Purple Real Estate Income PLC (‘Purple Group’ or ‘Purple’ or ‘PREIP’ or ‘The Group’) has announced its audited results for the half year ended 30 June 2022.

Consolidated Income Statement

● Gross earnings of ₦4.7 billion, up 157.5% year-on-year (H1 2021: ₦1.8 billion)

● Net revenue of ₦984.6 million, up by 57.1% year-on-year (H1 2021: ₦626.8 million)

● Total other income rose by 14.0% to ₦779.8 million year-on-year (H1 2021: ₦684.1 million)

● Net operating income grew by 34.6% to ₦1.8 billion year on year (H1 2021: ₦1.3 billion)

● Adjusted operating expenses grew by 46.9% to ₦469.8 million year-on-year (H1 2021: ₦319.7 million)

● EBITDA of ₦1.3 billion, up by 30.5% year-on-year (H1 2021: ₦1.0 billion)

● Operating profit (or EBIT) of ₦1.3 billion, up 30.6% year-on-year (H1 2021: ₦991.2 million)

● Profit before tax of ₦938.1 million, up by 47.6% year-on-year (H1 2021: ₦635.4 million)

● Profit after tax of ₦744.7 million, up 39.3% year-on-year (H1 2021: ₦543.5 million)

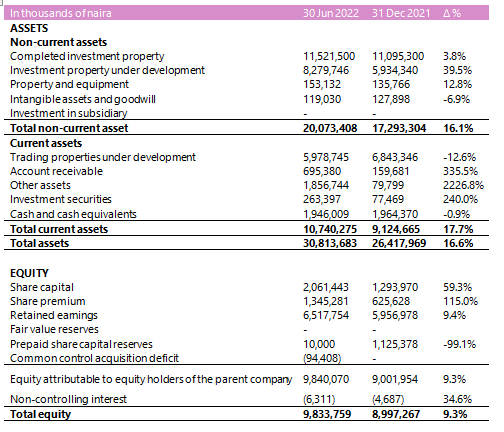

Consolidated Statement of Financial Position

● Total assets increased by 16.6% to ₦30.8 billion year-to-date (FY 2021: ₦26.4 billion)

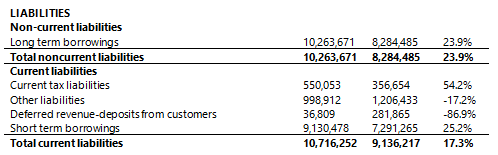

● Total liabilities of ₦21.0 billion, up 20.4% year-to-date (FY 2021: ₦17.4 billion)

● Shareholders’ funds of ₦9.8 billion (FY 2021: ₦9.0 billion)

● The total amount of the Interim dividend declared/proposed is ₦185.5 million of 6 kobo per share held as of 31 March 2022 for the period ended 30 June 2022 (2021: ₦142.3 million).

Key Ratios

● Net revenue margin of 20.9% (H1 2021: 34.3%)

● Cost to income of 26.6% (H1 2021: 24.4%)

● EBITDA margin of 28.0% (H1 2021: 55.3%)

● Operating profit margin of 27.5% (H1 2021: 54.2%)

● Profit before tax margin of 19.9% (H1 2021: 34.7%)

● Leverage ratio of 2.0x (FY 2021: 1.7x)

Commenting on the performance, the Chief Executive Officer, Mr Laide Agboola, stated:

“Building on the momentum we achieved in 2021, we made significant progress during the first half of 2022 and reached several milestones as we expanded our client reach and developed more properties. This was accomplished despite a background of considerable geopolitical instability made worse by the conflict in Ukraine. This war has had a big influence on consumer spending, supply chains, overall inflation, exchange rate and energy prices.

“We remain committed to providing solutions that cater for the needs of our environment and young and vibrant population. The aim is to diversify our revenue streams through our real estate and lifestyle development businesses. Our focus is on strengthening growth through technology and partnerships, as well as improving our capital base. We look forward to progressing further during the year.”

