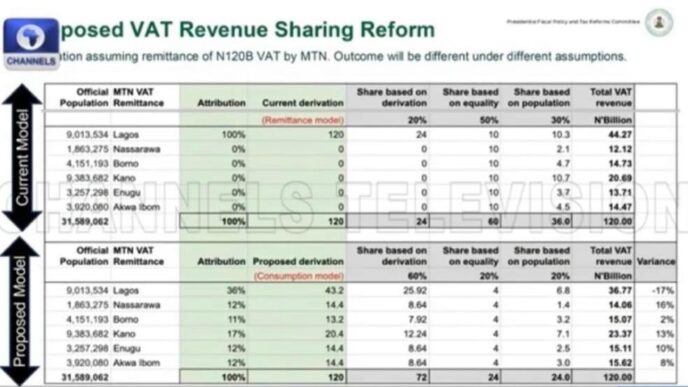

The recent controversy surrounding the proposed tax reform bills has highlighted the need for more inclusive and extensive consultation with stakeholders. The government’s decision to transmit the bills to the National Assembly without reported adequate engagement with state governments, the private sector, and other relevant stakeholders has sparked intense debate and opposition.

While the government’s intention to reform the tax system and increase revenue is laudable, the approach has been flawed. The reported lack of consultation and engagement has led to concerns that the proposed reforms will disproportionately affect certain regions and sectors, exacerbating existing economic inequalities.

The controversy surrounding the proposed tax reform brings to the fore the suboptimal approach to communications by governments at all levels. They do not communicate with the citizenry. They just inform the citizenry. Communicating with the citizenry and engaging with key stakeholders leads to consensus and buy-in. It places a premium on building a partnership with the citizenry, rather than just informing them of the activities of Government. Compounding the situation is the tendency by Nigerian public administrators and technocrats to focus only on the technical aspects of policy with scant regards to the non-technical or soft issues. Crazy, approach in this era of agbero, bole kaja communications, that “ thanks” to technology, we have all become “authoritative speculators” commenting on issues with such authority that embarrasses our knowledge of the subject matter.

The contentious debate arising from the tax reform bills is not particularly different from that which occurred when the Obasanjo administration introduced a number of economic governance bills to the National Assembly. These were the Fiscal Responsibility Bill, The Public Procurement Bill, and the Nigerian Extractive Industry Bill. The Obasanjo administration initially did not engage in adequate consultations leading to a stalemate. The administration had to re-strategize to secure passage of these legislations.

Advertisement

By adopting a more inclusive and consultative approach, the government can build trust and confidence in the tax reform process. This will help to address the concerns of stakeholders, ensure that the proposed reforms are equitable and effective, and ultimately increase revenue for the government. It is thus imperative that the government embarks on a campaign with a view to addressing the various concerns and ensuring that the tax reform bill is effective and equitable. The campaign should be designed to facilitate constructive informed input to the National Assembly directly and through stakeholders and the media indirectly. Particular attention should be devoted to even-handedly addressing issues and concerns raised by stakeholders, as well as motivating supporters to advocate for the passage of the bills.

Ultimately, the success of the tax reform bill depends on the government’s ability to build trust and confidence with stakeholders. This requires a willingness to listen to concerns, address issues, and make adjustments to the bills as needed. By doing so, the government can create a tax reform bill that promotes economic growth, reduces inequality, and increases revenue for the government.

Maduegbuna is the chairman of C&F Porter Novelli, a communications consultancy

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.