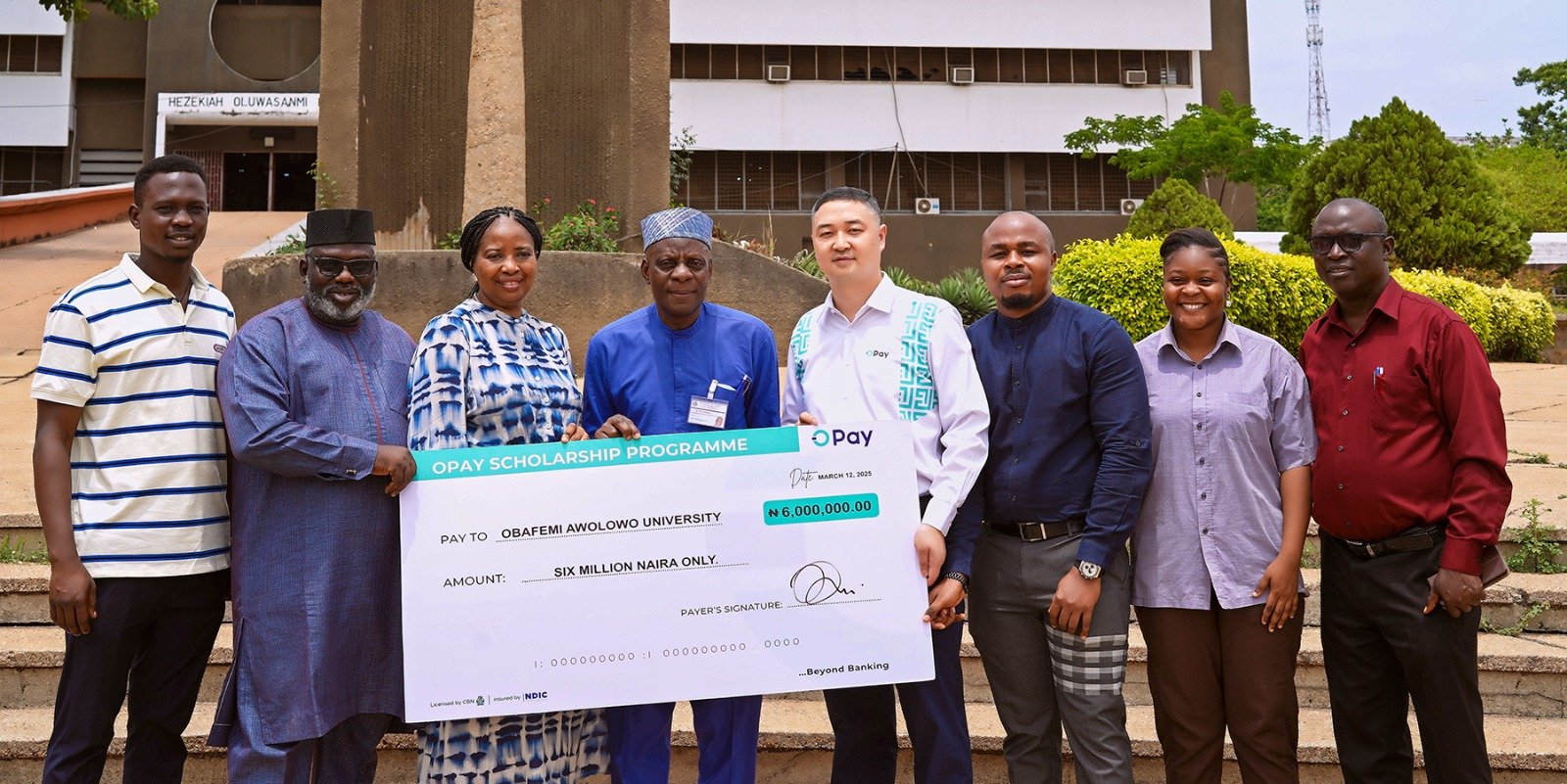

(L-R: Mr. Omoboriowo Damilola Isaac, OAU SUG President; Prof. Niran Oluwanranti, OAU Director Linkages & Partnerships; Prof. Ebun Adejuyigbe, Executive Director COR; Prof. O.M.A. Daramola, OAU's DVP Admin; Mr. Justin Zhang, OPay's Chief Public Affairs Officer; Mr. Adekunle Adeyemi, OPay's Head of Marketing; Ms. Kinifeosi Joy, OAU SUG Secretary General, and a member of OAU's faculty).

