One of the most anticipated publications that influence oil prices will be released this afternoon.

Published once a year by the Organisation of Petroleum Exporting Countries (OPEC), the World Oil Outlook is a big deal for oil markets as it provides critical insight into the outlook for oil in the period ahead.

This year the WOO report will be of significant importance due to oil prices going sub-zero for the first time in history, and complicated supply/demand-side dynamics caused by COVID-19.

It is widely known that Oil remains one of the biggest casualties from COVID-19. When the world went on lockdown earlier in the year as coronavirus cases skyrocketed, demand for oil simply evaporated. Fast forward today, both WTI crude and Brent are still down over 30% year-to-date and remain pressured by demand-side factors.

Advertisement

Given the state of the global economy, it will be interesting to see whether OPEC’s projections through the year 2045 adopt either a more hopeful or realistic tone.

It must be kept in mind that oil not only remains pressured by demand-side factors but supply-side themes in the form of non-compliance among some of its members.

Questions are already being raised whether the group will extend the current level of cuts past December. The idea of more supply returning to markets at a time where demand remains threatened by rising coronavirus cases across the globe and renewed lockdown restrictions is bad news for oil bulls.

Advertisement

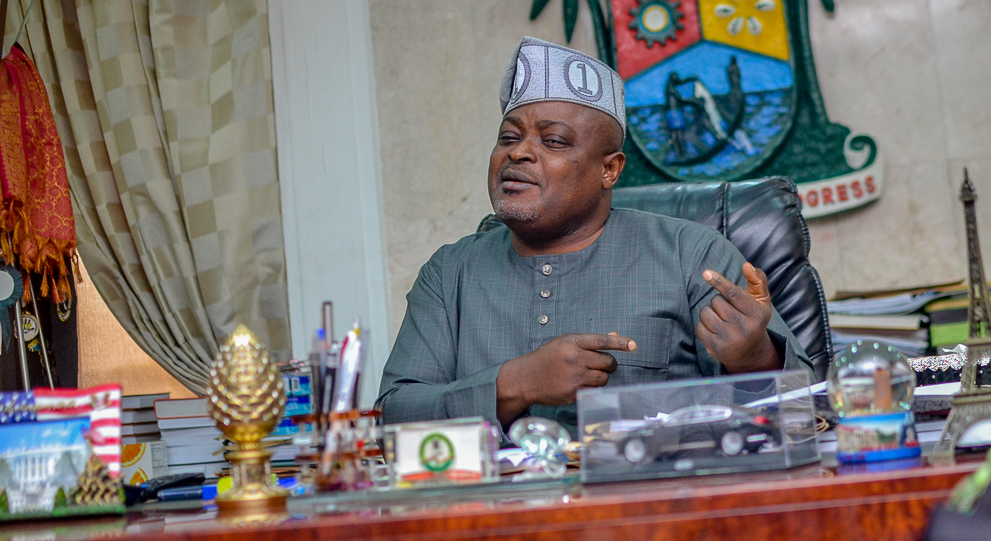

For Nigeria which remains heavily reliant on Oil sales for foreign exchange earnings and governments revenues, the prospects of lower Oil directly threaten the country’s outlook.

Africa’s largest economy continues to nurse wounds inflicted by COVID-19, while the Central Bank of Nigeria has cut interest rates to stimulate economic growth. With inflation rising to its highest level in 29 months amid the coronavirus crises, Nigeria needs all the support it can get to ride through the current storm.

While the country remains in an ongoing quest to break away from the chains of oil reliance, a recovery in oil may boost foreign exchange reserves and government earnings, consequently supporting the naira and economic growth.

Advertisement

Add a comment