Tailors in Wuse market in Abuja

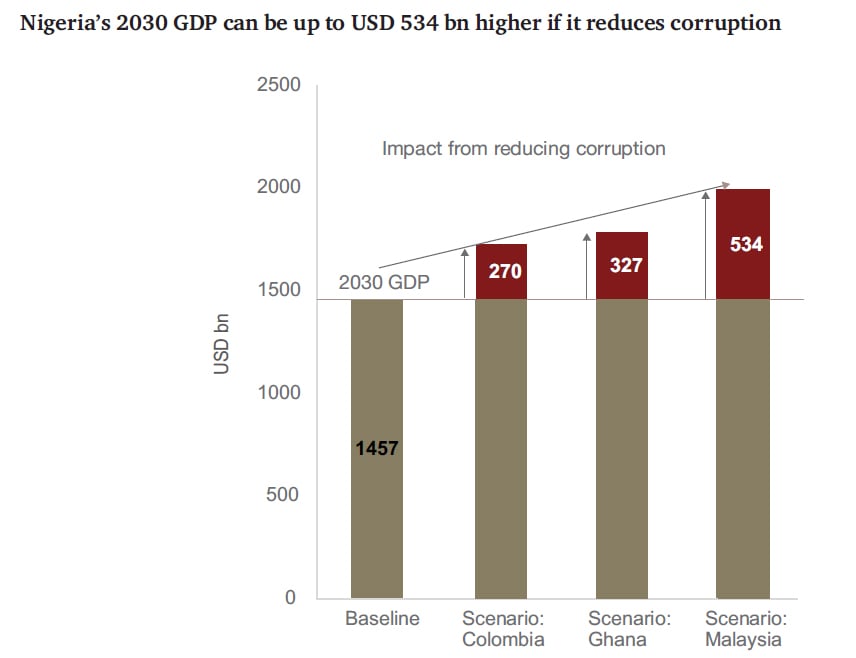

Nigeria’s GDP will nearly quadruple by 2030 if the country reduces corruption to the current levels in Malaysia, PricewaterhouseCoopers (PwC) has projected in its “Impact of Corruption on Nigeria’s Economy” report seen by TheCable.

