The Peering Advocacy and Advancement Centre in Africa (PAACA), a civil society organisation, has called for a non-partisan approach to the ongoing tax reform process.

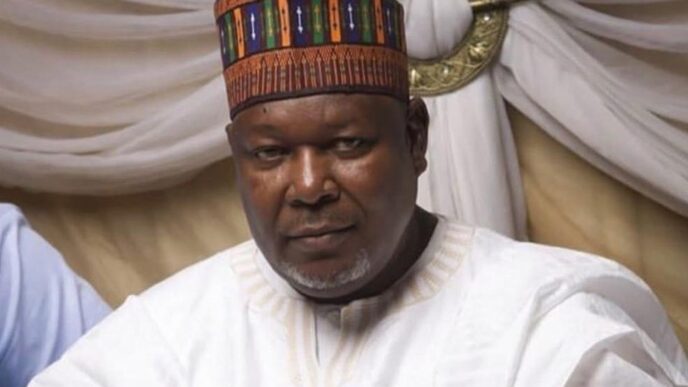

Speaking on Wednesday on the sidelines of the public hearing on the tax reform bills organised by the house of representatives committee on finance, Ezenwa Nwagwu, PAACA executive director, said a stable and well-structured tax system will benefit Nigerians irrespective of political affiliations.

He said the reforms should be driven by national interest rather than political or regional inclination.

“A well-balanced tax system is key to national development and these reforms must be approached with a collective, non-partisan mindset,” he said.

Advertisement

On the contentious proposed changes to the value-added tax (VAT) sharing formula, Nwagwu said the bills have the potential to encourage economic activities and job creation in underdeveloped regions and increase their earnings in the long run.

He urged stakeholders to view the reform as an opportunity to stimulate broader economic participation rather than as a disadvantage to certain states.

He harped on the need for a post-reform monitoring mechanism to track progress, address implementation challenges, and ensure continuous improvement.

Advertisement

Nwagwu said such a framework would help assess the effectiveness of the new tax policies and make necessary adjustments where needed.

He called on the government to uphold transparency and public accountability in the execution of the tax reforms.

“The success of these reforms depends on how well they are implemented and whether Nigerians see them as fair and beneficial. Government must commit to openness and engage citizens in the process,” he said.

Nwagwu added that clear communication and responsible governance are crucial to building public trust and ensuring compliance with the new tax policies.

Advertisement

Add a comment