Gross earnings of ₦4.7 billion, up by 157.5% (H1 2021: ₦1.8 billion). A key driver of gross earnings growth was income earned from trading properties under development (70.5% of gross earnings) which grew year-on-year by 391.0% to ₦3.3 billion (H1 2021: ₦676.1 million).

Other drivers of gross earnings include:

● Rental income (5.8% of gross earnings) of ₦273.8 million (H1 2021: 288.9 million), down marginally by 5.2% as a result of concessions given to tenants to help alleviate the adverse economic conditions in the country.

● Revenue from services to tenants (7.2% of gross earnings) grew significantly by 87.2% to ₦337.1 million from ₦180.1 million in H1 2021 driven by the rise in diesel and electricity rates in 2022.

● Total other income (16.6% of gross earnings) grew by 14.0% to ₦779.8 from ₦684.1 million recorded in H1 2021 on higher impairment write-backs of ₦273.8 million (H1 2021: ₦147.2 million)

Net revenue grew by 57.1% to ₦984.6 million in H1 2022 (H1 2021: ₦626.8 million), primarily on account of higher revenue recorded on trading properties under development. The cost of sales also increased significantly over the period specifically, the cost of sales from trading properties under development rose by 638.6% to ₦2.7 billion (H1 2021: ₦372.9 million) because of the recognition of the direct cost associated with the sales of trading property in addition to the rise in the cost of materials and exchange rate. Overall, this resulted in a net revenue margin of 20.9% in H1 2022 relative to the 34.3% recorded in H1 2021.

Adjusted operating expenses of ₦469.8 million (10.0% of gross earnings), up by 46.9% (H1 2021: ₦319.7 million). Growth in other operating expenses was largely dominated by professional expenses which grew by 53.7% to ₦125.8 million (H1 2021: ₦81.8 million). Personnel expenses of ₦257.0 million were up 65.5% from ₦155.3 million due to business operation expansion. Overall, the Group recorded a cost-to-income of 26.6% (H1 2021: 24.4%), due to higher growth in adjusted operating expenses relative to the increase in net operating income (+34.6% to ₦1.8 billion from ₦1.3 billion).

EBITDA increased by 30.5% to ₦1.3 billion from ₦1.0 billion reported in H1 2021. Depreciation for property and equipment increased by 26.9% to ₦26.2 million (H1 2021: ₦20.6 million). The Group’s EBITDA margin declined to 28.0% year-on-year from 55.3%, reflective of the significant increase in marketing expenses and professional fees along with the exchange rate factors affecting the cost of materials.

Operating profits increased by 30.6% to ₦1.3 billion from ₦991.2 million in the year-ago period. The operating profit margin of 27.5% relative to 54.2% in H1 2021 is reflective of the trickle-down impact of fund-raising activities and marketing expenses incurred this year and the slight decline in margins from sales due to the increase in cost of materials due to do the declining value of the Naira against the Dollar.

Finance costs increased marginally by 0.2% to ₦356.6 million (H1 2021: ₦355.8 million). Interest expense on borrowings represented over 94.2% of finance costs with an interest coverage ratio of 3.6x (H1 2021: 2.8x)

Profit before tax rose by 47.6% to ₦938.1 million (H1 2021: ₦635.4 million) driven largely by higher revenue from increased activities, resulting in a Profit before tax margin of 19.9% (H1 2021: 34.7%).

The Group recorded an effective tax rate of 20.6% (H1 2021: 15.9%) due to higher operating profit. Profit after tax of ₦744.7 million, up by 39.3% from ₦534.5 million reported in H1 2021. The growth was largely driven by an increase in gross earnings which resulted from higher activity levels and sales value.

Year-to-date, total assets grew by 16.6% to ₦30.8 billion (FY 2021: ₦26.4 billion). The growth in non-current assets to ₦20.1 billion (FY 2021 ₦17.7 billion) was driven by a 39.5% increase in investment property under development to ₦8.3 billion (FY 2021: ₦5.9 billion). Current assets also grew by 17.7% to ₦10.7 billion (FY 2021: ₦9.1 billion) driven largely by growth in account receivables which is a function of the Group’s sales revenue for trading properties and other assets.

