From July 1, 2017, the federal government opened an amnesty window for tax defaulters, to help regularise the tax paying process and bring a whole lot more people into the tax net.

According to the ministry of finance, only 214 Nigerians are paying tax of more than N20 million per annum, and all these persons are resident in Lagos state.

Professor Yemi Osinbajo, during the launch of the voluntary asset and income declaration scheme (VAIDS), said “all of these 214 Nigerians who pay N20m or more in taxes annually are to be found in Lagos State. I’m sure in this room (and I’m not looking at anyone), there are another 214 people who earn more than N80 million annually“.

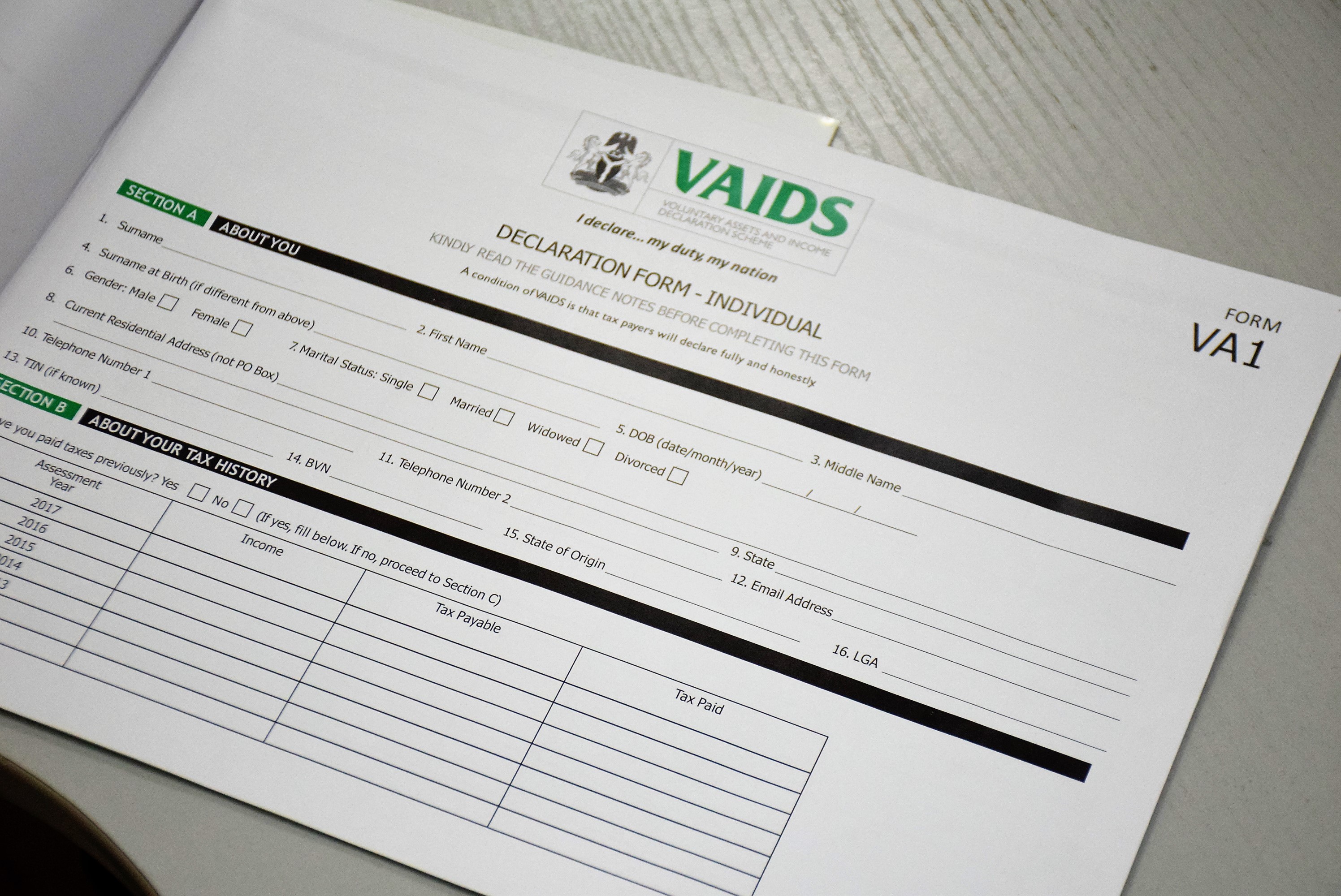

To handle this, VAIDS was launched and TheCable presents all you need to know about the scheme:

Advertisement

WHAT IS THE VOLUNTARY ASSET AND INCOME DECLARATION SCHEME?

The Voluntary Asset and Income Declaration Scheme is part of a nationwide crackdown on corruption and aims to rebuild Nigeria’s finances by tackling tax evasion.

Nigeria has a long history of tax evasion by high net worth individuals and multinational companies, whose actions

increase the burden on those who can least afford it. The government intends to stop this.

Advertisement

HOW DOES IT WORK?

The Scheme will last for nine months, from July 1, 2017 to March 31, 2018 with benefits to declaring early:

From July 1, 2017 to December 31, 2017, there will be waiver of interest and penalty, no prosecution of tax offences and no tax audit.

From January 1, 2018 to March 31, 2018 there will be waiver of penalty, no prosecution of tax offences and no tax audit. But interest will be paid.

