Guaranty Trust Holding Company (GTCO) Plc has announced it raised N209.41 billion through a public offer.

According to a statement on Monday, GTCO said the public offer is the first phase of its equity capital raise programme.

The financial institution said the first phase was completed following the capital verification exercise by the Central Bank of Nigeria (CBN) and approval of the basis of allotment by the Securities and Exchange Commission (SEC).

GTCO said 130,617 valid applications were recorded for 4,705,800,290 ordinary shares, which were fully allotted.

Advertisement

“This milestone concludes the first phase of GTCO’s phased equity capital raise programme, which is structured on a balanced allocation strategy based on an equal split between institutional and retail investors,” GTCO said.

“This balanced approach aligns with GTCO Plc’s commitment to fostering a well-diversified and robust investor base.”

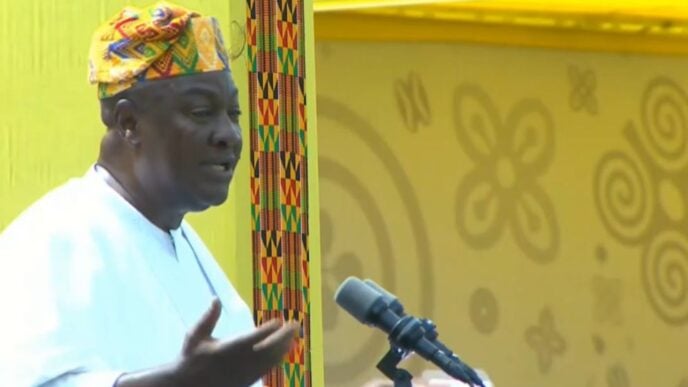

Segun Agbaje, group chief executive officer of GTCO, expressed gratitude to shareholders for their support during the first phase of the recapitalisation exercise.

Advertisement

“We extend our sincere appreciation to our new and existing shareholders, as well as the regulatory authorities, for their unwavering support during this initial phase of our equity capital raise,” Agbaje said.

“The strong participation and successful capital verification exercise and allotment process reaffirm the confidence investors have in our fundamentals and execution capabilities.

“This sets a solid foundation for accelerating our strategic roadmap, which aims to pivot the Group for transformational growth and unlock greater value across the Group’s Banking and Non-Banking businesses.”

‘SECOND PHASE WILL TARGET FOREIGN INVESTORS’

Advertisement

GTCO said the second phase of its recapitalisation programme will be held in 2025.

The company added that the second phase will target significant foreign institutional investments to reinforce the company’s international brand reputation.

GTCO said the proceeds from the phase of the capital raise will be used to recapitalise the company’s flagship subsidiary, Guaranty Trust Bank (GTB) Limited, enhancing its ability to meet regulatory requirements and further solidify its position as a leading financial institution.

“Additionally, the funds will support Group-wide growth initiatives, including footprint expansion, product enhancement, and innovation across both Banking and Non-Banking subsidiaries,” the company added.

Advertisement

GTCO reaffirmed its commitment to delivering sustainable value to its stakeholders and driving innovation across the financial services landscape in Africa.

On March 28, 2024, CBN announced an upward review of the minimum capital requirements for commercial, merchant and non-interest banks.

Advertisement

CBN adjusted the capital base for commercial banks with international licences to N500 billion.

All banks are required to meet the minimum capital requirement between April 1, 2024, and March 31, 2026.

Advertisement

Add a comment