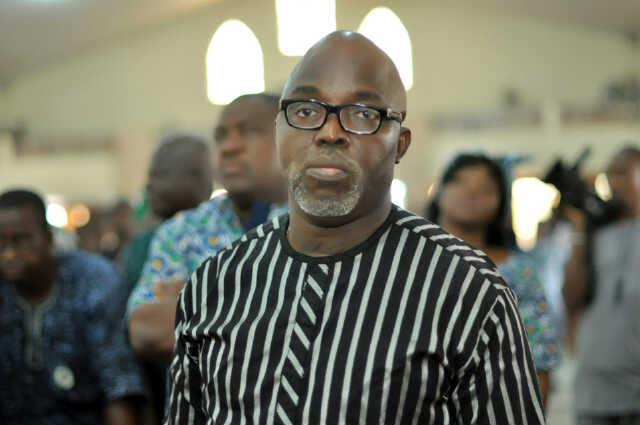

From one market in Zamfara to another in Anambra, you would spot him with a computer tablet, pacing from one store to the other attending to petty traders who want to grow their businesses but do not have the fund. At 31, Uzoma Nwagba is driving “Africa’s largest social enterprise programme”. He is the chief operating officer (COO) of the Government Enterprise and Empowerment Programme (GEEP), one of the components of the National Social Investment Programme (NSIP) under the office of Vice President Yemi Osinbajo.

Implemented by the Bank of Industry, GEEP comprises FarmerMoni, MarketMoni and TraderMoni products. For Nwagba, who coordinates 4000 agents across the country, it is all about using technology to deliver measurable impact in financial inclusion and to make lives of the common man better.

ABA-BORN FIRST-CLASS GRADUATE

Nwagba was born on September 7, 1987, in Aba, Abia state, where he hails from. He attended Kings College, Lagos and holds a first-class degree in electrical engineering from Howard University and an MBA from Harvard, both in the US. While at Howard, he served as the student government president.

Advertisement

He had worked as a senior associate at African Capital Alliance, an equity firm, and as a product manager at Microsoft. He also worked with Goldman Sachs in New York Redmond. He was recently selected as a 2019 Desmond Tutu Fellow by the African Leadership Institute for his impact in public service.

OBSESSED WITH TECHNOLOGY AND DATA

Leveraging his experience in finance and technology, Nwagba believes traders and artisans, who are financially marginalised, can get access to corporate financial services.

Advertisement

“I use the app, make the calls, monitor the systems, just to get a feel. Our GEEP agents are equipped with a proprietary application that enables full registration and capture of 48 data points, information on the market, nature of trader, pictures of trader and their trade point, GPS coordinate of the trade point, farm plot mapping, association membership and 43 other data points that enable credit assessment,” he told TheCable.

“Data on every captured beneficiary is first duplicated via facial recognition technology and BVN validation, then delivered to Bank of Industry real time to enable verification, appraisals and credit assessment.”

‘I WANT TO HELP OTHERS GROW THEIR BUSINESSES’

The engineer-turned public servant said he has been lucky enough to have several opportunities that accelerated his life; hence, it is only right that he helps others too.

Advertisement

“These are the things that motivate me personally. The idea that we can build something from scratch, deliver real measurable impact in financial inclusion at such an enormous scale, and in the process give back to the society that has raised us,” he said.

He said MarketMoni targets small businesses with soft loans from N50,000 to N100,000, while FarmerMoni targets local smallholder farmers with loans starting at N250,000 and a buy-off guarantee on their produce. TraderMoni having the widest reach of the three GEEP initiatives, due to the target demography, has given loans starting at N10,000.

“Of the over two million beneficiaries of the GEEP, the vast majority of these micro-enterprises are petty traders, merchants, enterprising youth, and agricultural workers in over 1600 clusters and markets across all 36 states of Nigeria, and the federal capital territory,” Nwagba said.

MY EXPERIENCE WITH THE TRADERS

Advertisement

On his experience moving across the country and dealing with market women and artisans, he said: “The experiences are beautiful. I recall one time in Bauchi where a group of staunch Muslim traders gathered in a circle with their Imam and were praying for me, an Igbo Christian, and of course praying for the government. These are priceless moments. I have gotten a well-rounded view of this country to see that the things that unite us are stronger than those that divide us. We all want better lives and the dignity that comes with economic empowerment.”

Some of his challenges running the project come from enumerating millions of people, managing 4,000 agents nationwide and lots of technological tools and systems. But the most daunting one comes from the wrong narratives that the initiatives are political.

Advertisement

“I have never seen a PVC on this job. We have never given loans based on political affiliation. We have no idea who is APC or PDP or XYZ. It does not matter, and it will never matter. When that lady in Anambra who started with 10,000 (TraderMoni) is now on her 50,000 loan (MarketMoni), there is nothing you will tell her about party. I am glad that season is behind us and our work continues,” he said.

THE TASK AHEAD

Advertisement

Nwagba said the task ahead of him is to create an enabling environment for more small businesses and reduce poverty among the lower people in the economic ladder.

“I would like to use GEEP to give a new meaning to possibility: for government projects, for digital finance, for credit, for impact, for applied tech and innovation, for what young people can do when given a real leadership chance. This happens to be one platform but there are several more where we can achieve results of similar scale and magnitude,” he said.

Advertisement

“In Nigeria, our biggest social challenge is poverty. I am a strong believer that the most effective way to fight poverty is to accelerate enterprise. At some point, this could all be private sector and industry-driven; but until then, we must be deliberate about achieving what you call “fiscal cushions” on the way there, and do it at all levels – even the poor, otherwise the country will implode before our very eyes.”

Add a comment