Sub-Saharan Africa reportedly lost an estimated $10 billion in foreign direct investments due to the effects of instability within and outside the continent in 2024.

In its 2024 African country instability risk index (ACIRI) report released on Thursday, SB Morgen (SBM) Intelligence, a geopolitical research firm, described the last 11 months as a busy year for sub-Saharan Africa, citing multiple elections across countries.

“Attempted coups in some countries in the Sahel further added to the growing instability, as did climate issues such as floods and drought,” the report reads.

The report added that ongoing conflicts in the Middle East and Eastern Europe have also had an outsized geopolitical impact on the region, colouring a great focus on its international outlook.

Advertisement

“These effects include an estimated loss of $10 billion in foreign direct investments—approximately half a percent of SSA’s annual GDP growth,” the report said.

Botswana, the Seychelles, Nigeria, Namibia, and Zimbabwe were named the biggest economic losers.

“Botswana experienced a GDP decline of nearly 2% in the first quarter of 2024, and Zimbabwe experienced economic challenges such as debt and currency crises,” the report indicated.

Advertisement

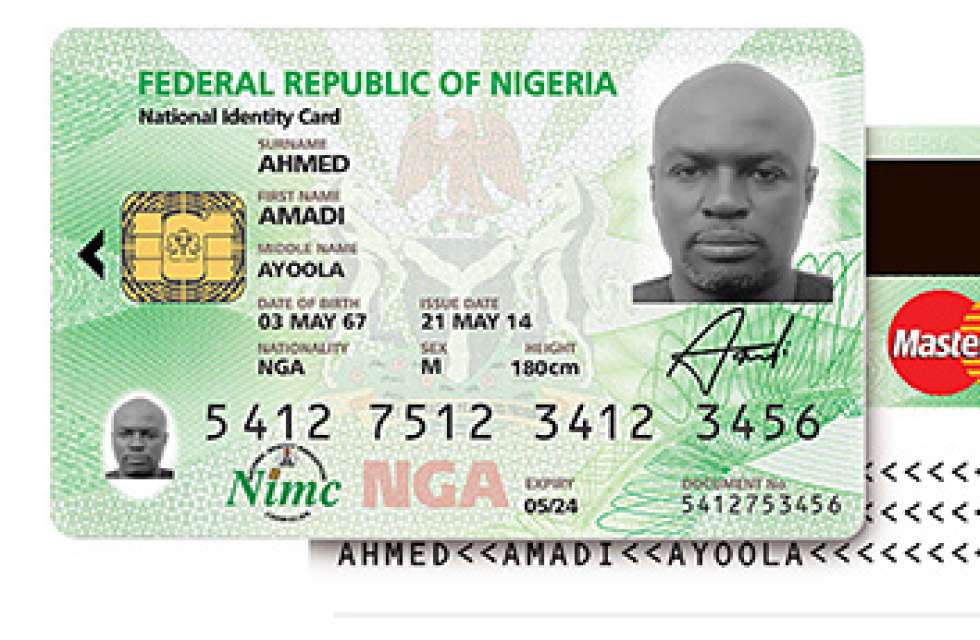

“Nigeria, Africa’s fourth largest economy, ended the year with a score change of -6, following the exit of foreign businesses over weaker currency, rising inflation, and other economic challenges.”

SBM Intelligence also linked Nigeria’s brittle economy to the rising food inflation, persistent insecurity across all geopolitical zones, and many people falling into extreme poverty.

The report also blamed the economic reforms introduced by President Bola Tinubu when he came into office, adding that the country “is more polarised now than ever after the 2023 elections”.

Southern Africa was listed as the most stable region on the continent.

Advertisement