BY OLUWASHOLA SAMUEL

In the face of challenges in traditional Nigerian banks, OPay has proven to be a trusted financial lifeline for millions of Nigerians. While traditional banking platforms experience downtime, OPay’s digital service has proven to be a resilient and reliable platform, offering swift and seamless mobile transactions, even during high-stress periods.

In recent times, major Nigerian banks have been grappling with various system upgrades and issues, leading to widespread disruptions in online banking services. From numerous failed transfers to inaccessible accounts, customers have had their daily financial activities severely hindered by these glitches. In response, many Nigerians are using OPay, which has consistently delivered fast, secure, and efficient money transfers without the complications experienced by conventional banks.

OPay’s platform provides solutions that allow users conduct everything from instant payments to transfers, bill payments, airtime top-ups, and much more. With its robust infrastructure, OPay has recorded swift and reliable network uptime, even as bank outages persist. This reliability has led customers to rely heavily on the fintech platform to handle their transactions during a time when other financial institutions face downtime.

Many Nigerians now see OPay as a “life-saving” platform. Business owners, in particular, have benefited from the fintech’s ability to handle high volumes of transactions. Point of Sale (POS) operators have also turned to OPay, as the platform ensures successful transactions where banks often fail, helping them keep their businesses running smoothly.

Advertisement

OPay’s popularity is also a reflection of its enhanced security features, which ensure users can transfer funds without fear of breaches or fraud. Features like OPay’s Large Transaction Shield and NightGuard, which offer extra layers of protection, have reassured users of the platform’s commitment to security and peace of mind.

