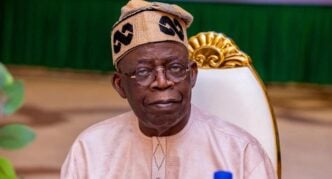

President Bola Tinubu’s economic policies have generated significant reactions in Nigeria, with many citizens feeling the effects deeply. Since his administration took office on May 29, 2023, when the gauntlet was thrown on the presidential dias nestled at Eagle Square, PBAT’s “subsidy is gone” pronouncement has thrown the economy into an uncontrollable spin with the resemblance of a mayday in aviation parlance, and several key policy changes have led to economic challenges for the Nigerian populace, particularly around inflation, unemployment, and the cost of living.

The most impactful decisions include the removal of fuel subsidy during PBAT’s honeymoon season with Nigerian citizens during the early days of his administration. One of Tinubu’s first major decisions was to remove the long-standing fuel subsidy. While the subsidy was seen as a drain on government finances, its removal has caused the price of petrol to skyrocket.

Nigeria, despite being an oil-producing country, relies heavily on fuel imports due to its limited refining capacity. With fuel prices more than doubling, transportation costs soared, triggering inflation across various sectors, particularly food, goods and services. This has directly impacted the livelihoods of millions of Nigerians, many of whom live below the poverty line.

Furthermore, currency unification and exchange rate liberalisation is one hot potato; Tinubu’s administration implemented a more flexible exchange rate system, allowing the naira to float against foreign currencies. Previously, the Central Bank of Nigeria (CBN) maintained multiple exchange rates to manage inflation and reduce the impact of external shocks. With the unification of the rates, the naira quickly depreciated, causing import costs to rise and contributing further to inflation. Nigerians now face higher costs for imported goods, including essential items such as food, medicine, and fuel.

Advertisement

The mountain-high economic drawbacks do not end there, as high inflation and cost of living kill the living. The combination of fuel price increases, currency devaluation and pre-existing economic conditions (such as unemployment and poverty) have contributed to inflation levels not seen in recent history. Food has become increasingly unaffordable for many families. Nigeria’s inflation rate has hovered around 32 and 33 percent, putting severe pressure on consumers and creating widespread economic anxiety. The middle class is shrinking and practically going into extinction – Right now it’s either you’re poor or rich at this rate), and more citizens are sliding into poverty, with some skipping meals to cope with rising costs.

The latest increase in petrol pump prices across the federation has further pushed up the cost of goods and services and worsened the economic strain on a struggling population gasping for breath. As Nigerians grapple with rising inflation and excruciating hardship, the president and C-in-C is on a working vacation in London and Paris, with a detached façade from the challenges of the masses. This growing disconnect fuels frustration, with the consensus being that the current administration lacks a clear plan and vision to address the nation’s economic woes. The road ahead seems long and difficult, as Nigerians need to brace themselves for the impact of more challenges under PBAT’s leadership.

The economic nerve centre that acts as a socio-economic barometer for the nation has now become a shadow of itself thanks to the recent hike in fuel prices. The bustling energy and drive that used to define the aquatic city of splendour has faded, as all locomotion is considered before any. The rising cost of fuel has not only made transportation more expensive but also forced businesses to scale back operations or shut down completely.

Advertisement

As a result, the city nestled by the Atlantic Ocean is now eerily quiet during the wee hours of the night, reflecting the deepening impact of the economic crisis on everyday life. Before poisoned darts and vitriol fly in the direction of this author, the hinterland of Nigeria is not any better. This lucid treatise is not based on an armchair conclusion that’s based on the economic oasis christened Lagos, as other federating units are considered to reach this conclusion.

Lest we forget, the rising interest rates and borrowing costs are another piece of cake that the economy has to deal with. To curb inflation, the Central Bank of Nigeria has maintained high interest rates, which have raised the cost of borrowing for businesses and individuals. While this policy is aimed at controlling inflation, it has stifled business growth, especially for small and medium enterprises (SMEs), and discouraged new investments. The result has been a sluggish economy with fewer job opportunities, exacerbating Nigeria’s unemployment problem.

In addition, social unrest and public backlash have greeted these economic policies, leading to widespread discontent among Nigerians. Protests over the removal of the fuel subsidy have occurred across several states. The increased cost of living has driven public frustration, with many criticising the government for implementing reforms without adequate social safety nets in place. All the pronouncement(s) on the provision of CNG transportation and removal of import duty on certain food items are neither here nor there. While Tinubu’s administration has introduced temporary measures such as cash transfers to vulnerable populations, these have not been enough to offset the economic pain for most Nigerians.

It has been mixed tales of reactions to the said economic reforms so far. While some economists and international institutions like the Bretton Woods institutions like the World Bank and IMF have praised the reforms as necessary for long-term stability and attracting foreign investment, the immediate effects have been harsh. Critics argue that the government’s approach is worsening inequality, with the poorest Nigerians bearing the brunt of the changes. The reforms may benefit Nigeria’s macroeconomic stability over time, but the short-term impact on households has been profound, leading to a sense of despair among many citizens and emotional panic beyond comprehension skyrocketing on basic needs such as feeding, transportation and housing.

Advertisement

The kernel of this submission will be incomplete without harping on the yoyo-like locomotion at the petroleum ministry where the PBAT supritends as minister of petroleum. The back and forth between industry regulator NNPCL and Dangote refinery leaves a sour taste in one’s mouth. It’s a cacophony of pronouncement daily from all angles and the likes of IPMAN, MOMAN, and NPA amongst others have joined the fray. All Nigerians ask for is to access petrol without hassles – Who says as the Yuletide season approaches the pump price might not hit N1,500.

In a nutshell, PBAT’s economic reforms have had a severe impact on the daily lives of Nigerians. The medley of rising fuel pump prices, currency depreciation, and high inflation has pushed millions deeper into economic hardship and woes. While these policies are intended to address structural weaknesses in the Nigerian economy, they have created significant social and economic distress, with many citizens feeling that they are being pushed into economic doldrums. The long-term success of these reforms depends on whether the government can cushion their immediate impact and create conditions for sustainable growth.

Ayoola Ajanaku is a communications and advocacy specialist based in Lagos, Nigeria

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.