Lagos, Nigeria’s commercial nerve centre, is a city where making money is swift, but doing business comes with a price tag. A shadowy narrative of tax evasion and business closures has recently emerged in the state. On October 31, 2023, the Lagos Inland Revenue Service (LIRS) made headlines when it announced the closure of 34 companies and hotels for non-payment of consumption and personal income taxes totalling about N356.12 million. However, an investigation by TheCable’s BUSOLA ARO reveals a more nuanced story, shedding light on discrepancies in the shutdown claims and the challenges faced by businesses in navigating the complex tax landscape of Lagos.

The Lagos Ministry for Commerce, Industry, and Cooperatives estimates that 3,224,324 microbusinesses and over 11,663 SMEs are operating in the state. These businesses, ranging from small shops to large corporations, are essential to Lagos’ economic machinery, contributing significantly to its vibrant business ecosystem.

Staying afloat in Lagos’ competitive business environment is no easy feat. Many businesses struggle to turn in a significant profit while grappling with a myriad of tax obligations imposed by the government. This challenge is exacerbated by the current state of inflation and economic volatility, making it increasingly difficult for businesses to thrive.

Lagos state has a myriad of tax obligations that individuals and corporate entities are expected to meet. This includes the personal income tax, which falls under pay as you earn (PAYE) or direct/self-assessment. Every employer is expected to collect their employee’s tax by deducting 8% from their salaries. But if an individual (employee/ employer) has other incomes, he/she could be under direct assessment for one and PAYE for the other.

Advertisement

Also, there is Withholding tax (WHT). There are different types of withholding taxes, such as withholding on dividends, withholding on rent, withholding on consulting, etc.

For each of these, there are different percentages to pay. Where the company or person providing the technical services is an enterprise, the withholding tax would go to the state. But if it is a company, the WHT goes to the federal government.

The development levy is another tax collected by the state. The sum of N100 is collected per individual. For instance, if a company has 10 staff, N1,000 is collected for all in a year.

Advertisement

Also, companies and businesses resident in the state are supposed to pay business premises tax. This is paid to the LIRS with N10,000 in the first year and N5,000 subsequently.

Lastly, a consumption tax of 5% is collected by the Lagos state government. It’s a tax on hotels, restaurants and eateries that sell food and drinks, or any bar operating in the state.

According to the 2022 internally generated revenue (IGR) report published by the National Bureau of Statistics (NBS), Lagos had the highest IGR with N651.15 billion in the year, representing 34 percent of N1.92 trillion, the total IGR of the 36 states of the federation and the Federal Capital Territory (FCT).

Out of the N651.15 billion IGR recorded in Lagos, N524.87 billion (80.61 percent) came from taxes.

Advertisement

A further breakdown of the total tax revenue contribution to the IGR shows that PAYE is N360 billion (55.29 percent), direct assessment, N27 billion (4.15 percent); stamp duties, N12 billion (1.84 percent); capital gain tax, N1 billion (0.15 percent); Withholding tax, N86 billion (13.21 percent); other taxes, N25 billion (3.84 percent), and LGA revenue is N11 billion (1.69 percent).

THE SHUTDOWN CLAIMS: A CLOSER LOOK

The announcement of the shutdown of 34 companies and hotels by the LIRS sent shockwaves through Lagos’ business community. According to Monsurat Amasa-Oyelude, LIRS’ head of corporate communications, the tax liabilities of these companies and hotels amounted to over N356.12 million, representing a significant loss in revenue for the state.

However, a detailed investigation into these claims revealed discrepancies that cast doubt on the accuracy of the government’s position.

Advertisement

A check with the Corporate Affairs Commission (CAC) showed that six companies were actively filing annual tax reports.

Additionally, 17 companies appeared inactive on CAC records; but more significantly, nine out of the 34 companies were found to be unregistered with the CAC, raising questions about their existence and legitimacy.

Advertisement

The reporter visited 10 hotels, seven companies on the list (ranging from construction, media, pharmaceuticals, and consulting firms), two restaurants, and one event centre – all within Agege, Ogba, Oshodi, Ikotun, Ikoyi, Obalende, Ikeja, Victoria-Island, and Ketu areas of the state.

During the visits, it was discovered that a company named Business Intelligence Technology, located at Allen Avenue, Ikeja, was not found at any of the addresses provided online. Even neighbouring offices are unaware of the company’s presence in the area.

