Men have lived, some are living, and many more will live; many will be forgotten while in power, few will be remembered even out of the corridors of influence. Atedo Nari Atowari Peterside is one of those men who have been known in power, and can never be forgotten.

In Nigeria or any other country on the continent, you will hardly find professionals like Peterside – he has worked with three presidents and six central bank governors, yet staying true to his creed, calling and character.

He said his life as an economist, investment banker, merger and acquisition expert, board room giant, public commentator and government consultant has been driven by one goal – a better Nigeria.

KINGS COME FROM KINGS COLLEGE

Alex Ekueme, former vice president; Adetokunbo Ademola, former chief justice of Nigeria, Odumegwu Ojukwu, head of state of former Republic of Biafra; Hakeem Bello-Osagie, CEO Etisalat Nigeria; Senate President Bukola Saraki; Lateef Jakande, former governor of Lagos state; Muhammad Sanusi II, emir of Kano; and Peterside all have one thing in common – Kings College, Lagos.

Advertisement

Peterside, one of the many kings who have walked the streets, sat through classes, and slept in the dormitories of Kings College, Lagos, went on to City University, London, where he studied economics.

FOUNDED AND BECAME IBTC CEO AT 33

In the late 1980s, Peterside returned to Nigeria, at a time when the country was beckoning on some of its best brains to return home for a the development of its commonwealth.

Advertisement

This was a time Nigeria was grappling with multiple shades of recessions, and was seeking economic means of getting through public hardship.

Peterside set up Investment Banking and Trust Company (IBTC) at a small office in Marina, Lagos, with the aim of driving and developing investment banking in Nigeria. Peterside’s investment bank grew into a giant in the industry.

By 2003, he listed the same on the Nigerian Stock Exchange. In 2004, IBTC merged with Chartered Bank in what became IBTC Chartered Bank, following a recapitalisation of Nigerian banks under Charles Soludo, governor of CBN at the time.

He was CEO from 1989 to 2007. And in his usual style, he sent a mail to all members of staff announcing his resignation as the leader of the executive team, after a successful merger and acquisition process with Standard Bank of South Africa.

Advertisement

“Please do not send a reply to this e-mail. Instead, join me in praying to the Lord Almighty for our bank,” he wrote in before he was appointed chairman of the bank.

WORKED WITH THREE PRESIDENTS AND SIX CBN GOVS

From IBTC to IBTC Chartered and finally to Stanbic IBTC leadership, Peterside worked with three democratic presidents and six governors of the CBN.

Former President Olusegun Obasanjo appointed him as the chairman of the Committee on Corporate Governance of Public Companies in Nigeria. He led the committee of experts into crafting the first Code of Best Practices for Public Companies operating in Nigeria.

The Code was published in October 2003.

Advertisement

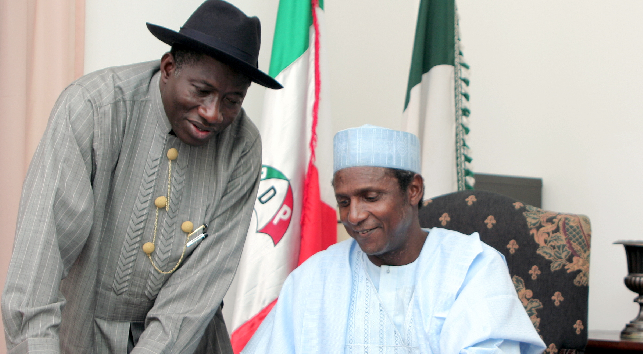

Former President Umar Yar’Adua also named Peterside as a member of the national economic management team, which was led by Shamsuddeen Usman, former finance finance minister.

He was also appointed to a task force that was given 30 days to submit an interim report on how to accelerate the improvement of the electricity supply situation.

Advertisement

Peterside also worked with former President Goodluck Jonathan, whom he called a democrat at heart.

Speaking on the CBN governors he had worked with through the years, the banker per excellence had fond words about Sanusi.

Advertisement

“Sanusi, a seasoned and knowledgeable economist and professional banker/risk manager with impeccable credentials, including, notably, integrity and a penchant for telling the truth at all times,” Peterside said in London, back in 2009, while presenting Sanusi as the new CBN governor.

He had reservations for Soludo’s defining policies. He said Joseph Sanusi, Soludo’s predecessor did “too little too late” and that his approach was “frustrating but not dangerous”, while Soludo was “trying to do far too much and far too soon”.

Advertisement

He was also active when Sarah Alade was appointed acting governor of the apex bank, following the suspension of Sanusi by the government of Jonathan.

Peterside was very much in the banking system when Godwin Emefiele was appointed governor, and he fiercely criticised his policies, especially as regards the exchange rate. In January, 2017, he said Emefiele’s CBN must accept its forex policies have failed.

HELPED UNBUNDLE POWER SECTOR AT THE PAIN OF DEATH

Jonathan, who had observed Peterside, while he worked for Yar’Adua made him a number of offers to join his government as a political appointee, which he rejected.

“He (Jonathan) offered me appointments at various times but I declined them while promising to assist 100 percent with any effort on his part to introduce certain long-overdue economic reforms,” Peterside told Guardian.

On the invitation of the president, Peterside eventually joined the National Council on Privatisation (NCP) and was appointed the technical committee chairman, responsible for privatisation of the power sector.

“With all due modesty, when the president and vice-president gave me the power sector privatisation assignment, I think it was a signal to investors that they wanted to do it properly and to follow due process,” Peterside said.

“If they wanted to rig the process they would never have appointed me because my antecedents were well known to the president and vice-president.

“Even the political enemies of the president and the vice-president called me to ask me if it was true that they could participate in the privatisation programme without fear or favour.

He said he gave all investors his personal guarantee “and promised all and sundry who inquired that I would be fair to all even at the pain of death”.

BOWING OUT AS A BOARDROOM GIANT

As he bows out of the Stanbic IBTC, after 28 years at the helm, Peterside remains a giant in the boardroom, after the likes of Gamaliel Onosode.

He served as an independent director of Presco plc from April 17, 2008 to December 31, 2014. He served as a non- executive director of Lekoil Limited from February 25, 2013 to June 2014.

He was director of Mobil Oil Nigeria plc from April 19, 2006 to December 2006, and served on the board of Presco plc from December 2005 to December 2006. He served as Director of FSDH Merchant Bank Limited.

He serves as a member of the private sector advisory board set up by the World Bank to assist in setting up a Country Assistance Strategy (CAS) for Nigeria.

He is the non-executive chairman of Cadbury Nigeria Plc and also sits on the board of directors of Flour Mills of Nigeria Plc, Nigerian Breweries Plc (Heineken Subsidiary) and Unilever Nigeria Plc.

Peterside is still the non-executive director on the boards of both Standard Bank Group Ltd and The Standard Bank Of South Africa Ltd.

1 comments

You are a great man sir…. i celebrate you