Tax evasion is a criminal offence. According to the ministry of finance, this scheme is a one-off opportunity for evaders to avoid the full force of the law.

Advertisement

It will not be extended and there are no exemptions. International regulation that will be effective from 2018 will make identifying and prosecuting tax evaders easier.

To this end, Nigeria has signed agreements with the United States, Canada, UAE, Switzerland, Mauritius, Panama and Bahamas.

Will it affect all Nigerians?

It only affects Nigerian citizens or companies who haven’t got their tax affairs in order. If you are a citizen or company that is fully registered with the tax authorities and are not in dispute about your outstanding balance then this does not affect you.

WHY ARE WE DOING THIS?

Advertisement

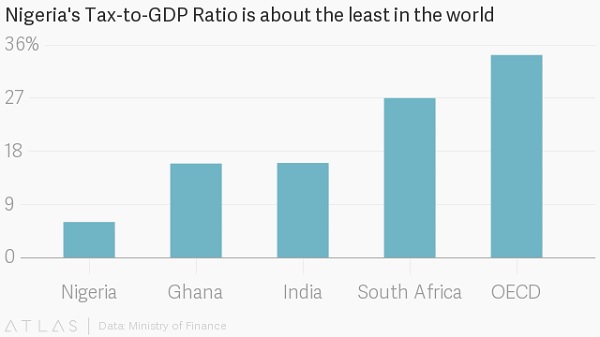

Kemi Adeosun, minister of finance for Nigeria, said Nigeria’s tax to GDP ratio is about the worst anywhere in the world, and the government is working to change that and get funds to build the nation’s infrastructure.

“We are doing two things today: we are sending a clear signal to tax evaders in our country that the party is over. We’re also calling on these evaders to do the right thing and rapidly come clean for the good of their country or face the full consequences of the law,” Adeosun said.

Advertisement

“This window of opportunity will never be offered again. The proceeds of this scheme will not disappear. They will be invested in key infrastructure projects and for clearance of pension arrears.”

Tax evasion hinders development and chasing down tax evaders is long overdue. At six percent, Nigeria’s tax-to-GDP ratio (i.e. the value of Nigeria’s tax receipts divided by the value of its GDP) is one of the world’s lowest. This compares to 32-35% in most developed nations.

Advertisement

The challenging economic environment, with slow growth rates and low commodities prices, means that sustainable development is not easy. The funds from Nigeria’s unrecorded and untaxed shadow economy could make a significant contribution to encouraging national economic growth.

What about Nigerians who live or own assets abroad?

If you are Nigerian and you earn income or own assets anywhere in the world– you must pay tax on your income and all your owned assets. The scheme covers both in-country and out-country assets.

Advertisement

What sort of taxes are covered in this Scheme?

All Federal and State taxes and both personal and business taxes.

I haven’t deliberately evaded taxes – I just didn’t know what to do?

It doesn’t matter if you have deliberately evaded taxes or have just been disorganised. You have nine months to get organised. If you have never paid taxes, you will need to register for a Tax Identification Number (TIN). Please follow this link to register.

Will this hit the rich or the poor the most?

As in all other countries, there is a greater incentive for Nigeria’s richer people to try and evade paying tax. The scheme is definitely not focused on the most vulnerable in our society.

If I am unemployed, am I affected?

If you worked previously but are unemployed now – and you haven’t registered with the tax authorities – then you could still be liable.

How do I pay what I owe and do I have pay everything at once?

No, you don’t have to pay everything at once. You must agree a payment plan with the respective tax authorities and you may have up to 3 years to pay your liability in instalments, during which you will be charged an annual interest rate of approximately 20 percent.

All taxes will be collected by the designated banks of the respective tax authorities, Federal Inland Revenue Service (FIRS) or State Inland Revenue Service (SIRS).

What has this got to do wider corruption?

Not paying your taxes is a clear form of corrupt behaviour. You are denying other Nigerian citizens the benefit of your tax payments, which are collected and managed by the government. The more you evade taxes, the more lawabiding taxpayers have to pay. That is corrupt.

Where can I get more information?

More information is available from the official website of this scheme. You could also visit the Federal Inland Revenue Service (FIRS) website for more information on tax centres.

What if I owe taxes and I choose to ignore this?

If you ignore this scheme, and are in dispute or not registered with the tax authorities, then you risk the full consequences of the law. This includes: Up to five year imprisonment, severe extra penalties: up to 100% of the outstanding tax due, compound interest at 21 percent per annum, and losing your assets.

What will the funds be used for?

Funds are earmarked for investment in infrastructure, which Nigeria desperately needs. Funds will be transparently invested in this sector and regular updates published publicly.

WHAT ARE THE BENEFITS?

The scheme is estimated to rake in $1 billion for the government, which is said to go into brigding Nigeria’s huge infrastructure and housing deficits. This scheme will enable the government to invest more funds in addressing these challenges, which is critical to Nigeria’s economic development.

It will increase Nigeria’s competitiveness, encourage the growth of new industries and create much-needed jobs, as well as improve quality of life. This scheme will alleviate the financial burden of paying tax on law-abiding citizens and help address the prominent issue of wealth inequality in Nigeria.

This scheme is about looking forward as much as it is looking back. By introducing new taxpayers into the system now, tax revenue will be significantly higher in the future.

Add a comment