Advertisement

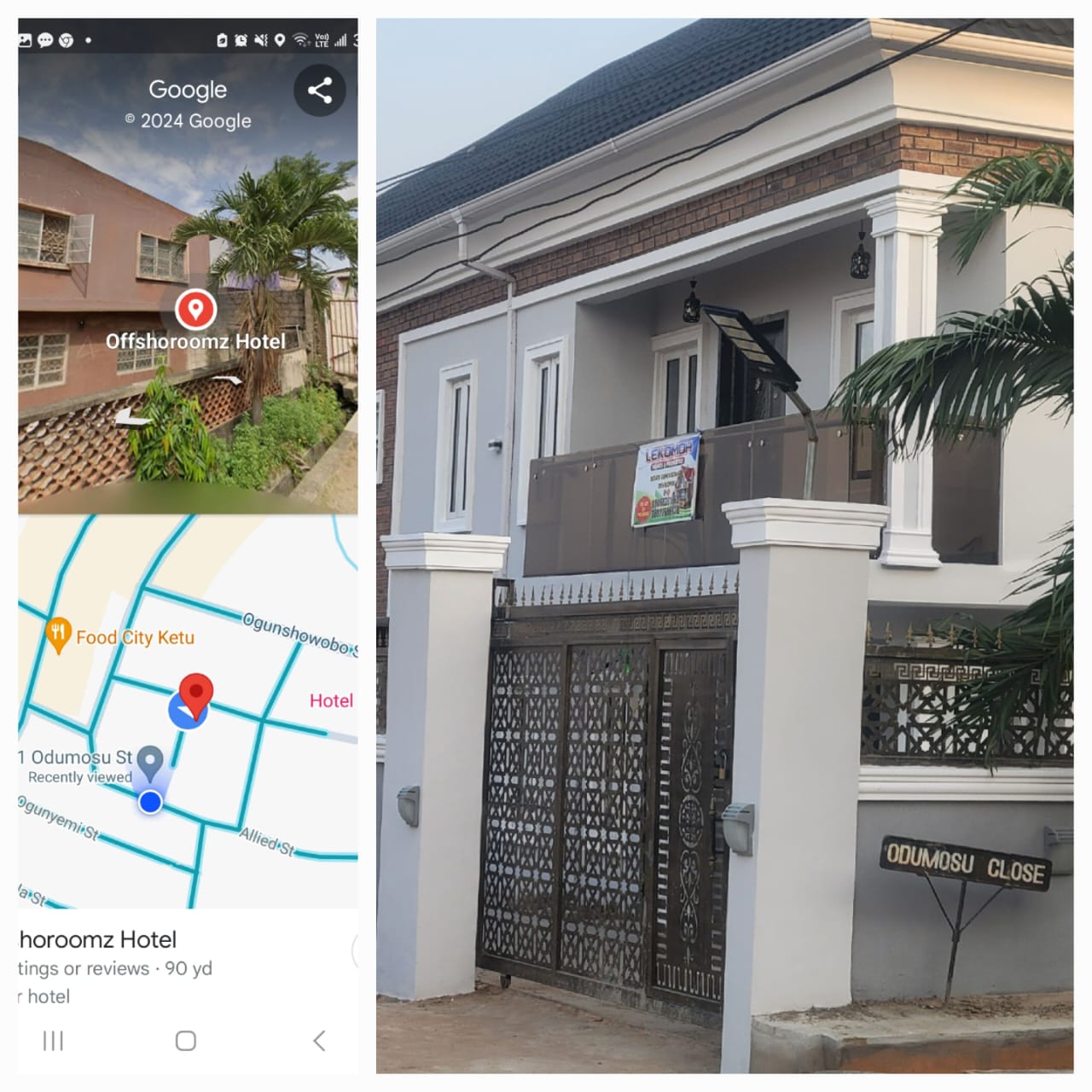

Also, a hotel listed by LIRS, Chelsea Hotel, was not found in Lagos. There is a Chelsea Hotel in Abuja, though. The same also applies to Offshoroomz Hotel located in Ketu. The hotel has been converted into a residential apartment.

At Chez Moi Apartment located in Ikeja, the owner of the place, who spoke to the reporter, said she bought the property eight years ago from Chez Moi which had ceased to exist since then. She said the place is currently a residential apartment.

Advertisement

In the Ikotun area of the state, where Model Motels is located, the building was locked, and confirmations from residents around the area revealed that the business had stopped operating for more than a year.

After due diligence, the reporter also discovered that Falode Hotel and Bereans Venture neither had addresses nor records on CAC.

This discovery underscores the challenges faced by regulatory agencies in monitoring and enforcing compliance among businesses operating in Lagos. Apparently, the state government needs to design an efficient, technology-driven business information tracking system to improve its tax administration.

THE HUMAN COST OF TAX ENFORCEMENT

Behind the headlines and official statements lies the human cost of tax enforcement in Lagos. TheCable’s investigation revealed stories of businesses struggling to comply with tax obligations while staying afloat in a challenging economic climate.

Mayowa Afe, managing director of Danvic Petroleum, one of the companies allegedly shut down by LIRS, recounted the encounter his company faced because of the government’s action. He described how the company responded immediately to LIRS’ claims, clearing its name within hours of being shut down.

“That day, they (LIRS) came and said they wanted to stop our company from operating, but we said no,” Afe retorted.

“They said we didn’t give the correct payment and didn’t pay at the right time, which we didn’t dispute because we didn’t want to go into any issues with the government.

“That day, we were stopped in the morning, but we cleared ourselves before noon because we were sure of responding to every letter or notice. Because we never wanted any case with the government, we submitted the required document, which I cannot remember, and paid for them to open the company, and this happened in the morning.”

Similarly, Olaoye Olabisi, the manager of High Climax Hotel, shared how the company was unexpectedly billed almost N1 million in unpaid taxes since 2016, leading to negotiations for payment in instalments.

“Since I took over the payment of taxes for the hotel, I have never owed; but when they (LIRS) came, they also confirmed that I do not owe them but that there is an outstanding payment for 2016 that we have not paid,” he said.

“We were caught unaware, and the bill they gave me was about N940,000, almost N1 million. They also said that the auditor has been keeping them waiting on that, claiming that he is looking for a document.”

Despite the financial strain, Olaoye remains committed to meeting the tax obligations.

“Right now, I have about N100,000 to balance up and will do so this year. If not for the bad market and the slow economy, I should have completed the payments,” he added.

James Philip, a staff member at De Orange Events Centre, said the business premises were shut down for three days due to tax issues, costing the company N3 million in payments to the state before it could reopen.

At the Four Seasons Hotel, the dilapidated state of the facility tells how well the hotel is doing in terms of profitability or viability—much less paying taxes.

When the reporter arrived at the hotel, the gate flung open without any stress, as there was no security office. Esther Ibeanu, the receptionist, who struggled to respond to questions, was able to speak to the reporter about the events that happened at the hotel.

“The hotel was closed for about a month before we could open again. Although I don’t know how much was paid, the tax officials had requested about N4.5 million,” Esther said.

“For more than a month, we’ve not made any proper sales. We cannot even boast of making N100,000 not to mention N200,000 in a day. Is that not poor for a hotel?

“We charge just N15,000 per room; but lately, we rarely get patronage. I cannot remember the last time we sold out all the rooms. Last year, things were fair, but it turned out worse this year.”

These stories highlight the challenges faced by businesses in meeting their tax obligations and the impact of enforcement actions on their operations.

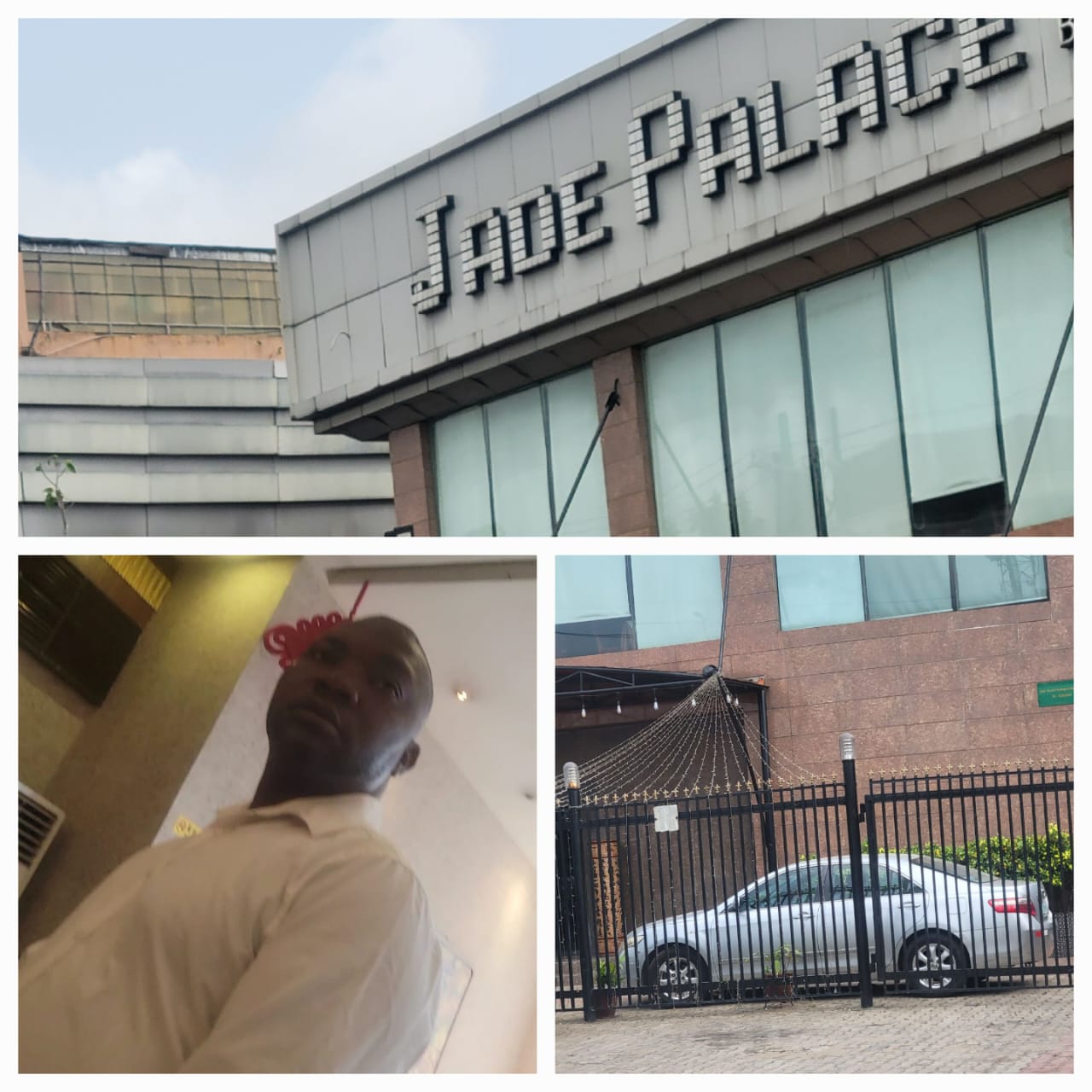

Meanwhile, contrary to others, Emmanuel, manager at Jade Place, a Chinese restaurant, who claimed to have worked in the company for more than 10 years, said the place has never been shut down at any point. Yet, the company’s name was on the list made public by the LIRS.

“Anything tax, we’ve never been disturbed. Health, environmental, and FIRS officials come every month,” he said.

“I go to the bank to pay all the levies and taxes and we have the receipt for everything paid. Whenever they come, we show them receipts. I am 100% sure LIRS never shut us down.

“We pay value-added tax (VAT) of 7.5 percent to FIRS and 5 percent VAT or consumption tax to LIRS.”

Like Jade Place, four other companies and three hotels on the list denied that they were ever out of operation between October, when the tax authority claimed to have shut them down, and the period in which the reporter visited these places.

THE LEGAL LANDSCAPE OF TAX ENFORCEMENT

Faith Zekeri, a tax lawyer, in an interview with TheCable, noted the importance of obtaining legal counsel in tax matters, adding that companies often fall into legal trouble due to a lack of understanding of their rights.

She said the LIRS and FIRS do not have the power to shut down a company without a court order, underscoring the need for due process in tax enforcement actions.

“The problem is that a lot of people and companies do not know their rights. A lot of them do not engage their lawyers when they encounter these kinds of problems,” she said.

“However, LIRS and FIRS do not have the power to stop a company from operations without an order of court.

“So, while there is authority for distraint and restraint, they must have gone to court and got the court order before they can do that. Generally, only CAC can shut down a company. The penalty for not filing returns is even more than not paying your taxes.

“So, it is illegal if there is no order of court for LIRS to shut down companies. Also, whether a company is registered or not, it is compulsory to file taxes.”

The tax lawyer also claimed that the LIRS is majorly obligated to collect PAYE tax and “has no business with other taxes”.

However, Zekeri said that although the idea of calling out companies and hotels is a way of being transparent in their job, it would be defamatory for LIRS to call out companies if they had complied with the tax agency’s court order.

“So, the question is, what they did, was it legal? And when it comes to fighting the illegality of things, it also goes to the process. What was the process that was followed? Did they go to court and get a court order?” she added.

