The Debt Management Office (DMO) says Sukuk issuance may be upscaled to include other projects.

A Sukuk is a bond structured to generate returns without infringing the Islamic prohibition of interest.

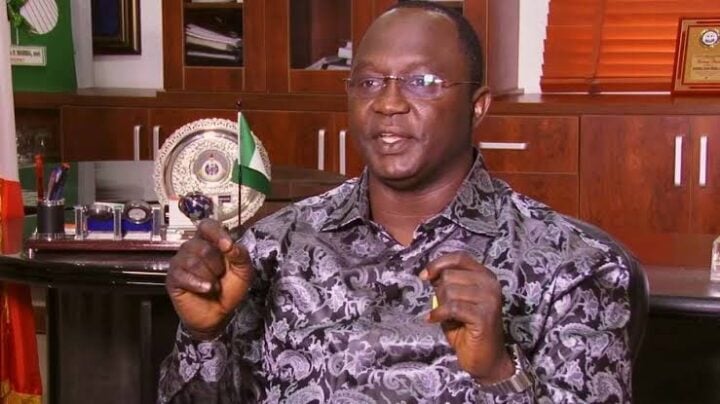

Patience Oniha, director-general of DMO, said this on Wednesday, at the third edition of Islamic Finance News Nigeria Road show, organised by Nigerian Exchange (NGX) Ltd.

NAN reports that the virtual event was themed ‘Systemic Restart: Islamic Finance in Nigeria’.

Advertisement

Although the diversification of projects might not be immediate, she said that all the three Sukuk issuances had been raised for road infrastructure.

The DMO DG said the issuance could be used to support other projects that would be revenue- generating to service the Sukuk, even if it had to be issued in another currency.

“Certainly, we are working on Sukuk issuance for 2021. We have already received notification of interest; we are in the process of appointing transaction parties. I expect that by the third quarter of this year (2021), it will be out; it will almost be the same structure, although tenure may be different,” NAN quoted her to have said.

Advertisement

“It depends on where market is at that time, what the cost is and also, what works with our medium term debt management strategy. On the long term, because market understands it, we also understand it; it may also be for road; that is the approval we have received. You know we have been using Sukuk for road projects.

“Going forward however, it may not be in the immediate term and not even next year; we need to upscale the Sukuk issuance to include other projects.”

She further explained that the existing capital market master plan recognised non-interest banking, which was initiated by the Central Bank of Nigeria (CBN), followed by the capital market, which also recognised non-interest financial products.

On deepening retail investments to position the capital market for economic growth, Oniha said there is a need to have a more diversified base of investors for all the products, especially as the government looks into huge investments on infrastructure for which funds may not all come from it.

Advertisement

Add a comment