On Thursday, the Africa Export-Import Bank (Afreximbank), in collaboration with African Union (AU) and African Continental Free Trade Area (AfCFTA), officially launched the pan-African payment settlement system (PAPSS) for commercial use.

PAPSS is a cross-border financial market infrastructure enabling payment transactions across Africa, bridging trade challenges in a continent with over 40 known currencies.

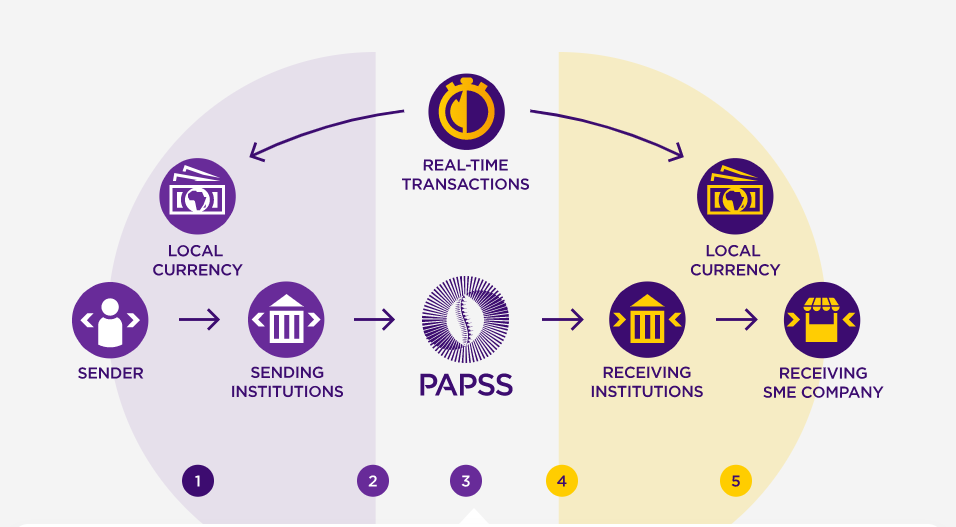

According to Afreximbank, participants pay in local currency, while a seller in another country receives payment in their local currency. This means that a buyer in South Africa can pay in rand while the seller from Nigeria receives payment in naira.

Speaking at the unveiling, Benedict Oramah, Chairman of the board of directors of Afreximbank, said: “PAPSS will effectively eliminate Africa’s financial borders, formalise and integrate Africa’s payment systems, and play a major role in facilitating and accelerating the huge AfCFTA-induced growth curve in intra-African trade.”

Advertisement

On his part, Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), said the apex bank would continue to facilitate the widespread adoption, acceptance and implementation of PAPSS.

Here are key features of the pan African payment settlement platform (PAPSS).

Advertisement

WHAT IS PAPSS?

The PAPSS, developed by African Export-Import Bank (Afreximbank), is a platform generated to facilitate free trade transactions among African countries.

The platform allows cross-border transactions to ensure ease and safety, thereby minimising risk and reducing the cost of intra-African trade for institutions(Commercial banks, payment service providers and other financial intermediaries), businesses, companies and individuals.

PAPSS guarantees instant payments and is less costly while shopping, transferring money, paying salaries, dealing in stocks and shares or making high-value business transactions.

Advertisement

Ultimately, it is a single payment infrastructure that connects payment to eradicate existing challenges of local currency exchange and bridging trade in a continent with over 41 known currencies.

WHAT PAPSS IS NOT?

- It is not a platform for competition

- It is not just for buying

- It does not discriminate or undermine any African trade.

- It is not for non-indigenous businesses.

- Does not work outside authorised commercial banks.

HOW PAPSS WORKS?

According to Afreximbank, PAPSS works through three major processes:

Advertisement

INSTANT PAYMENTS FOR HOUSEHOLDS AND BUSINESSES

Individuals and businesses can visit an authorised participant (commercial bank) from any African country. After which, the bank sends payment to PAPSS, who validates the payment instructions sent. The beneficiary bank receives validated payment instructions from PAPSS. The recipient receives payment in local currency.

Advertisement

PRE-FUNDING BY DIRECT PARTICIPANTS

This process is to ensure safe transfers for both parties (sender and receiver) based on pre-funding agreements from participants.

Advertisement

After payments instructions have been sent to PAPSS by the direct participant.

Direct Participants integrate directly with PAPSS and the real-time gross settlement (RTGS) systems of central banks in the pre-funding process.

Advertisement

Participants without an RTGS account – Indirect Participants(without settlement accounts) — can fund or defund their clearing accounts on PAPSS with the aid of a Direct Participant providing the required liquidity.

Notifications are carried via the ISO 20022 messaging standard, notifying PAPSS, the Participants and RTGS of the status of every stage of the transaction.

SETTLEMENTS TO SIMPLIFY TRANSACTIONS IN LOCAL CURRENCY

The settlement goes through key institutions such as Afreximbank, PAPSS and central banks. How?

PAPSS determines the net position in local currency for all participating central banks. The payment platform sends credit or debit settlement instructions to Central Bank’s real-time gross settlement system (RTGS) — depending on net position.

Central Bank RTGS debit or credits between PAPSS pre-funded account and Central Bank suspense account and confirms settlement to PAPSS.

PAPSS mirrors central bank instruction to conclude local currency settlement.

PAPSS issues equivalent hard currency settlement instruction (based on the net position) to Afreximbank.

Afreximbank credits/debits the central banks’ hard currency settlement account held in Afreximbank and confirms it to PAPSS.

Transactions are completed in a maximum of 24 hours and monitored by participants.

WHAT IS THE EXCHANGE RATE FOR TRANSACTION

In October 2021, the Central Bank of Nigeria (CBN) directed commercial banks to adopt the exchange rate in the importer and exporter window (I&E) for cross border payments through the Pan-African Payments and Settlement System (PAPSS).

Although market-driven, CBN pegs the rate between N411 and N414.89 at the market.

HOW TO USE PAPSS

As a household or business owner, all you have to do is:

- Visit an authorised participant (commercial bank) from any African country.

- Bank sends payment to PAPSS, which validates the payments instructions sent.

- The beneficiary bank receives validated payment instructions from PAPSS.

- The recipient receives payment in local currency.

PRE-FUNDING OPTION

This process is to ensure safe transfers for both parties (sender and receiver). However, participants must accept the pre-funding agreement.

- After payments instructions have been sent to PAPSS by the direct participant.

- Direct participants integrate directly with PAPSS and the real-time gross settlement (RTGS) systems of central banks in the pre-funding process.

- Participants without an RTGS account – Indirect Participants (without settlement accounts) – are able to fund or defund their clearing accounts on PAPSS with the aid of a direct participant providing the required liquidity.

- Notifications are carried via the ISO 20022 messaging standard, notifying PAPSS, the participants and RTGS of the status of every stage of the transaction.

Add a comment