Now that the pump price of petrol has nearly doubled, we can officially conclude that President Muhammadu Buhari has finally blinked. For a man of the masses, we can assume that this was a very difficult decision for him. The truth is: any upward adjustment in the price of petrol increases the cost of living and worsens economic hardship, even if in the short run. Transportation is a major component of the cost of living in Nigeria. It is not just about commuting; we are transporting goods and services. We are powering our homes and businesses with generators. Even the landlady will raise the rent to make ends meet. That is why hiking fuel prices has always led to protests and riots.

But why was petrol price increased? There can only be one explanation: the Nigerian National Petroleum Corporation (NNPC) does not have the forex to pay for imports. At the official rate of N197 to the dollar, the Central Bank of Nigeria (CBN) needs to make some $500 million available to the NNPC every month for fuel imports. Where will CBN get the dollars? Petrodollar is by far the apex bank’s biggest source of forex inflow. Crude oil price is down. Against our budgeted daily production of 2.2 million barrels per day, output is down to around 1.4 mbpd as a result of militant activities. We are losing in both price and quantity. In plain English, we are in soup.

The CBN/NNPC “partnership” was not going to last. To start with, do we even make up to $500 million monthly from crude oil sales these days? Even if we do, will every dollar inflow go into fuel importation? What about our several other international obligations, such as debt repayments, letters of credit and investors’ funds? We think our foreign reserve is $28 billion, but by the time we go into details… it is a big bubble. And our international trading partners know this very well. The moment the reserve can no longer finance three months of import, they will pull the plug. Then we will know the true meaning of economic crisis.

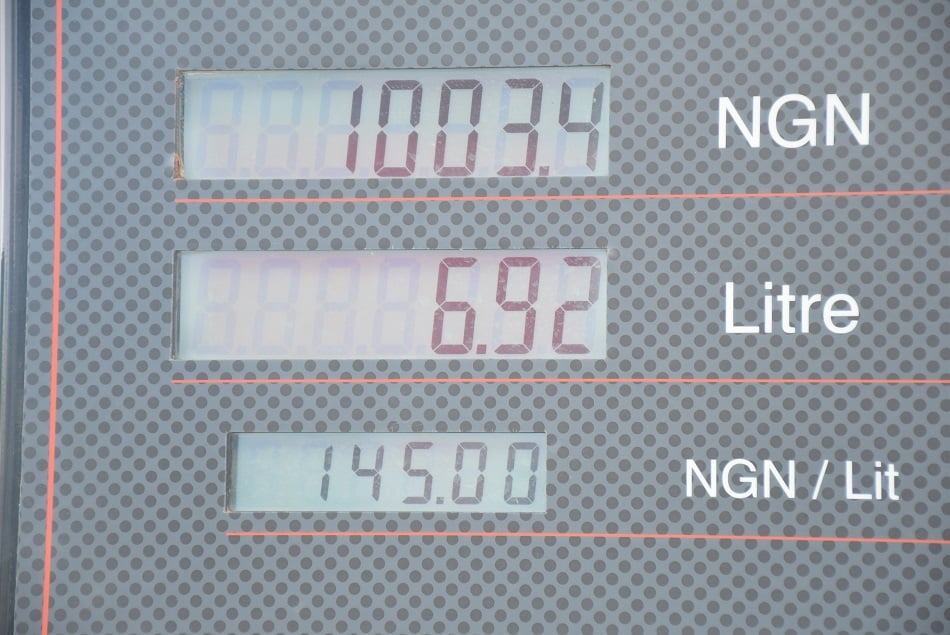

What the government has done is to implore marketers to return to the importation business to stop the crippling crisis. NNPC has been badly exposed by the logistical nightmare, and incapacitated by forex scarcity. In extending invitation to the marketers — who stopped importing in October 2015 as a result of lack of clarity in policy — the government has told them to source their forex from “secondary market”. That means parallel market. If they buy dollar at N285, there is no way they will sell petrol at N86.50, the official price. The PPPRA template landing cost of N99 per litre is priced at the official N197 to the dollar. Something must give. Pump price had to go up.

