The presidency says President Bola Tinubu did not create Nigeria’s current economic problems.

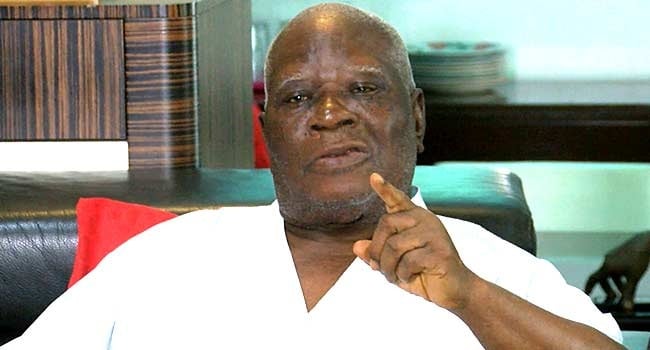

In a statement on Sunday addressing a report by the New York Times titled ‘Nigeria Confronts Its Worst Economic Crisis in a Generation,’ Bayo Onanuga, special adviser to the president on information and strategy, said Tinubu inherited the economic problems.

Onanuga said the report reflected the “typical predetermined, reductionist, derogatory, and denigrating way foreign media establishments reported African countries for several decades”.

According to the spokesperson, the publication painted the dire experiences of some Nigerians amid the inflationary spiral of the last year and blamed it all on the policies of Tinubu’s administration, however, it never mentioned the positive aspects of the economy.

Advertisement

“The report, based on several interviews, is at best jaundiced, all gloom and doom, as it never mentioned the positive aspects in the same economy as well as the ameliorative policies being implemented by the central and state governments,” Onanuga said.

“To be sure, President Tinubu did not create the economic problems Nigeria faces today. He inherited them. As a respected economist in our country once put it, Tinubu inherited a dead economy.

“The economy was bleeding and needed quick surgery to avoid being plunged into the abyss, as happened in Zimbabwe and Venezuela. This was the background to the policy direction taken by the government in May/June 2023: the abrogation of the fuel subsidy regime and the unification of the multiple exchange rates.”

Advertisement

‘TINUBU REMOVED PETROL SUBSIDY TO DEAL WITH CANCER OF PUBLIC FINANCE’

Defending the decision to remove the petrol subsidy, Onanuga said it gulped $84.39 billion between 2005 and 2022 from the public treasury in a country with huge infrastructural deficits and in high need of better social services for its citizens.

He said the Nigerian National Petroleum Company (NNPC) Limited, the sole importer of petrol, had “amassed trillions of naira in debts for absorbing the unsustainable subsidy payments” in its books.

“By the time President Tinubu took over the leadership of the country, there was no provision made for fuel subsidy payments in the national budget beyond June 2023,” the spokesperson said.

Advertisement

“The budget itself had a striking feature: it planned to spend 97 percent of revenue servicing debt, with little left for recurrent or capital expenditure. The previous government had resorted to massive borrowing to cover such costs.”

According to Onanuga, to deal with the cancer of public finance on the first day, Tinubu had to end the subsidy regime and the “generosity that spread to neighbouring countries”.

‘CBN SUBSIDISED EXCHANGE RATE WITH $1.5 BILLION MONTHLY’

Onanuga said the government was also subsiding the exchange rate as it was doing with oil in a bid to defend the naira against the “unquenchable demand” for the dollar.

Advertisement

The spokesperson said the Central Bank of Nigeria (CBN) spent an estimated $1.5 billion monthly to defend the local currency against the American greenback.

He said subsidising the exchange rate encouraged arbitrage as the gap between the official and parallel markets’ rates widened, and at the same period, the country was unable to fulfil its remittance obligations to airlines and other foreign businesses.

Advertisement

“Like oil, the exchange rate was also being subsidized by the government, with an estimated $1.5 billion spent monthly by the CBN to ‘defend’ the currency against the unquenchable demand for the dollar by the country’s import-dependent economy,” he said.

“By keeping the rate low, arbitrage grew as a gulf existed between the official rate and the rate being used by over 5000 BDCs that were previously licensed by the Central Bank. What was more, the country was failing to fulfil its remittance obligations to airlines and other foreign businesses, such that FDIs and investment in the oil sector dried up, and notably Emirate Airlines cut off the Nigerian route.”

Advertisement

He said the president’s administration also floated the naira to deal with the cancer of public finance.

‘STABILITY IS BEING RESTORED… ALBEIT SOME CHALLENGES’

Advertisement

Onanuga said stability is being restored in the foreign exchange markets since the naira depreciated to an all-time low of N1,900/$, although he acknowledged there are still challenges.

“The exchange rate is now below N1500 to the dollar, and there are prospects that the naira could regain its muscle and appreciate to between N1000 and N1200 before the end of the year,” added.

He also said the economy recorded a trade surplus of N6.52 trillion in the first quarter (Q1) of 2024, against a deficit of N1.4 trillion in Q4 of 2023.

Highlighting other positives from the reforms within Tinubu’s first year, Onanuga said portfolio investors have streamed in as long-term investors.

“When Diageo wanted to sell its stake in Guinness Nigeria, it had the Singaporean conglomerate, Tolaram, ready for the uptake,” the spokesperson said.

“With the World Bank extending a $2.25 billion loan and other loans by the AfDB and Afreximbank coming in, Nigeria has become bankable again. This is all because the reforms being implemented have restored some confidence.”

Onanuga said the inflationary rate is slowing down according to the National Bureau of Statistics (NBS) data for April.

“Food inflation remains the biggest challenge, and the government is working very hard to rein it in with increased agricultural production. The Tinubu administration and the 36 states are working assiduously to produce food in abundance to reduce the cost,” he said.

“Some state governments, such as Lagos and Akwa Ibom, have set up retail shops to sell raw food items to residents at a lower price than the market price. The Tinubu government, in November last year, in consonance with its food emergency declaration, invested heavily in dry-season farming, giving farmers incentives to produce wheat, maize, and rice.

“The CBN has donated N100 billion worth of fertiliser to farmers, and numerous incentives are being implemented. In the western part of Nigeria, the six governors have announced plans to invest massively in agriculture.”

According to the special adviser, with all the plans being executed, inflation, especially food inflation, will soon be tamed.

Onanuga said Nigeria is not the only country in the world facing a rising cost of living crisis, adding that the United States is also experiencing a similar situation, “with families finding it hard to make ends meet”.

“US Treasury Secretary Janet Yellen raised this concern recently. Europe is similarly in the throes of a cost-of-living crisis. As those countries are trying to confront the problem, the Tinubu administration is also working hard to overturn the economic problems in Nigeria,” he said.

Onanuga said Nigeria faced economic difficulties in the past, and just as the country overcame them, the present difficulties will soon be quelled.

Add a comment