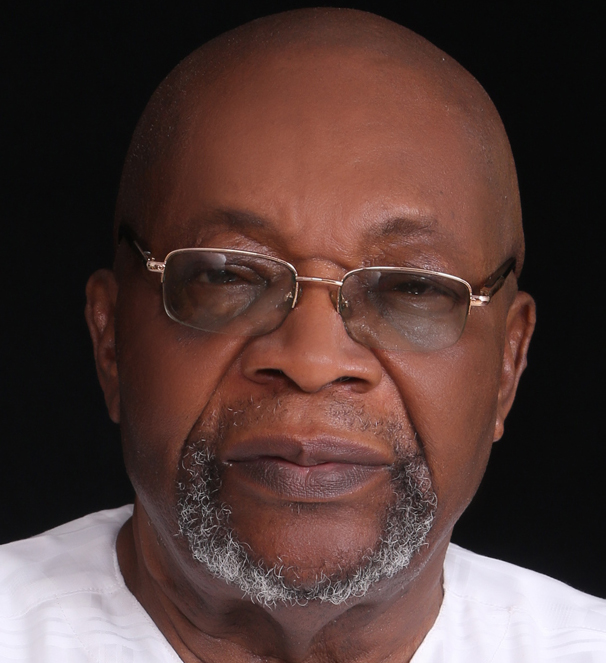

It is indeed interesting to see so many Nigerians today talk about restructuring the Nigerian state. This is heartwarming on account of the fact that today we have come to appreciate restructuring as a necessity for Nigeria’s continued existence. This is a crusade I began almost two decades ago; a crusade that has taken me to prison and back.

In the course of this crusade, I have had my younger brother brutally murdered in cold blood by agents of the state; I have had my residence turned inside-out by security agents brooding over my massive library like maggots rummaging the remains of decaying carcass. I have been cursed and discussed; scandalised and analysed. The leeches of the Nigerian state are mad; and I am happy. The struggle rages on and that’s just the way I love it. My happiness is that my crusade has put Nigeria on notice and today we are all talking about it.

Even though it is a welcome development that we have been caught by the bug of restructuring, I am afraid not so many of us understand the true essence of restructuring. I say this because in recent times I have heard people talk about merging of states as a form of restructuring. I am afraid this is not restructuring by any stretch of the imagination.

The question is: What type of restructuring does Nigeria need? For the avoidance of doubt, Nigeria needs both structural and fiscal restructuring. Structurally, Nigeria must constitutionally define the federating units. For now there are six geo-political zones in the country. These geo-political zones should be constituted into the federating units with equal constitutional rights. The states as presently existing make up the zones.

Advertisement

Each zone will have its own constitution, which must not be in conflict with the federal constitution. The federating units should be in-charge of the states and LGS. The States’ Houses of Assembly will remain as they are but there will be Regional Houses of Assembly that will function as the highest legislative organ of the region.

Each region should also have its own police, courts; and sustain its educational and other sectors. The powers of the central government should be significantly reduced to issues of immigration, currency, military/defence and foreign affairs. Power, in essence should devolve more to the federating units. Each region must have a premier who should coordinate the activities of the region and report to the federal Prime Minister.

On fiscal restructuring, there must be a comprehensive overhaul of the exclusive legislative list as contained in the First Schedule of the constitution. The regions must be in-charge of resources within their space. These resources are to be exploited by the regions and an agreed percentage paid to the central government. In other words, we must be ready to do away with the present revenue sharing formula. In terms of elections, INEC will remain to conduct federal elections, while each region will establish its own electoral body to conduct regional and municipal elections.

Advertisement

In concrete terms, these were the provisions of the 1963 Republican constitution which was suspended in the wake of the 1966 military coup, which paved the way for the usurpation of regional powers by the military. This type of restructuring would immediately address issues of ethnic and religious agitations and put a permanent stop to the conflagration in the Niger-Delta. It will also stop this monthly ritual of disbursing federal allocations to states.