Advertisement

But our problem may have just begun. As soon as marketers invade the “secondary” market, the rate will go up. Again, that is simple logic. Forex inflow has not increased. What we are facing is a forex supply crisis. Increasing fuel price does not increase forex inflow. It follows, logically, that even the N145 pump price is not sustainable. The more the pressure on the parallel market, the more the rate will inch upwards. And the marketers will have to reflect this appropriately in the pump price, except we have to return to the subsidy regime to keep the price at N145 at all cost. In sum, except forex inflow improves, the naira will continue to fall, and petrol price will keep rising.

What then? How do we improve the inflow of forex so that the naira does not depreciate further? One common prescription is that the CBN should devalue the naira officially, since the naira has already devalued itself. Only NNPC and a few manufacturers were getting the dollar at N197 in any case. Most prices had adjusted to N320/$1 before now. Now that oil marketers will source forex at non-official rate, and most manufacturers either go to the black market or shut down, the CBN rate is nothing but window dressing. Who actually gets dollar at N197? Manufacturers are complaining of getting little or nothing. NNPC is complaining.

The argument of the pro-devaluation group all along is that if the CBN devalues the naira, non-oil sources of forex would open up. Remittances and repatriation would return through official sources, and investors would also be more confident to bring their capital into the Nigerian economy. Our foreign reserves would thus be boosted and the pressure on naira would ease. The implication would be a one-off inflation that would be offset by economic growth rather than the contraction we have witnessed in the last one year. But Buhari has maintained for a long time that devaluation is not an option, that he would not “kill” the naira.

Advertisement

Now that the president has allowed an upward adjustment in petrol price, the pro-devaluation group would be feeling hopeful. Former CBN governors Chief Joseph Sanusi, Professor Chukwuma Soludo and Alhaji Muhammad Sanusi II all argued that falling oil revenue and dwindling foreign reserves meant the official exchange rate was no longer sustainable — and capital controls would only worsen the currency crisis. They canvassed, at various fora, the need to allow the naira to depreciate to reflect market realities. However, they should not celebrate still: the naira has not been devalued — only petrol price has gone up. Our fingers remain crossed.

Delayed or dysfunctional adjustment is costly, Soludo warned Buhari in his famous lecture in Enugu in November 2015. Has he been proved right? Buhari tried to hold on to N197/$1 and N87 per litre of petrol for nearly a year, though he has finally let go of petrol price. But between 2015 and 2016, a lot has gone wrong. Inflation has gone into double digit; billions of dollars in investors’ funds have taken flight out of Nigeria; petrol has been sold for as high as N250 per litre in many parts of the country as a result of lingering shortages; 26 states are unable to pay salaries; many factories have closed down; and many companies and states have retrenched workers.

Would things have turned out differently if Buhari had taken a different route on assuming office in May 2015? We may never know, but many analysts would argue that if Buhari had allowed the devaluation of the naira in June or July last year, the peg would probably be around N250 today. The uncertainly sent the currency market into an overdrive, and the arbitrage by the speculators did serious damage to the naira. That is the price of late adjustment, many of the analysts would argue. By freeing the pricing of petrol but holding on to the exchange rate, Buhari may be setting the stage for a more brutal outcome. Rent-seeking behaviours get incentivised this way.

In other words, we may end up paying a much higher price for another delayed adjustment. As pressure shifts to the non-official currency market, the naira will continue to crash. Fuel prices will inevitably go up. And as CBN continues to share oil revenue at N197 to the dollar, the three tiers of government will continue to receive half the market value of their statutory allocations. The paucity of funds continues. Many states will still be unable to pay salaries. Many manufacturers will still be unable to access forex at the official rate. More jobs will continue to be shed. Arbitrage will be more unrelenting and more rewarding. The picture is not pretty.

