Upon the Central Bank of Nigeria’s announcement of a new lending policy for the commercial banks, stakeholders and analysts in the financial and manufacturing sector have held up the policy to a microscope, examining its pros and cons.

In a letter signed by Ahmad Abdullahi, director of banking supervision, the apex bank had directed that banks must increase their lending to deposit ratio to 60%.

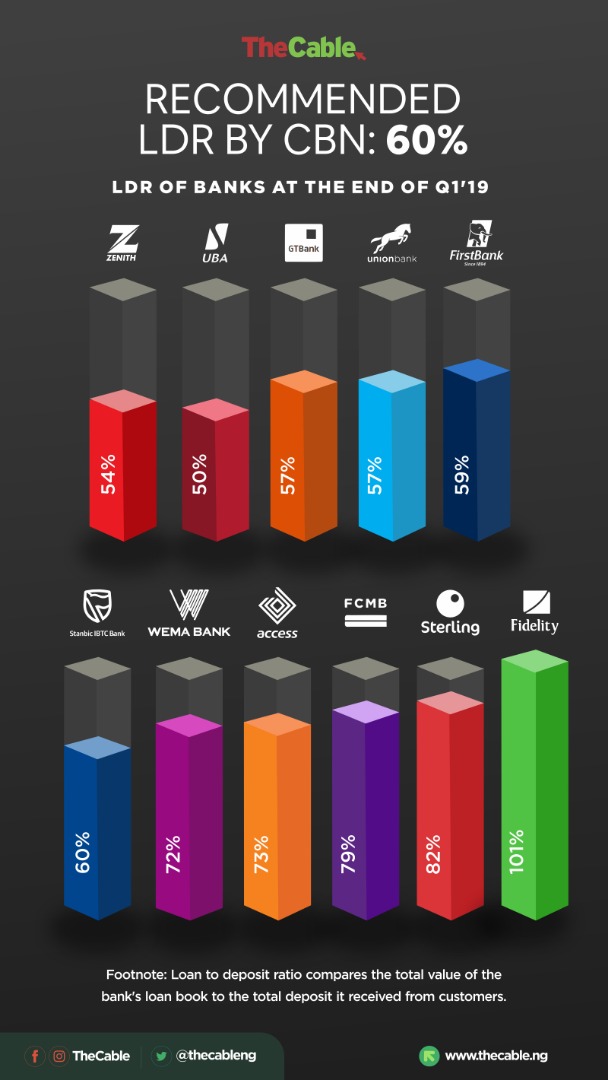

The lending to deposit ratio represents the portion of customers’ deposit that is given out as loans.

According to the apex bank, failure to meet the specified LDR by September would result in a levy of additional cash reserve requirement equal to 50% of the lending shortfall of the target LDR.

Advertisement

The cash reserve ratio is the share of customers’ deposit that is kept with the central bank. Unlike loans, banks are unable to earn interest on money kept with the central bank.

What do manufacturers think?

Commending the directive, Segun Ajayi Kadiri, director-general of the Manufacturer of Association of Nigerian (MAN), says it solves the first half of the problem.

Advertisement

“We welcome the recent directive given by the CBN to banks, it is a step in the right direction,” he told TheCable.

“This will mean that manufacturers can get loans and that will boost business and in turn, stimulate the economy.

“However, this just resolves the first half of the problem even though we all know that access to finance is a major problem for manufacturers.

“The other half is at what rate? At the moment, the monetary policy rate is double-digit but it is not healthy for manufacturers to lend at double-digit interest rate especially for the SMEs.

Advertisement

“What we recommend is loans at 5%, the maximum interest rate should be 9%.”

In 2018, the Bankers Committee of the CBN agreed that banks could give loans to the real sector at 9% interest rate.

The committee agreed that the loans would be sourced from the cash reserve ratio of banks.

Kadiri, however, said he had no idea that banks had such provision for manufacturers.

Advertisement

“Not only am I not aware of such provision, but I would also have known if anyone got loans at such rate.”

Analysts: It’s good but…

Advertisement

Giving his opinion, Chukwu Johnson, chief executive officer at Cowry Assets Management, said the policy could mean that more credit would be channelled to the private sector if religiously implemented.

However, he is of the opinion that the policy could compel banks to give loans to sub-prime creditors.

Advertisement

“The banks could be compelled to give out loans to subprime borrowers that could lead to the incidence of non-performing loans. Banks also have to make this adjustment within a period that is less than two months then you can imagine the volume of work that banks have to do,” he told TheCable.

“What can be done is to moderate the target or extend the timeline otherwise we will see banks book a lot of credit that will not be able to come back because high cost of credit is one of the contributing factors to credit default.

Advertisement

“If you ask me, some banks might rather have their money in the cash reserve and take their time to look for creditworthy customers to lend to.

“If we can avoid the risk of loan failure, we should see an enhanced level of economic activity, a high level of productivity as a result of credit availability.

“Availability of credit facilities will stimulate economic activity, lead to job creation and a positive impact on the GDP.”

Fitch, a credit rating agency headquartered in New York, also shares this thought.

In a statement released on Thursday, the agency said achieving the new requirement “in such a short timescale will be very difficult for some banks given their lending levels, particularly if customer deposits continue to grow at present rates”.

“It is unlikely that there is sufficient demand from good-quality borrowers for banks to meet the target without relaxing their underwriting or pricing standards. Banks continue to struggle with high impaired and other problem loans

“The present operating conditions are not conducive to loan growth, and rapid lending during the fragile economic recovery could increase asset-quality problems in the future. Chasing loan growth could also weaken banks’ profitability if they cut margins to attract customers.”

Banks that might have to do the most work

According to the financials of the banks made available at the end of the first quarter, some banks that have maintained a lower loan to deposit ratio than the others.

This means that they would have to do more work in raising LDR than their peers.

At the end of the first quarter, United Bank for Africa (UBA) had the lowest at 50%.

Add a comment