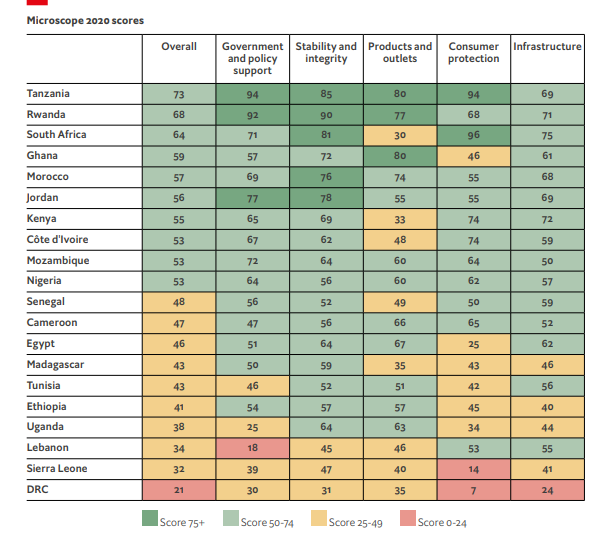

Nigeria has moved up six places to 30th position in the new global financial inclusion ranking with an overall score of 53 points — falling behind peers such as South Africa and Ghana.

Financial inclusion refers to efforts by governments to make financial products and services accessible and affordable to all individuals and businesses, regardless of their personal net worth or company size.

In a new report by the Economist Intelligence Unit: “Global Microscope 2020, The Role of Financial Inclusion in COVID-19 response”, a report that assesses the enabling environment for financial inclusion across five categories in 55 countries, said changes since 2019 were driven by improvements in Nigeria’s strategy to reduce the gender gap including a partnership with the Alliance for Financial Inclusion to develop a national woman’s financial inclusion strategy.

Despite the improvement in ranking, Nigeria, Africa’s largest economy, still lags behind countries such as South Africa and Ghana as they scored 65 and 59 points respectively, securing 13th and 20th positions respectively in the global financial inclusion ranking.

Advertisement

The Global Microscope data assess the enabling environment for financial inclusion across five categories these include, government and policy support; stability and integrity regulation; products and outlets regulation; consumer protection, and infrastructure.

Source: Economist Intelligence Unit Report 2020

Advertisement

Nigeria currently has an estimated 40 million adult population outside the formal financial system. The ranking rated the country low in areas of financial inclusion stability, integrity, and infrastructure.

Lower-income regions scored 62 points in the financial inclusion infrastructure category but Nigeria scored 57 points.

“While there was a 300 percent increase in mobile money sign-ups in the second quarter, there is no evidence of measures to support digital financial services,” the report said.

Analysts have suggested the use of mobile money, a teleco-powered financial inclusion model, that has helped countries such as Kenya’s MPESA and Ghana’s mobile money to deepen financial inclusion.

Advertisement

Add a comment