and infrastructure development in the country.

Advertisement

Add a comment