Advertisement

I almost forgot the good news: there could be a miracle. Crude oil price could do the extraordinary — that is, go back to the days of $100 a barrel. We can then forget all our troubles. There will be enough forex inflow to finance our needs, the naira will regain strength, government will have enough money to pay salaries and embark on new projects, and manufacturers will complain less. Purchasing power will be on the rise and the market women would be smiling again. That is the painless way to recovery. Otherwise, there is nothing we can do now that will not bring severe pains. Adjustment has a price, and delayed adjustment a bigger price.

AND FOUR OTHER THINGS…

OCCUPYING NIGERIA

The fuel price hike is eliciting the usual response: threats of mass action. However, I would advise that we proceed with caution. Many of the economic problems we are facing today originated from the mismanagement of the petroleum industry. Despite that, we made it impossible for Presidents Olusegun Obasanjo and Goodluck Jonathan to deregulate the downstream sector. Are we better off today? That is one question we should keep asking ourselves. It should be clear to all now that reform is inevitable. Let us try something new, endure the pains and see where we end up in years ahead. Wisdom.

DEREGULATION OR WHAT?

Advertisement

A litre of petrol will now sell for a maximum of N145 per litre. But what does that mean really? Many commentators have identified lack of policy clarity as a major problem of the Muhammadu Buhari administration — and here is one more evidence. Raising the pump price of petrol from N86.50 to N145 without telling us what will happen to “equalisation fund”, without saying anything on kerosene pricing, without letting us into a clear-cut deregulation programme, without a word on the petroleum industry bill (PIB), what exactly is that? To me, it looks like just another fuel price hike. Disjointed.

QC DEAD END

Advertisement

At the end of it all, the allegation of sexual harassment of a student at Queen’s College, Lagos, could not be proved, according to the investigative panel set up by the federal ministry of education. This is because the accuser failed to come forward to give evidence that indeed her daughter was harassed. There is an unconfirmed report that the woman chickened out because her husband was angry with her for daring to expose their daughter to danger with the school authorities. If this is true, that is unfortunate. Or could it be that no harassment ever took place? Puzzling.

CAMERON ON CAMERA

Advertisement

There is a mistake many Nigerians are making over the “fantastically corrupt” statement by David Cameron, the British PM. People say it is a statement of fact. But as Eseoghene Al-Faruq Ohwojeheri has pointed out, there is a difference between mockery and statement of fact. Cameron was simply mocking us in a private conversation with the Queen, unaware it was caught on camera. Am I surprised? The US diplomatic cables published by Wikileaks years ago showed clearly that while these people openly talk about us with choreographed respect, sympathy and concern, they are full of nothing but contempt for us. Hypocrisy.

Advertisement

7 comments

I’m better informed on the real need for Naira devaluation now. Thanks for making this article simple and plain.

Thanks for your piece on the fuel price. Brilliantly written and captured all the facts. Unfortunately, the Labour unions seem to have their own alternative universe and cannot see the points eloquently stated by you. Their planned strike will worsen the economy and lead to their members losing their jobs. I am surprised that the Labour unions did not call out for a national strike when several states were failing to pay their members salaries.

This is very well thought out and researched.Thanks

Excellent piece

Good points but there is no way govt would have been able to do any social support system without a budget which makes difficult decisions difficult to implement immmediately the govt. came in.VP has been consistent that the tight controls on economy would be for short time. Now there is an approved budget, there are social protection programs, now, it is time to take the difficult decisions. Strategy is key for govt decisions and it seems majority now tend to support the decision at this time. PMB has unbelievable support from people, they just trust the man.

there is need to increase the number of marketers importing fuel. it has now be expedient to allow those Niger Deltans to produce petroleum products in their backyards. i don’t like the idea behind fixing of prices in the downstream sector. All the prices they have fixed have never been stable

Makes a lot of sense. However a few explanations required before I refuse to protest.

1. Why do we have the highest paid elected officials in the world yet one of the poorest masses?

2. Why have nass and senate salaries not been cut?

3. Why must the masses suffer alone. OK elected decision makers get free fuel from taxes paid.

4. Why must it cost so much to run aso rock?