BY EMMANUEL IKE

There have been what looks like a groundswell of criticisms against plans by the Nigerian National Petroleum Company (NNPC) Limited to expand its operations by exercising its pre-emption rights over some assets that are up for sale in the country.

The right of pre-emption is a legal right to parties in a joint venture (JV) to be the first to be considered for any planned sale or takeover of assets in the JVs if either party choose to trade them off.

Clearly, with the passage of the Petroleum Industry Act (PIA), there’s no gainsaying that the operations of the NNPC will be significantly impacted when the law comes into full swing. It, therefore, shouldn’t come as a surprise that the national oil company, which is expected to sustain its new status by pursuing new investment opportunities in the oil and gas industry, has decided to expand its asset base.

Advertisement

Although the growing attention to the activities in the oil and gas industry remains a positive development, many of the comments on the latest issue have been mostly uninformed. The insinuation that the NNPC is creating a wedge on Seplat Energy’s plan to purchase ExxonMobil’s Nigerian unit, Mobil Oil Producing Nigeria Unlimited (MPNU) is misconstrued. There can be nothing further from the truth.

The Sale and Purchase Agreement (SPA) to acquire the entire share capital of MPNU, it has been reported, was for a purchase price of over $1.283 billion shares of the company, plus up to $300 million contingent consideration.

But that the state-owned oil giant has opted to exercise its Right of First Refusal (RFR) on the sale of the assets, shouldn’t be misconstrued.

Advertisement

Although the NNPC has not officially spoken on the matter, a source close to the goings-on, listed three criteria for assets that may be reshaping the portfolio of the new NNPC.

Accordingly, it stated that the NNPC Limited in the new energy transition world and post-PIA needs to reshape and optimise its portfolio to ensure it can deliver value to its shareholders and stakeholders.

To reshape its portfolio, it will rely on acquiring assets that have high performance, low vulnerability and huge gas potential.

It would also aspire to acquire high-performance assets with robust reserves with potential for growth and high performance and operators will be a key priority NNPC would consider in reshaping its portfolio.

Advertisement

With this, assets that have minimal vulnerability would be prioritised over assets that have higher vulnerability to security or production loss issues.

To reshape its portfolio, NNPC is thus carefully selecting assets that have low vulnerability with regards to security and production losses over other assets.

With this, divested assets under MPN JV would thus take priority to be acquired by NNPC over assets in SPDC JV, which have high vulnerability to security and production loss issues.

It is also worthy to note that gas is the new oil expected to drive the strategy in reshaping and optimising the NNPC portfolio. Therefore, the NNPC would thus prioritise the acquisition of assets rich in gas, especially those ready for blowdown.

Advertisement

Furthermore, the NNPC places strategic interest in assets like MPN JV which have been unable to monetise its huge gas resources. NNPC, thus not willing to risk another partner on the asset that may not prioritise the monetisation of gas.

Although some have argued that NNPC’s action could lead to a legal tussle between Seplat and the national oil company as the NNPC did not have the power to halt the acquisition of the multinational oil company’s shares by Seplat, the national oil company has the right under the law to take the action it took.

Advertisement

The NNPC, it was learnt, had previously conveyed its decision to exercise its rights and match any offer by interested parties for the assets following ExxonMobil’s decision to receive bids for their share of the JV, the platform reported.

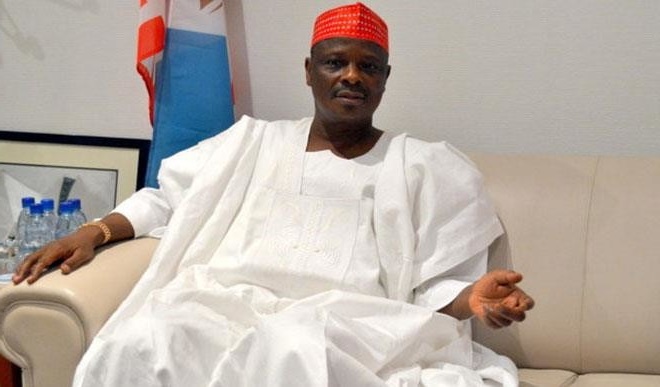

A letter signed by Mele Kyari, group managing director, and addressed to ExxonMobil, quoted NNPC as reiterating its resolve to take over the company’s share of the assets.

