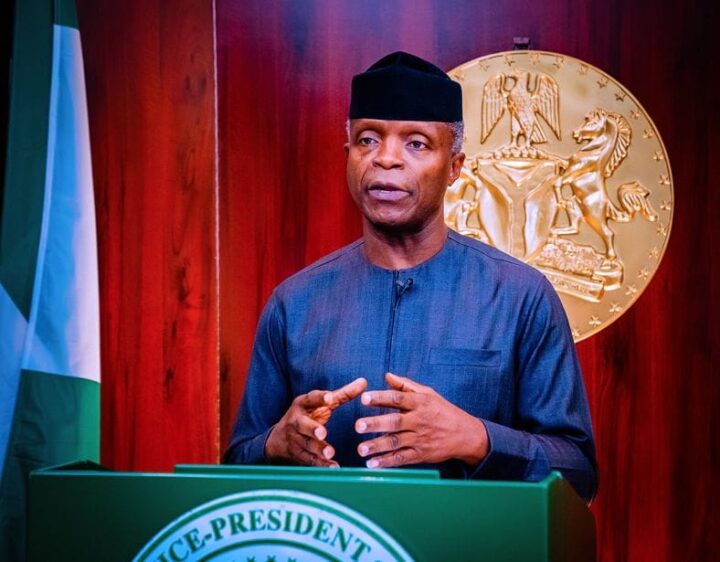

Vice President Yemi Osinbajo has called for an effective synergy between the fiscal and monetary policy as well as a more market-driven approach to managing foreign exchange (FX) in Nigeria.

Osinbajo said this at the third ministerial performance review retreat on Monday in Abuja.

In his presentation titled ‘the Buhari administration: reflections on the journey so far,’ Osinbajo highlighted areas of concern as well as achievements of the current administration.

Speaking on the FX rate and what can be done, he said the disagreement in the fiscal and monetary operation has been a serious challenge.

Advertisement

Monetary policy seeks to spark economic activity, while fiscal policy seeks to address either total spending, the total composition of spending, or both.

Osinbajo also said a more market-driven approach will guarantee access and inflows of forex.

A market approach is a method of determining the value of an asset based on the selling price of similar assets or influenced by market knowledge and customer needs.

Advertisement

“The first is the synergy between fiscal and monetary policy. The failure of that synergy has led to unnecessary drawbacks in our economic performance and planning. What imports are eligible for foreign exchange must agree with the fiscal ambitions for manufacturing and industry,” Osinbajo said.

“Currently such decisions on import eligibility for foreign exchange for instance, are being taken solely by the monetary arm, although the fiscal arm would normally be expected to lead in such matters.

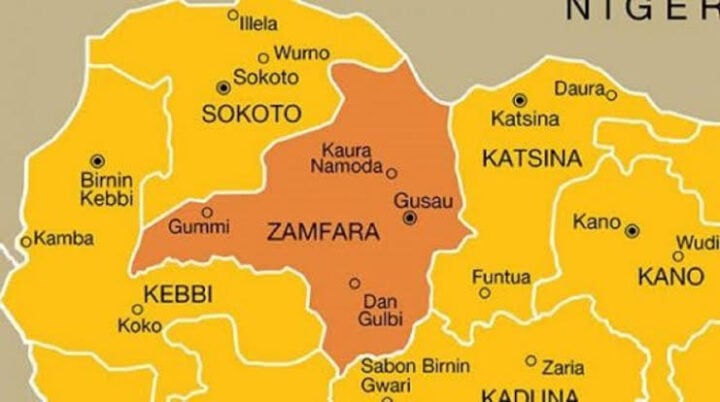

“Our exchange rate management continues to be an issue. The exchange rate of the naira to convertible currencies continues to face significant downward pressure because demand substantially outstrips supply.

“That is just the reality. On one hand, we have tried demand management and rationing, which has not really worked because fixing the price while the parallel market reveals a massive arbitrage merely creates the opportunity for massive rents.

Advertisement

“It will also compound the backlog of remittances for foreign businesses who want to repatriate their earnings. The discussion that we must now have going forward is how best to manage the situation by finding a mechanism for increasing supply and moderating demand which will be transparent and will boost confidence.

“I think that a more market-driven approach will be best, some price discovery within the context of a managed float is certainly required. Some efforts at controlled price discovery that had been made in the past include the foreign exchange market (FEM), interbank foreign exchange market (IFEM), and various iterations of the dutch auction system (DAS), wholesale dutch auction system (W-DAS), retail dutch auction system (R-DAS).

“While they may not have been perfect it would appear as if the rules were clear and there was relative stability. When people know how they can access foreign exchange competitively, this will boost confidence and inward flows will increase.”

Speaking further on achievements of the Buhari administration, Osinbajo stressed on the development of infrastructure and “the creativity introduced in infrastructure financing.”

Advertisement

In addition, he said the progress in the digital economy, leading to its contribution of over 18 percent to the gross domestic product of the economy — almost three times the oil and gas contribution — is an achievement.

Advertisement