FBN Holdings Plc has announced plans to raise about N150 billion through a rights issue programme.

In a document seen by TheCable on Friday, the bank is offering a rights issue of 5.98 billion ordinary shares at 50 kobo each — priced at N25 per share.

FBN Holdings said the offer would open on November 4 and close on December 17, noting that qualification was on October 18.

According to the document, if all provisionally allotted ordinary shares are fully taken up when the rights issue is completed, the bank would have a market capitalisation of N1.047 trillion.

Advertisement

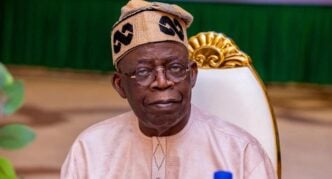

Speaking on the offer, Femi Otedola, chairman of FBN Holdings, said all necessary arrangements regarding the rights issue have been made.

He said the requisite approvals have been received from the Securities and Exchange Commission (SEC) and the Nigerian Exchange Limited for the registration and subsequent listing of the shares being issued.

“It is important to note that the shares now being issued will rank pari passu in all respects with the existing issued ordinary shares of the company and shall qualify for any dividend (or any other distribution) declared, as long as the qualification date for the dividend (or any other distribution) declared is after the allotment of the ordinary shares now being issued,” the FBN Holdings chairman said.

Advertisement

“By supporting the Rights Issue through accepting your rights, the Company will be well positioned to achieve its strategic objectives and to deliver improved returns to all stakeholders, going forward.

“I therefore enjoin you to carefully consider this investment opportunity and take up your rights, in full, as the company continues to harness imminent opportunities and deliver on its promises.”

On April 8, FBN Holdings announced plans to sell shares to private investors and existing shareholders to raise N300 billion.

The Bank’s effort to raise capital comes amid the recapitalisation policy of the Central Bank of Nigeria (CBN).

Advertisement

On March 29, the CBN announced a new capital requirement for tier-1 banks with international banking licences from N25 billion to N500 billion while that of national banks was put at N200 billion.

The apex bank set a timeline of two years — from April 1, 2024 to March 31, 2026 — for banks to meet the new requirement.

Add a comment