At least five local oil and gas companies have indicated interest to submit bids as Royal Dutch Shell Plc (Shell) plans to sell more of its Nigerian onshore assets.

The sale has drawn interest from independent Nigerian oil and gas firms, including Seplat Energy (SEPLAT), Sahara Group, Famfa Oil, Troilus Investments Limited and Nigeria Delta Exploration and Production (NDEP), according to a report by Reuters.

The move could yield up to $3 billion, three sources involved in the bidding process told Reuters.

Shell Petroleum Development Company of Nigeria (SPDC) is a subsidiary of Shell In Nigeria. SPDC is the operator of a joint venture between the Nigerian National Petroleum Corporation (55%), SPDC (30%), Total E&P Nigeria Limited (10%) and Nigerian Agip Oil Company Limited (5%).

Advertisement

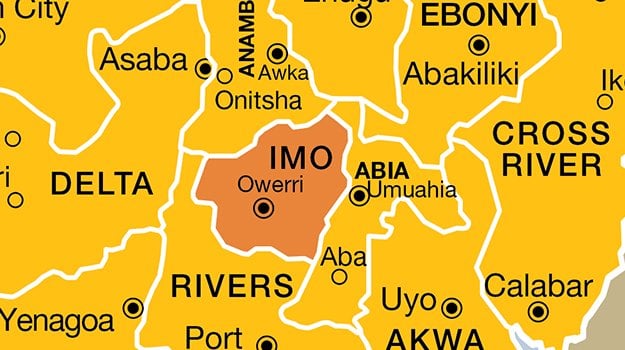

The Anglo-Dutch company has stakes in 19 oil mining leases in Nigeria’s onshore oil and gas joint venture through (SPDC).

For over a decade, the company has been selling its onshore assets to focus on offshore.

In 2021, Shell announced that it started talks with the federal government to sell its onshore oil assets in Nigeria.

Advertisement

Ben van Beurden, chief executive officer of Shell, said: “We cannot solve community problems in the Niger Delta; that’s for the Nigerian government perhaps to solve. We can do our best, but at some point in time, we also have to conclude that this is an exposure that doesn’t fit with our risk appetite anymore.”

Foreign oil companies were not expected to take part in the bidding process ahead of January 31 deadline, the sources added.

With majority stakes in the assets, Nigerian National Petroleum Corporation (NNPC) could also choose to exercise its right to pre-empt any sale to a third company, Reuters reported.

TheCable has reached out to Shell spokesperson in Nigeria for comment.

Advertisement

Add a comment