Opay has initiated a merit scholarship at the Obafemi Awolowo University (OAU) that would see it spend N6 million annually to finance the education of 20 students at the institution for the next 10 years.

The mobile banking operator, as part of a corporate social responsibility project, signed an MoU with the university’s management at its main campus in Ile Ife, Osun state on March 12.

Justin Zhang, the chief public affairs officer at Opay, said the MoU signing at OAU marks the start of a broader CSR project that would require it to spend N1.2 billion on tertiary scholarships over ten years.

As part of the scheme, 400 students across at least 20 tertiary institutions in Nigeria are to be awarded a merit scholarship annually by selection committees comprising both staff members of the partnering schools and Opay’s team.

Advertisement

“We’re giving OAU 20 slots annually for the next 10 years. Each student gets N300,000 for their education and other costs,” Zhang said.

He said the project started in 2024 with a pilot run at the University of Ibadan in Oyo state and the Ahmadu Bello University in Kaduna.

“This year, we’re extending it to other universities. We talking 400 students per year at N300,000. This would cost up to N120 million annually. Lasting for 10 years, the cost would go up to N1.2 billion,” Zhang added.

Advertisement

In 2024, Opay, along with other mobile money operators, recorded significant growth, processing N71.5 trillion in transactions, a 53.4 per cent increase from 2023.

Opay entered the Nigerian market in 2018, launching as a mobile payments platform under Opera Software and initially focusing on money transfers, bill payments, and mobile airtime vending.

Opera Group, its parent company, would expand into transportation, food delivery, and other services before streamlining its focus on fintech and digital banking.

Opay’s mobile banking platform targeting emerging markets, Zhang said, surged to over 40 million active Nigerian users in 2024.

Advertisement

“We passed our break-even point in 2024. We decided to undertake a CSR project and give back to society,” Zhang told TheCable in Osun.

Earlier at the MoU signing, Yomi Daramola, the deputy vice-chancellor (administration), said OAU has a 35,000-head student population, at least 11,000 lecturers, 50,000 staff members, and about 40,000 campus dwellers.

He said only about 5000 of its 11,000-hectare landmass is occupied by infrastructure.

“We have the facility to host Opay in whatever partnership capacity, as long as it prioritizes the affairs of our students,” the DVC said.

Advertisement

In 2023, Nigeria’s public tertiary school campuses were thrust into student protests after the federal government appeared to have lifted regulatory restrictions that hitherto prevented the adoption of cost-reflective tuition.

Some public universities, as a result, raised their fees by as much as 800 per cent, necessitating a federal student loan scheme, need-based grants, and private-sector interventions.

Advertisement

“At OAU, we’ve been making an effort to assist our indigent students. We had an account opened for them and started attracting funding to it,” Daramola told TheCable in Osun.

“Opay’s scholarship is great. It’s not the first, but it’s unique. The amount is huge. It will help our students focus on their studies instead of doing part-time jobs to fund their education.

Advertisement

“Selection of beneficiaries is going to be by merit. In the MoU, we agreed a committee would be set up to manage it. If it’s a five-member committee, we’ll have three members from OAU and two from Opay.”

Omoboriowo Damilola, student union president at OAU, argued that the fee hikes across public university campuses mean more private sector CSR investments are desperately needed to diversify education funding and expand access.

Advertisement

“There are indications that some campuses may be taking advantage of the federal student loans to further raise their fees,” said the student leader.

“We hope that more investors will take a path similar to Opay’s and support indigent students.”

Add a comment