Advertisement

“We are aware that you reached an agreement to divest from onshore and shallow waters JVs,” the letter read, adding, “Clearly we are interested.”

According to the letter, NNPC also reiterated that it had already transformed from being a corporation to being a profit-driven company, and it now had the capacity to buy over the share of ExxonMobil in the joint venture.

Advertisement

The NNPC had recently announced a funding agreement with Afreximbank for up to $5 billion to grow its investment in new and existing upstream assets. Those close to the happenings in the industry argue that sweeping reforms that the PIA introduced in the oil and gas sector, was the reason for the NNPC action.

In addition, President Muhammadu Buhari had recently mandated the national oil company to focus on profitability and continuous value creation beyond the simple fulfilment of legal and regulatory requirements.

“NNPC Limited is expected to operate at par with its industry peers across the world while acting as enabler company that will foster the development of other sectors of our economy,” Buhari had said.

Buhari signed the PIA into law on August 16, 2021, and following the assent of the president, the NNPC Limited was incorporated by the Corporate Affairs Commission (CAC) on September 22, 2021, after it received an application for its registration from the federal government.

The PIA also raised stakeholders’ expectations of the company, even as it has given it wide room to stimulate investments in the oil and gas industry. The company’s preference is to source lenders that can provide the funding in a ratio based on the capacity of each of the lenders.

Section 65 of the Act encourages NNPC Limited and its joint venture partners to explore the use of incorporated joint venture companies. The NNPC is also required to declare dividends to its shareholders and retain 20 per cent of profit as retained earnings to grow its business like any other incorporated entity incorporated under the Companies and Allied Matters Act, as provided under Section 53(7) of the PIA.

Also, the NNPC Limited supervises the mechanism of funding the Joint Venture Operations through the cash-call process.

Clearly, from the foregoing, as a commercial entity, the NNPC Limited is striving to ensure that its stakes in the Joint Venture Contracts are not weakened if further shares are issued would continue to exercise its right of pre-emption.

And by doing that, it is simply protecting its investments in the JVCs. With this, there is no need to cry wolf where there is none in the case of the ongoing divestment of ExxonMobil JV assets and the illusion. Kyari had said recently that the company’s operational leaning would henceforth be business-like, with a profit motive, since it is now a CAMA entity.

He had said under the new arrangement, the company would raise between $3.5 billion and $5 billion in corporate finance to fund major upstream investments under its funding strategy for selected upstream investments.

To achieve this objective, Kyari said NNPC planned to acquire pre-emptive rights in select Joint Venture (JV) operations in the industry as well as take over the ownership of some non-investing partnerships.

The NNPC strategy, Kyari said, also included investing in strategic assets to address integrity, bottlenecking, and growth issues in the oil industry, such as “rigless” activities and oil drilling campaigns.

He said the company preferred to find lenders who could provide this funding in a ratio based on each lender’s capacity to help finance part of NNPC’s key investments, including the acquisition of equity interests in quality upstream oil and gas producing assets.

According to him, this remains an integral part of NNPC’s corporate strategy to rebalance its oil and gas portfolio, by divesting from some toxic assets, to enable it to acquire choice strategic assets that would help support its long-term strategic objectives.

This saw the company recently securing a $5 billion corporate finance commitment from the African Export-Import Bank (Afreximbank) to fund major investments in Nigeria’s upstream sector.

Under the contract, Afreximbank agreed to enter into a financial advisory and fundraising role to raise $5 billion to “acquire, invest and operate energy-producing assets in Nigeria as part of NNPC’s growth strategy following its incorporation as a limited liability company.”

Furthermore, the bank committed to underwrite $1 billion as part of forwarding sales based trade finance transactions. The finance commitment would enable NNPC to fund some of its major investments in the country’s upstream oil and gas sector.

So, there is no cause for alarm as the federal government has through the PIA, renewed its commitment to attracting investments in the oil and gas industry as the legislation provides the needed improvements in fiscal and governance frameworks, emphasises transparency and accountability as well as provides a level playing field for all players.

The NNPC no longer has access to government funding but now survives based on its internal resilience and efficiency. It is now a going concern, and just like every other limited liability company, its level of productivity is what would determine if it would remain in business. These would continue to define its operations going forward and so its intervention in the Seplat-ExxonMobil deal should not be misinterpreted.

Ike writes from Umuahia, Abia state.

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment