The Nigeria Governors’ Forum (NGF) has asked banks and their compliance officers to disregard the payment of the controversial $418,953,670.59 to consultants.

TheCable had earlier reported that Zainab Ahmed, finance minister, had directed DMO to issue promissory notes to contractors and consultants relating to Paris and London Club refunds despite pending court cases.

In a letter dated August 30, the NGF had through their lawyer, Femi Falana, chided the minister for giving the directive despite being served with notices of appeal regarding the cases.

In a fresh letter dated September 3, signed by P.H Ogbole, another senior advocate of Nigeria (SAN), the governors reiterated that the promissory notes should be disregarded.

Advertisement

The letter was addressed to the governor of the Central Bank of Nigeria (CBN), the attorney-general of the federation (AGF), the finance minister, the director-general of the debt management office and MD/CEOS/compliance officers of all commercial banks in Nigeria.

“It must be noted that custodians and managers of public funds are public trustees and must at all times act in the public interest. In this case, the interest of all the states and local governments of the federation are involved and ought to be protected by the hon. minister of finance,” the letter stated.

“The issuance of promissory notes of a humongous sum of over $418million to private persons for alleged consultancy work demands not only caution but strict due diligence; particularly when the judgements which gave rise to the payments sought to be enforced are the subject of pending litigation.

Advertisement

“Matters that are sub-judice must not be acted upon in a manner that will foist a situation of complete helplessness on the courts and render their decisions nugatory.

“This caveat is therefore issued as a further notice to the honourable minister of finance and the director-general, debt management office to act in the interest of the public and refrain from foisting on the nation another case of P&ID in which but for due diligence, the nation would have been fleeced of billions of dollars.

“The nation is already going through economic adversity and every dollar is needed to be channeled to people-oriented projects. Public duty and probity demand that public trustees must, at all times, act in the interest of the people they serve in order to protect their commonwealth.

“Accordingly, justice must be allowed to run its full course.

Advertisement

“All Chief Executives of Banks and their compliance officers are hereby advised to desist from or otherwise not to accept for exchange or process for payment or giving value to any promissory notes issued by the DMO for purpose of satisfying alleged Paris Club consultants fees afore-mentioned.

BRIEF BACKGROUND

Olusegun Obasanjo, former president of Nigeria, had paid off the outstanding debts owed to the London Clubs of Creditors in the first quarter of 2007.

According to a report by PremiumTimes, the leadership of the Association of Local Governments of Nigeria (ALGON) acting in concert with some of the claimants, went to court to challenge what they described as the federal government’s unilateral deduction of the funds from the federation account to service the foreign debts without the consent of the third tier of government in the country.

Advertisement

The 774 local governments, coordinated by ALGON, filed the suit as the principal plaintiffs and joined the “consultants” and “contractors” which they claimed provided them legal and consultancy services to help them to secure the refund of the deducted money.

Eventually, judgments were resolved with huge awards in millions of dollars issued by the courts in favour of the claimants.

Advertisement

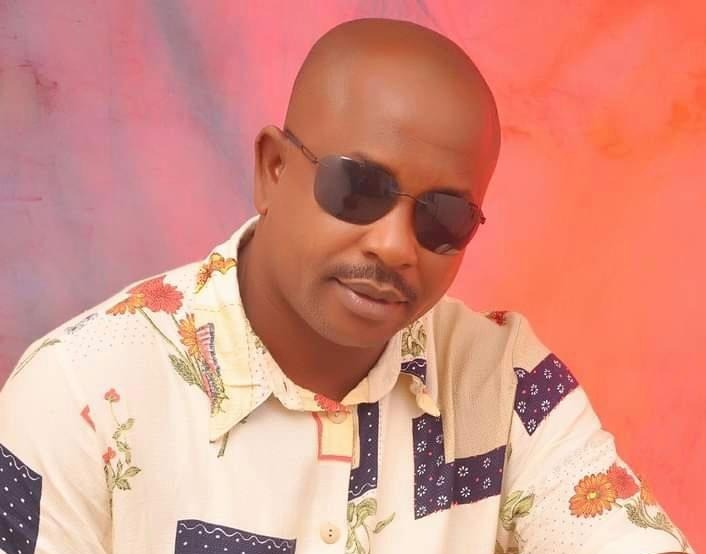

Some of the consultants and the amount include Ned Nwoko, who is laying claim to $142,028,941 via a consent judgment he obtained from a federal high court in Abuja in the suit marked FHC/ABJ/CS/148/2017.

In another judgment of the federal capital territory (FCT) high court in the suit marked FCT/HC/CV/2129/2014, Riok Nigeria Limited is claiming the sum of $142,028,941.95, Orji Nwafor Orizu is entitled to $1,219,440.45 and Olaitan Bello has a share of $215,159.36.