It is because of the monthly allocations that states no longer strive to develop their internal economies. A through-going restructuring of the type outlined above will compel the regions and states to look inwards to identify and develop their internal economies and by extension the national economy. That is the best way for diversification.

In the First Republic, the North was famous for its groundnut pyramids, the West was known for its cocoa, the Midwest for rubber, South-East for palm produce and South-South for lumbering and fishing. In addition to this vast agricultural profile, which presently is lying fallow, each region has mineral deposits. With proper restructuring, each region will be compelled to develop its own mineral resources. I have written extensively on this issue and many of my books dealing on Nigeria’s restructuring can be found on the book shelves. That is the restructuring Nigeria needs now; not merging of states.

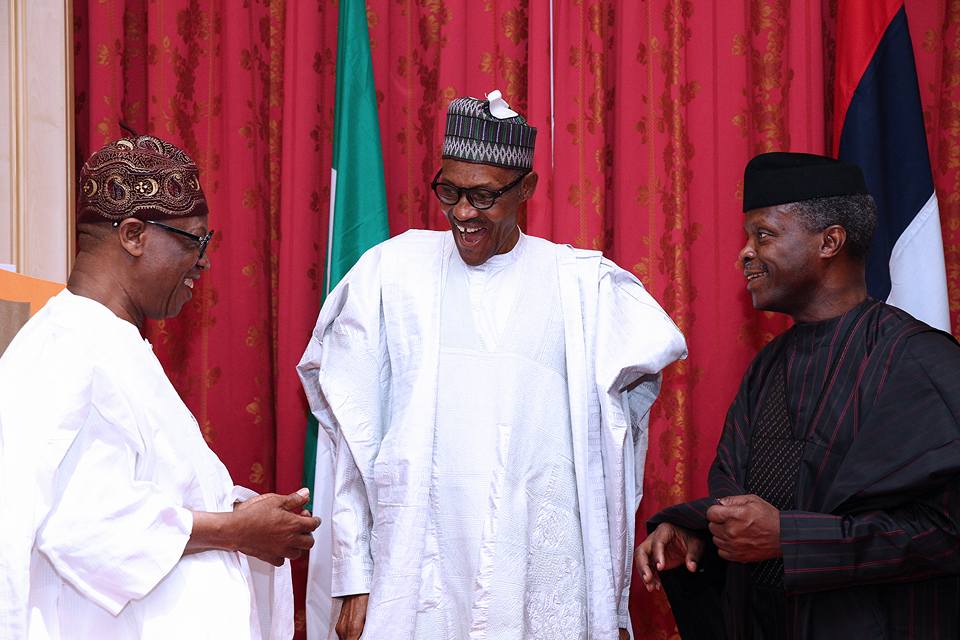

For the avoidance of doubt, the National Political Reform Conference of 2005 organized by the Obasanjo administration and the one organized by Goodluck Jonathan in 2013 recommended most of the foregoing. I recall the only contentious issues were tenure for the president and fiscal federalism – issues which we advised should be subjected to referendum. Rather than implement the recommendations of those Conferences, Buhari has typically dumped them into the trash can.

Advertisement

Honestly, Buhari’s medieval understanding of Nigeria’s problem leaves much to be desired. Among my people, a child is considered cursed when that child, instead of sucking the mother’s breast chooses to suck a bump on the mother’s body. Only a fool will see a straight route to a destination and choose to go through the bush path. Buhari has the answer to Nigeria’s restructuring in his hands. Why would he not implement it?

Or does he think that the answer to Nigeria’s problems lies in murdering defenceless Biafran agitators or sending Nigerian Army to crush Niger-Delta Avengers or Nigeria soldiers roaming the length and breadth of Sambisa forest in search of phantom missing Chibok girls on pretension of fighting Boko Haram. Buhari is indeed dancing the ghoulish Surugede without knowing the Surugede is the dance of the spirits. Igbo folklore has no record of any person who ever survived the Surugede dance.

Views expressed by contributors are strictly personal and not of TheCable.