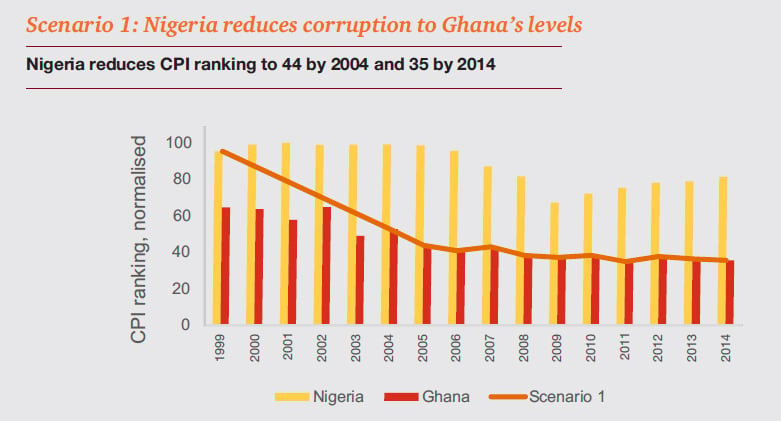

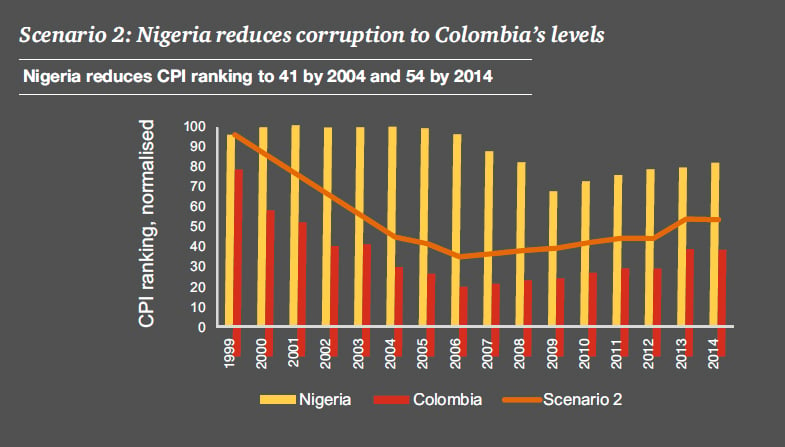

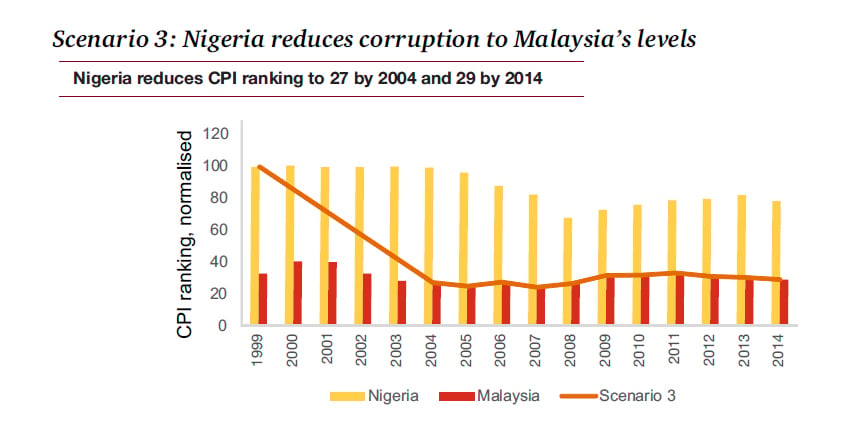

The professional services firm painted similar scenarios assuming Nigeria reduced corruption to the current levels recorded in Ghana and Columbia.

Nigeria’s GDP at as December 2014 was $513 billion — making it Africa’s biggest — but PwC reckons that it would have been $626 billion had the country witnessed the lower corruption levels in Ghana; $606 billion compared to Colombia’s; and $698 billion compared to Malaysia’s.

Projecting into the next 14 years, PwC painted a scenario that if the current anti-corruption efforts by President Muhammadu Buhari succeed, the GDP would grow to $1.783 trillion by 2030, going by Ghana’s levels, $1.726 trillion by Colombia’s, or $1.991 trillion by Malaysia’s.

Advertisement

Nigeria’s GDP is projected to be $1.457 trillion by 2030.

The current levels of corruption in Nigeria could cost the GDP up to 37% if it is not dealt with “immediately”, PwC said.

In GDP per capita terms, this cost is equated to around $1,000 per person in 2014 and nearly $2,000 per person by 2030.

Advertisement

In picking Ghana, Colombia and Malaysia for the comparative study to build the scenarios, PwC said it adopted the following criteria:

- the country’s natural resource rents must be greater than 10% of GDP i.e. a resource-rich country;

- the country has faced corruption problems and rank better than Nigeria on the Corruption Perceptions Index of Transparency International;

- the country must have implemented anti-corruption policies before and have improved corruption and macro-outcomes.

The impact of corruption on Nigeria, according to PwC, is felt in the long-run capacity of the country to achieve its potential.

The impact is felt in “lower governance effectiveness, especially through smaller tax base and inefficient government expenditure”, PwC said, estimating Nigeria’s tax revenues at 8% of GDP “which is the lowest for comparison countries”.

It is also manifested in weak investment, especially FDI, “as it’s harder to predict and do business”, and it means “lower human capital as fewer people, especially the poor, are unable to access healthcare and education”, PwC said.

Advertisement

The report has been presented to Vice-President Yemi Osinbajo, who is the chairman of the National Economic Council, on Friday.

Add a comment