Advertisement

Also, Ted Iseghoghi Edwards is laying claim to $159,000,000 through a judgment he obtained from the FCT high court in suit number FCT/CV/1545/2015.

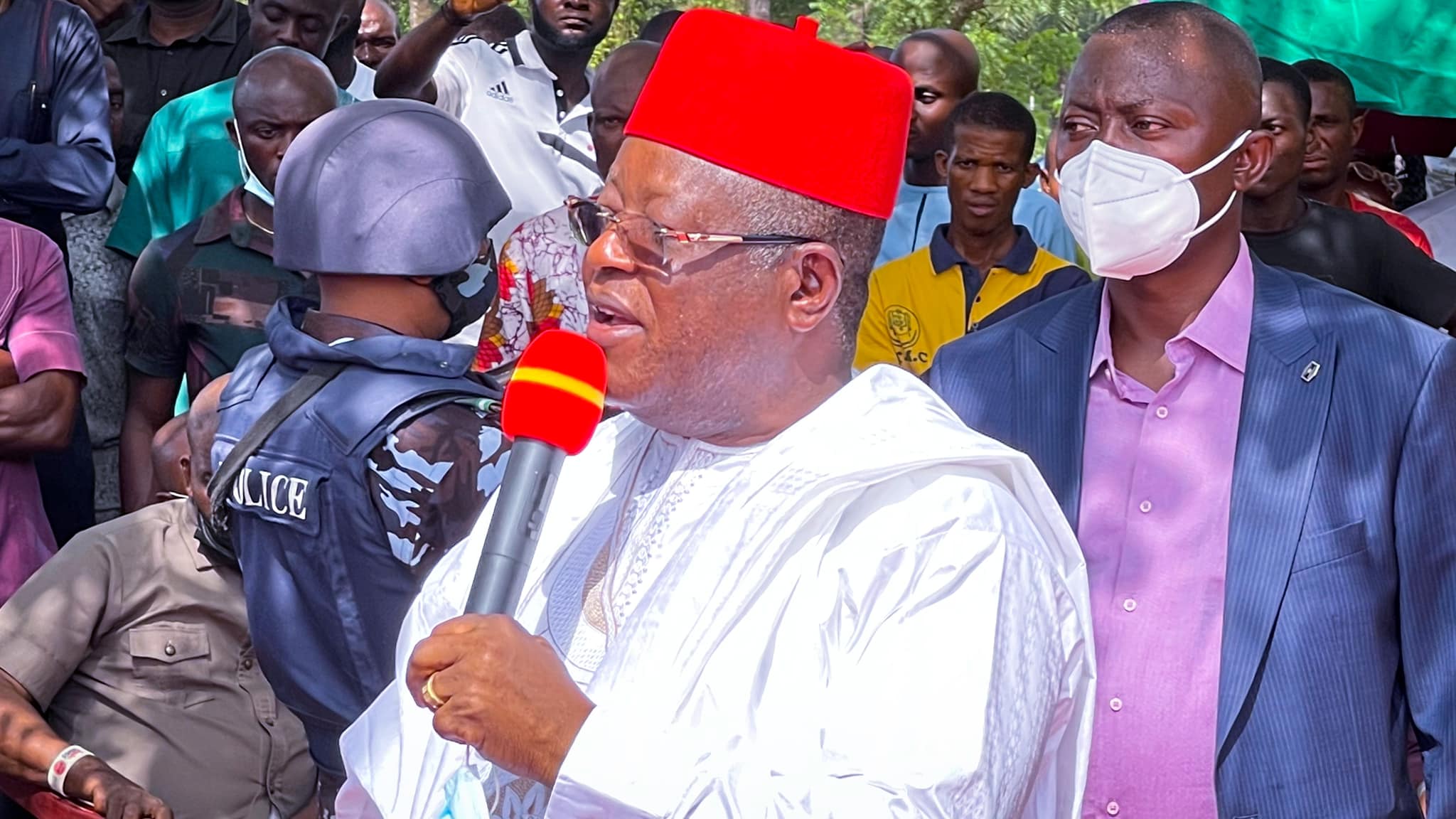

However, the NGF has asked for a review of the indebtedness, calling for a forensic audit into the agreements leading to the court judgments.

Advertisement

They have also filed appeals at the appellate court, seeking to upturn the judgment of the lower courts.

1 comments

In an attempt to revamp and clean up this sector the banks governor pledged to sanitize the banking system that has fuelled growth in the country. To protect investors and depositors, the authorities, following the outcome of their examination of balance sheets, took some measures designed to strengthen the banking system and protect those at risk.