The federal government is considering another eurobond issuance in the international capital market (ICM) to raise $2.1 billion.

This is part of the federal government’s borrowing plans to part-finance the 2021 budget deficit.

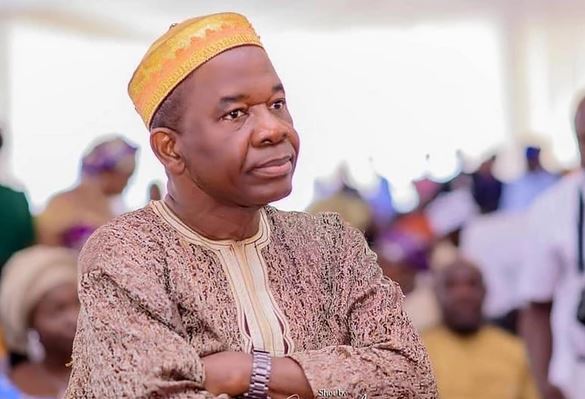

According to The Punch, Patience Oniha, director-general of the Debt Management Office (DMO), disclosed this during an interview in London on Thursday.

In September, Nigeria raised $4 billion through eurobond issuance.

Advertisement

Oniha said the government needs to assess the market before deciding to borrow more through eurobonds.

She explained that international investors had shown interest in engaging the government after a global investors meeting and roadshow as they were still optimistic about the country’s credit status.

“One of the questions that kept coming up was the balance of the new external borrowing for 2021, which is about $6.1bn,” Oniha said.

Advertisement

“We are going to have a meeting with our transaction parties after this engagement if we will come back to the market for the balance.

“We need to assess the market to understand how to proceed. We remain confident international investors find our credit story enticing enough.”

The newspaper also quoted Ben Akabueze, director-general of the budget office, in a separate interview, as saying that although investors were concerned about debt sustainability, the federal government had given an assurance on that.

Advertisement

Add a comment