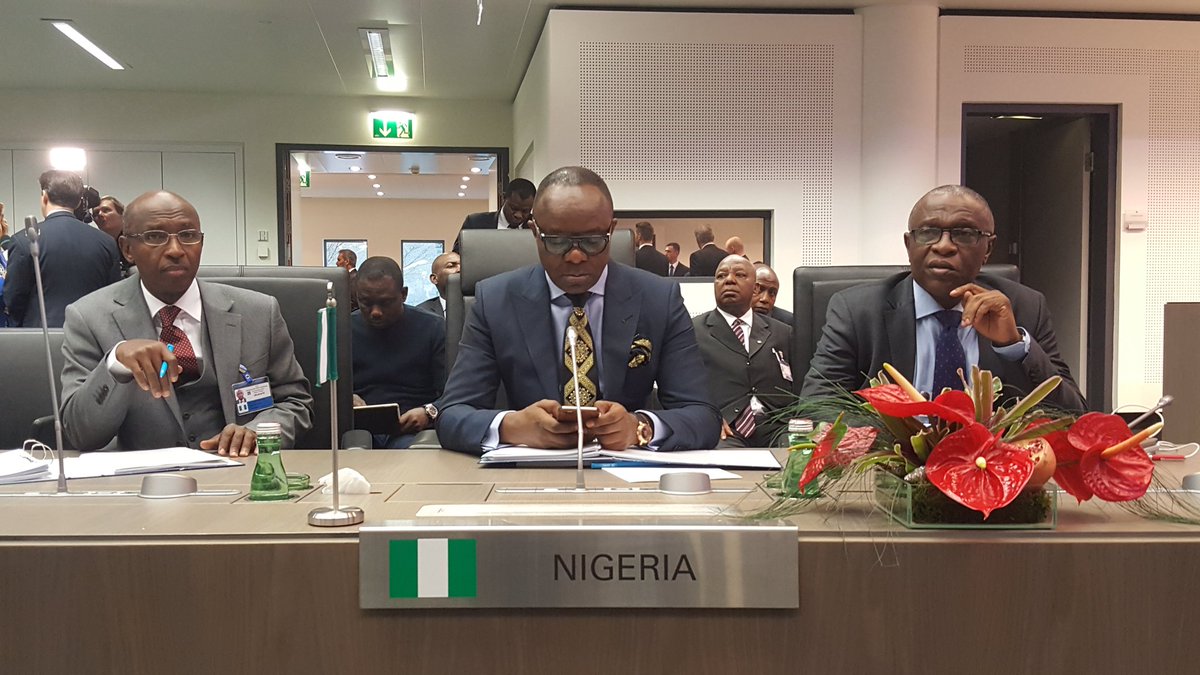

On Wednesday OPEC defied sceptics by telling the world we’re still united. When many thought that OPEC had no more influence on oil prices, yesterday proved them wrong with Brent prices surging by 9% to trade above $50.

For the first time since 2008 the cartel members managed to put their political conflicts aside and strike a deal that benefits their economic agenda by reducing output 1.2 million barrels a day starting January 2017 for six months.

Russia also said it will come on board and cut output by up to 300,000 barrels per day in H1 2017, and still to be seen whether other countries will join when OPEC and non-OPEC producers meet on December 9 in Doha.

Energy stocks around the world are enjoying one of their best days in many years with S&P/ASX and Topix energy indices up by more than 7% and U.S. S&P500 energy index closing 5% higher yesterday.

Advertisement

Will prices continue to move higher?

If you were long oil early Wednesday, then you’ve received your Christmas gift already, but whether prices will continue to surge higher depends on multiple factors.

- Which countries other than non-OPEC Russia will commit to a cut?

- Will the process be monitored effectively, or chances of prisoner’s dilemma that encourages some members to exceed their production quota come into play?

- Will U.S. drillers return fast if prices held above $50 and how many rigs will be reactivated?

- On the demand side, are we going to see higher revisions due to Trump’s infrastructure policies?

If oil prices traded in the range of $50-$60, shale isn’t likely to return in massive levels, however if prices spiked above $60 then the shales industry will return as a major player to rebalance prices. The bottom line is OPEC’s deal will put floor on the downside, but on the upside multiple factors should be taken into consideration.

Advertisement

Add a comment