Shareholders’ funds increased to ₦9.8 billion from ₦9.0 billion due to a 59.3% increase in share capital to ₦2.1 billion (FY 2021: ₦1.3 billion) while share premium increased to ₦1.3 billion (H1 2021: ₦625.6 million).

Total liabilities grew by 20.4% to ₦21.0 billion from ₦17.4 billion in FY 2021, driven by a 24.5% increase in total borrowings to ₦19.4 billion (FY 2021: ₦15.6 billion) and 54.2% growth in current tax liabilities to ₦550.0 million from ₦356.7 million in FY 2021.

Long-term borrowings, which made up 52.9% of total borrowings, increased by 23.9% to ₦10.3 billion (FY 2021: ₦8.3 billion), while short-term borrowings, which made up 47.1% of the total borrowings, increased by 25.2% year to date to ₦9.1 billion (FY 2021: ₦7.3 billion). This resulted in a year-to-date leverage ratio of 2.0x (FY 2021: 1.7x).

For investor inquiries, please contact:

Investor Relations

[email protected]

Olayinka Sodipe

Oluyemisi Lanre-Phillips

[email protected]

For media inquiries, please contact: Emmanuel Balogun at [email protected]

Follow Purple on

Facebook: Purple

Instagram:@Purplegroupng

LinkedIn: Purple Group NG

Twitter: @Purplegroup_ng

Consolidated Statement of Profit and Loss for the Half Year Ended 30 June 2022

Consolidated Statement of Financial Positionas at 30 June 2022

![]()

About Purple

Purple is Nigeria’s breakthrough real estate and financial services platform at the forefront of a real estate revolution. We invest in the development, management, and acquisition of superior multi-purpose properties and infrastructure across a wide range of sectors to democratise access to real estate ownership and investment, breaking down the barriers that prevent investors from the gains of appreciating assets.

Purple Real Estate Income Limited commenced operations in 2014 and is responsible for developing the Maryland Mall, a Grade-A mixed-use centre that boasts the largest outdoor LED screen in West Africa.

To discover more and join the Purple community, visit Purple.xyz

Disclaimer

This announcement contains or will contain forward-looking statements that reflect management’s expectations regarding the Company’s future growth, results of operations, performance, business prospects and opportunities. Wherever possible, words such as “anticipate”, “believe”, “expects”, “intend” “estimate”, “project”, “target”, “risks”, “goals” and similar terms and phrases have been used to identify the forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management. Certain material factors or assumptions have been applied in drawing the conclusions contained in the forward-looking statements. These factors or assumptions are subject to inherent risks and uncertainties surrounding future expectations generally.

Purple Group cautions readers that several factors could cause actual results, performance, or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and undue reliance should not be placed on forward-looking statements. For additional information concerning these risks or factors, reference should be made to the Company’s disclosure materials filed from time to time with the Securities & Exchange Commission in Nigeria. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether because of new information, future events or otherwise.

Definition of terms

- Gross earnings: computed as an aggregate of revenue from the sale of trading properties under development, rental income, revenue from services to tenants and total other income.

- Total cost of sales: comprised cost of sales from trading properties under development, expenses on services to tenants, and other property operating expenses

- Net revenue: computedby deducting the total cost of sales from total sales

- Adjusted operating expenses: computed by deducting finance cost from total expenses

- Net operating income: derived by aggregating net revenue and total other income

- EBITDA: derived by adding back depreciation for property and equipment to operating profit

- Operating profit/EBIT: computed by adding back finance cost to profit before minimum tax and income tax expense

- Total borrowings derived as an aggregate of short-term borrowings and long-term borrowings

- Interest coverage ratio: computed as operating profit divided by finance cost

- Cost-to-income: derived by dividing total operating cost by net operating income

- Net revenue margin: obtained by dividing net revenue by gross earnings

- EBITDA margin: as a ratio of EBITDA and gross earnings

- Operating profit margin: derived as a ratio of operating profit and gross earnings

- Profit before tax margin: as a ratio of operating profit and gross earnings

- Leverage ratio: computed as the ratio of total debt and total equity

Add a comment