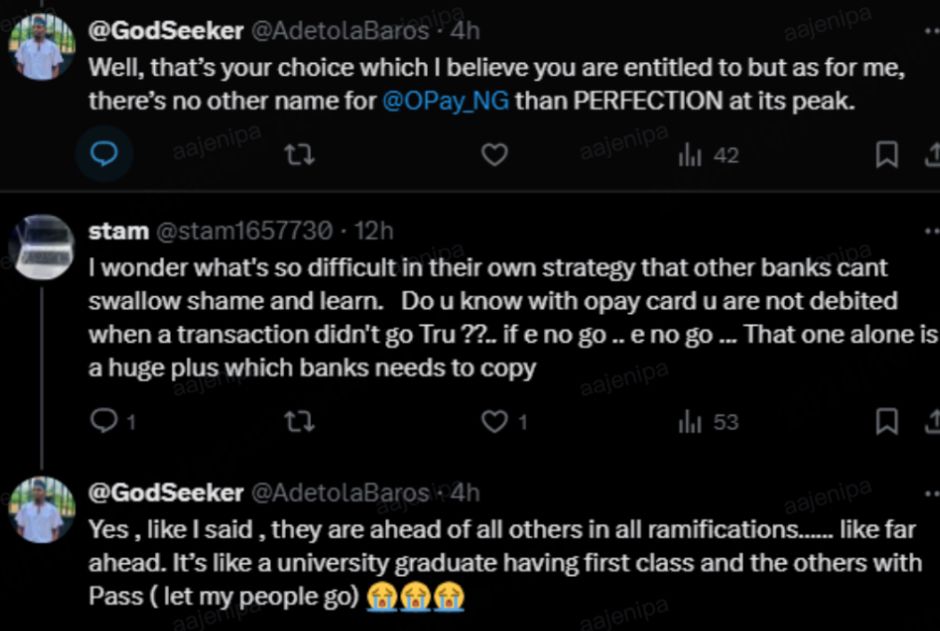

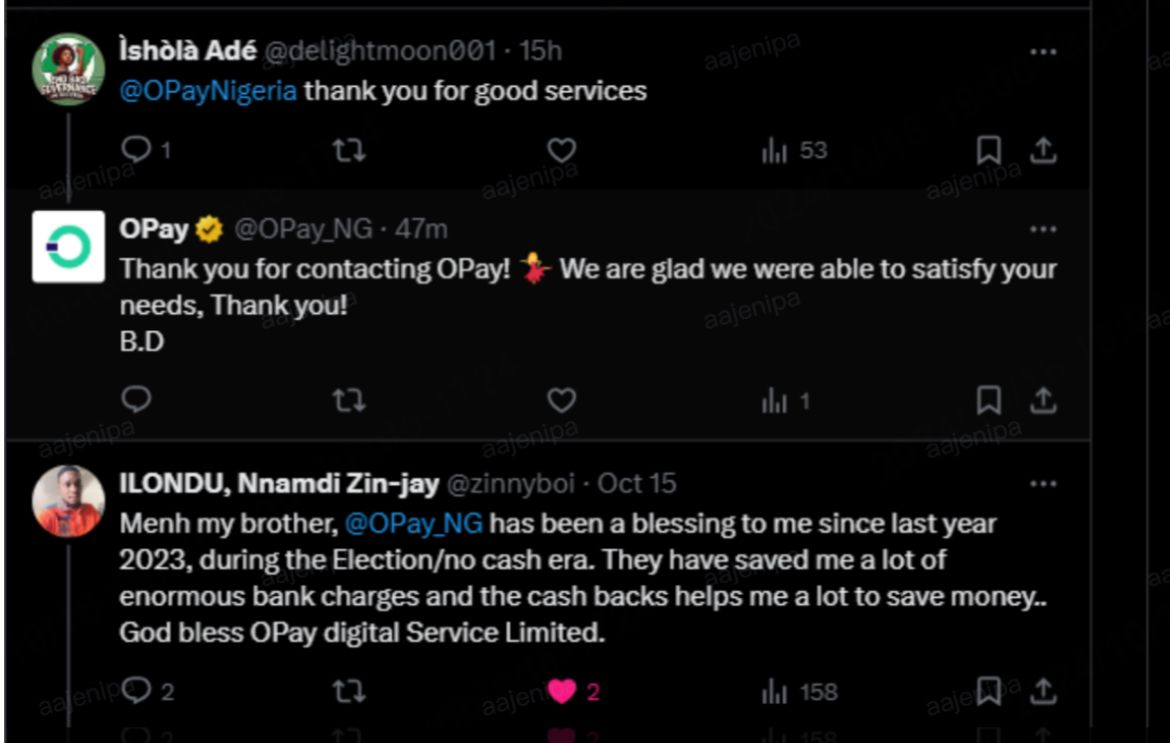

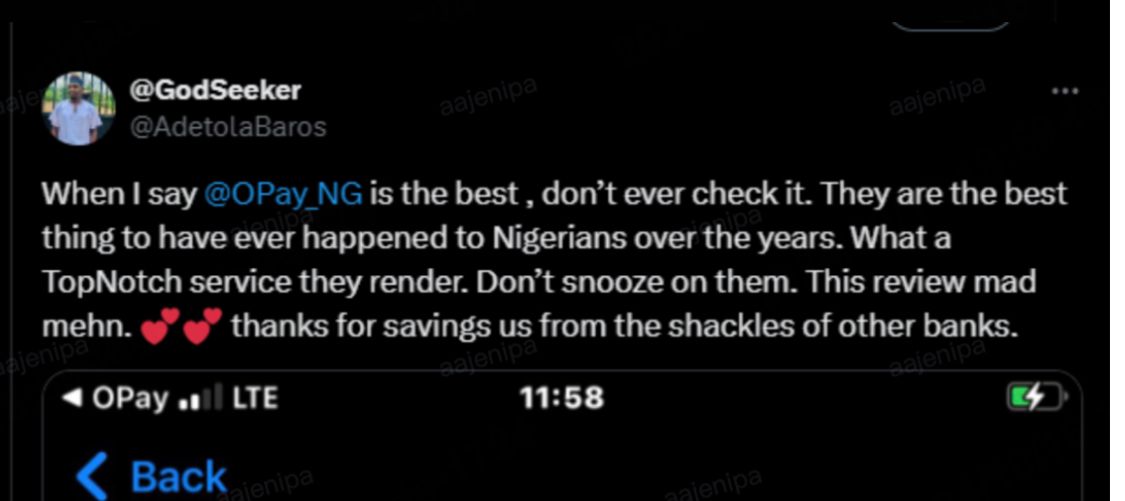

Many customers have openly expressed their satisfaction with OPay’s services during this period of banking challenges. Testimonials have poured in, highlighting OPay’s ability to seamlessly handle transfers and payments that would otherwise be impossible through conventional banks. Adetola Baros, a X and OPay user, shares, “….there’s no other way name for OPay than PERFECTION at its peak.

Another user, Ilondu Nnamdi Zin-jay also tweeted, “…OPay has been a blessing to me since last year 2023, during the Election/no cash era…” Similarly, another X user tweeted appreciating OPay for good services.

Advertisement

When a young woman on the streets was asked how she was coping with the incessant bank glitches, she mentioned “With the way banks are down, OPay has become my go-to. Transfers are fast, secure, and I don’t have to worry about delays.”

Advertisement

OPay’s consistent role in stabilizing the financial landscape amid the ongoing glitches has further cemented its position as a critical player in Nigeria’s fintech sector. As more customers make the switch to digital wallets, OPay’s reliable service promises to keep the country’s economy moving, ensuring that users—whether individuals, businesses, or POS operators—can continue with their financial activities without interruption.

While banks work to restore their systems, OPay continues to offer a much-needed lifeline, demonstrating the power and potential of fintech in a country where digital transformation is rapidly evolving. It is clear that OPay has positioned itself as the solution of choice before and during the crisis, offering Nigerians not just convenience, but also security and confidence in their daily transactions.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment