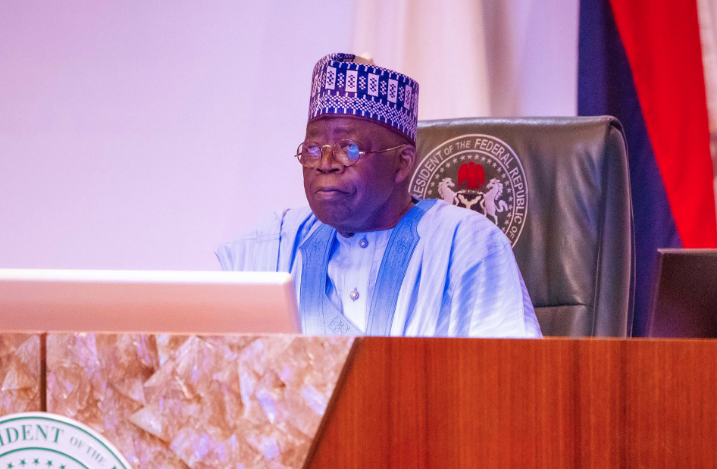

Tobias Adrian, director of the IMF monetary and capital markets department, briefing the press on the findings of the Global Financial Stability Report during the 2025 spring meetings of the World Bank Group and International Monetary Fund in Washington, DC, on April 22, 2025 | IMF Photo/Alyssa Schukar

The International Monetary Fund (IMF) says the level of policy uncertainty is rising, posing a threat to global financial stability.

Tobias Adrian, the fund’s financial counsellor and director of the monetary and capital markets department, spoke on Tuesday during a news conference on the world financial stability report.

Speaking at the event in Washington DC, the United States, Adrian said the IMF’s global financial stability evaluation indicates that risks are rising.

Advertisement

A major factor responsible for the assessment is “that the overall level of policy uncertainty has increased”, the IMF official said.

“The second factor is that the forecast of economic activity is lower. So it’s a combination of a lower baseline and larger risks that has been increasing the downside risks,” he added.

“Having said that, we do see both downside and upside risks”.

Advertisement

Adrian said risky asset values, leverage and maturity transformation in the financial system, and the overall level of global debt were the three major vulnerabilities that informed the fund’s assessment.

‘FG’S REFORMS HELPED IN LOWERING NIGERIA’S SOVEREIGN CREDIT SPREAD’

On investors’ sentiments in Nigeria, Jason Wu, assistant director of the monetary and capital markets department at the IMF, said the country’s sovereign credit spreads were seen lowering earlier in the year, owing to the federal government’s reforms, like the foreign exchange market liberalisation.

In finance, a sovereign credit spread refers to the difference in interest rates or yields between a country’s government bond and the yield on a government bond from a country considered safer or less risky, such as the United States.

Advertisement

According to experts, a wider spread indicates a higher perceived risk of default, while a narrower spread suggests lower perceived risk, signalling improved investor confidence.

Speaking on the factors contributing to Nigeria’s improved position in the global financial market, Wu said macroeconomic performance “has held up”.

“GDP growth had been fairly consistent, and inflation has been coming down. And earlier this year, we have seen Nigerian sovereign credit spreads lowering,” he said.

“I think the reforms that authorities have done, including the liberalisation of exchange rates, have helped in that regard.”

Advertisement

Wu, however, advised the authorities to remain vigilant amid a volatile global financial market.

‘LOWER SPREADS MEANS NIGERIA’S BORROWING COST WILL REDUCE’

Advertisement

Speaking to TheCable, Mojolaoluwa Ayeni, lead economist at Quartus Economics, said the development is good for Nigeria as it could lead to lower borrowing costs, and increased capital inflows (foreign portfolio investments) due to improved risk perception.

“Increased inflows and confidence will be a boost to currency stability,” he said.

Advertisement

In August 2024, the federal government issued a $500 million bond for subscription at $1,000 per unit to investors.

In a statement, the Debt Management Office (DMO) said the offer was a five-year domestic dollar bond due in 2029, at an interest rate of 9.75 percent per annum.

Advertisement

The following month, Wale Edun, minister of finance and coordinating minister of the economy, disclosed that over $900 million was raised from the offer, recording a 180 percent oversubscription.