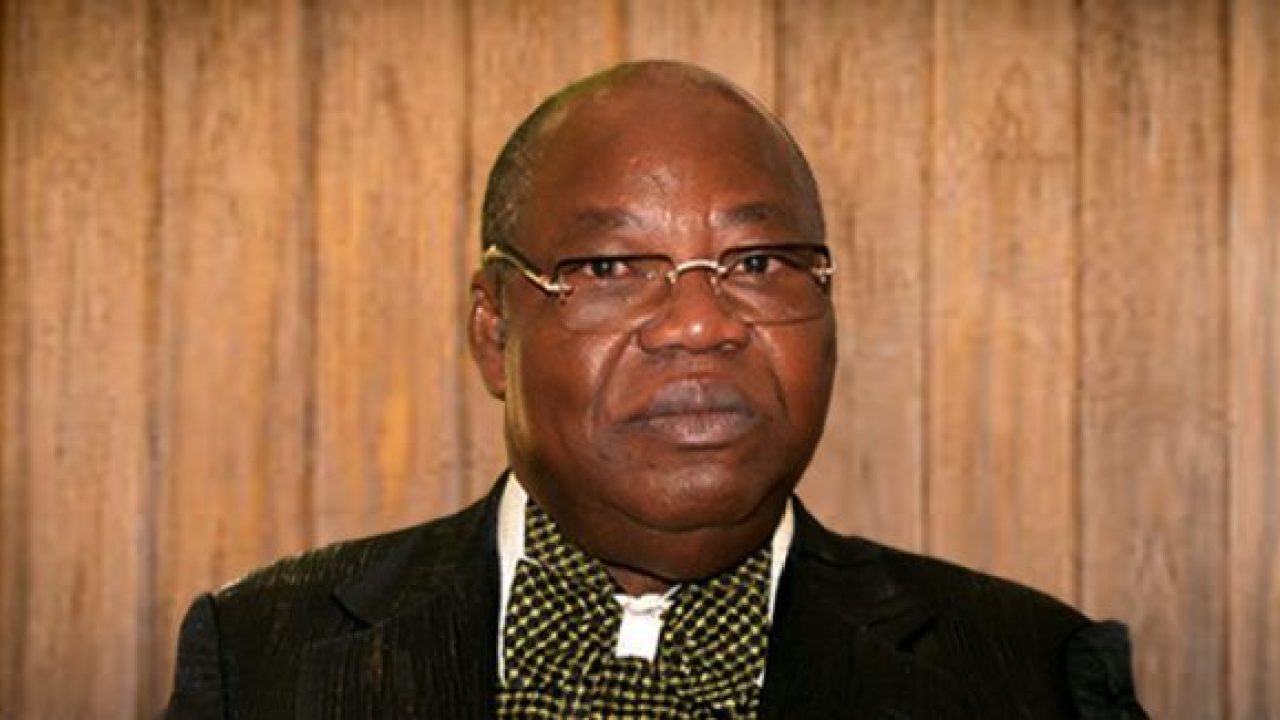

Temitope Erinomo, a staff member of the ministry of industry, trade and investment, has narrated to a federal high court in Abuja how Malabu Oil and Gas Limited failed to comply with the provisions of the Money Laundering (Prohibition) Act, 2011.

Malabu is standing trial alongside seven other defendants on a 67-count charge bordering on money laundering in relation to the OPL 245 deal of 2011.

Giving evidence as the first prosecution witness on Thursday, Erinomo said the Economic and Financial Crimes Commission (EFCC) wrote several letters to the ministry between December 31, 2019, and January 21, 2020, requesting information on the defendants.

He said upon investigation, the ministry found out that Malabu oil and other companies involved in the case being designated non-financial institutions (DNFI) failed to register and make a declaration of their activities to the ministry in compliance with the Money Laundering (Prohibition) Act.

Advertisement

The witness said the Act mandates DNFI firms to be registered with the ministry, submit statutory reports of their activities, and declare qualified transactions to the ministry and the EFCC.

“Upon receipt of the letter, we searched through our registration database and our report filing database and we found out that these companies have not made declarations of their activities with the ministry in accordance with the act,” he said.

“We also found out that they had also not filed reports to the ministry and the EFCC and we also found out that there were several violations of statutory reports that were not reported.

Advertisement

In addition, Erinomo said the companies “did not have a record of measures taken to combat money laundering”.

“They did not have an internal audit unit to measure the effectiveness of the measures they have taken to combat money laundering,” he said.

“They did not appoint a compliance officer from among the management staff to ensure compliance.

“They also did not carry out training for their staff on anti-money laundering measures. We also uncovered several transactions that were not reported to EFCC.”

Advertisement

The companies listed in the charge are: A-Group Construction Company Limited, Rocky Top Resources Limited, Mega Tech Engineering Limited, Novel Properties and Development Company Limited, and Carlin International Nigeria Limited.

According to the EFCC, Malabu oil alongside Dauzia Etete (Dan Etete), former petroleum minister, Seidougha Munamuna and Amaran Joseph, both directors of the company, who are currently on the run, “took control of the sum of $401,540,000 paid from the federal government of Nigeria Escrow Account No: 0041451493 IBAN 30CHAS609242411492 with JP Morgan Chase Bank in London into the account 2018288005 of Malabu Oil & Gas Limited domiciled with First Bank of Nigeria Limited”.

The anti-graft agency alleged that Malabu oil negotiated and signed the “block 245 resolution agreement with the federal government of Nigeria with Shell Nigeria Ultra Deep Limited, Nigerian National Petroleum Corporation, Nigeria Agip Exploration Limited, and Shell Nigeria Exploration and Production Company Limited, whereby taxes, accruals and royalties due to the federal government of Nigeria were unlawfully waived”.

Advertisement

Add a comment