The National Pension Commission (PenCom) says retirees whose retirement savings account (RSA) balances cannot provide a monthly pension of at least one third of minimum wage, can take the whole money at once.

The national minimum wage of workers in Nigeria is currently N30,000. By implication, workers whose monthly pension is below N10,000 are allowed to take the entire sum in their RSA.

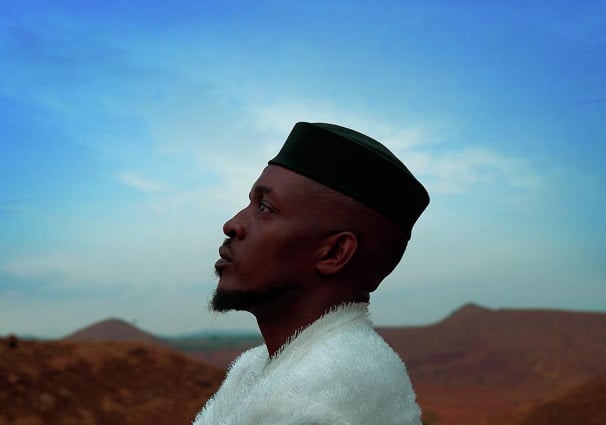

Obiora Ibeziako, head, benefits and insurance department of PenCom, said this on Thursday at an event organised by the commission in Lagos.

He said the provision was made in the commission’s revised regulation on the administration of retirement and terminal benefits.

Advertisement

“Where the fixed portion of RSA balance cannot procure a monthly pension/annuity up to one third of the prevailing minimum wage, the contributor shall receive their benefits en bloc,” Ibeziako said.

According to him, the provision ensured an increase in the amount to be disbursed as an en bloc payment when compared to the N550,000 maximum limit allowable as an en-bloc in the past.

“Based on our analysis, most people that have an RSA balance of N1.6 million and below can get their money at once. But this is not something that has been fixed, ” he added.

Advertisement

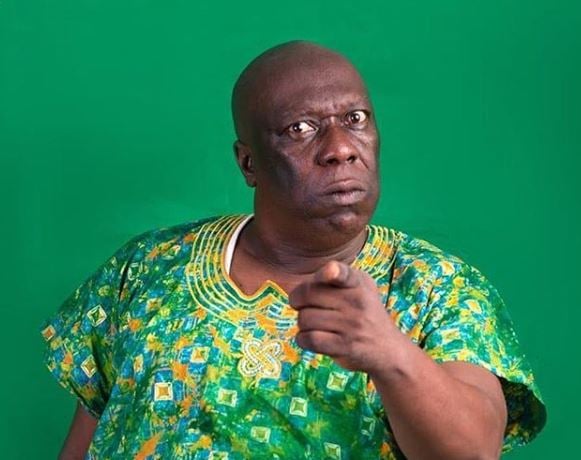

Also speaking at the event, Dauda Ahmed, head of micro pensions department at PenCom, said 81,674 informal sector workers that have registered for the micro pension plan (MPP) as at July 31, 2022.

The micro pension plan (MPP), launched in 2019, is a long-term voluntary financial plan for the provision of pension coverage to the self-employed, and persons working for organisations with less than three employees who are mainly in the informal sector.

It means that accountants, architects, lawyers, artisans, traders, stylists, farmers, commercial drivers and more can contribute for their pension.

Ahmed said that contributions under the scheme within the period stood at N296.9 million while total contingent withdrawals stood at N22.3 million.

Advertisement

He added that a total of N4.9 million was converted from informal to formal sectors within the period.

Listing strategies to encourage participation in the MPP, Ahmed said the commission would provide incentives such as subsidised health insurance and group life insurance schemes to participants.

He said PenCom was also working assiduously with pension fund administrators (PFAs) to increase awareness of the MPP across the country.

Advertisement

Add a comment