“If they did, then the companies must have been allowed to defend themselves because of the rule of fair hearing.”

Contributing, Mike Falade, executive secretary of the International Centre for Tax and Development, acknowledged the role of naming and shaming tax evaders as a deterrent but cautioned against illegal enforcement actions.

He also stressed the need for collaboration and data synchronisation among regulatory agencies to ensure a seamless tax process.

“VAT is not for LIRS but for FIRS. LIRS does not have the right to shut down companies for not paying consumption tax if they already pay VAT,” Falade told TheCable.

“The calling out of companies is just to bite. They need to portray a story to the public so that companies will turn up.

“But from my record, I am not sure LIRS shut down any company to the best of my knowledge; that is why some of the companies mentioned do not exist or are not operating.”

On the issue of CAC records, Falade said there is a difference between the annual returns and LIRS tax returns.

“Companies are also to file CAC annual returns, and the corporation had also said they would scrap dormant records. Those are yet to bite,” he added.

“Until there is a synchronisation of data, most of them (agencies) are beating around the bush. So, there should be collaboration across the board so that the tax process is seamless.

“If the non-state actors do not have the correct data to work with, how much more do the state actors? They do not have the correct data.”

Also, Falade explained that when a company is doing so badly that it cannot meet tax obligations, such a company or hotel should prove that they are making a loss.

“You declare a loss from the audited account,” he said.

“If you are earning an income, you are to file your returns; this is how officials (LIRS) would know that you are making a profit or a loss. You can file your audited account showing you are at a loss and don’t pay anything or file nil returns.”

LIRS CLARIFICATION

Providing details on how the agency works and how it carried out the shutdown activity, Folashade Coker, director of the informal sector and special duties at LIRS, said the agency cannot take any action without doing its due diligence.

Coker said as long as a company is registered, their details are recorded in the state’s database, which can be accessed by LIRS.

“So, step one is that we have teams that go out daily to scout for companies using the ‘Jehovah Witness’ approach, or door-to-door, streets-to-streets’ kind of thing. Also, these companies have been served notices before they get to the point where they are taken to court, an ex parte motion is obtained, they are convicted, and the court instructs them to be sealed,” she said.

“And in that vein, there is no company that is sealed that opens itself up because it’s a criminal indictment if the government closes you down and you break the seal. A breach of the seal will land you straight in jail.

“So, every company that you saw that after they were listed as being restrained or shut down and you see them open, it is because hotels cannot afford to be sealed for 12 or six or even one hour because they would have guests that have their things in the hotel or they have guests that have already paid, and that can be a criminal charge for them. So, they quickly came over to resolve their cases so that they could be open.

“Most times, we have to open them within an hour or a day because they will come to the office and offset their liability. When none of them come to rectify their issues, we send our team with police officers to arrest whoever has broken the seal and that is imprisonment.”

Responding to the case of the Chelsea Hotel that wasn’t found, Coker said, “The government cannot lie about where they did not seal. The company is registered and exists. It could have a different name, but the LIRS would not call out a company or hotel for no reason or justification.”

Coker also explained that if a company is no longer in operation, it must declare that it has ceased operations, and failure to do so would only lead to accumulated taxes.

“We (LIRS) do not just wake up and sanction companies. First, did you register when you opened it? Another is: did you file your returns when you should, for companies on January 1 and January 31? For individual owners, did you file between January 1 and March 31? When they do not file, it becomes a criminal offence,“ she said.

“Also, there are letters that must be filed. One, was the company audited? If so, was there an assessment? Were the 30 days due after the assessment note? Was there a demand note? Did they object? If they did, were they requested to bring their documents, and did they bring the complete document? If they did not bring the complete documents, was the notice of refusal to amend sent to them?

“When they do not provide those documents, their liability is required, and they are served with an intention to prosecute. When the company does not do the needful, LIRS goes to court to get a judgment, and a court order is then issued. From there, LIRS goes to enforce the judgement of the court.

“We do not just go to any place without proving to the court that we have done the needful.”

Coker also said if a company’s building is sold out to someone else or a company is no longer occupied by the original owner and they are not anywhere traceable, “they would be left off the hook, but the original owner who owes the tax would still be located”.

The shutdown claims by LIRS have brought to the forefront the complex challenges faced by businesses in Lagos in meeting their tax obligations.

While tax compliance is crucial for the government to generate revenue, there is a need for transparency, accountability, and adherence to due process in tax enforcement actions.

As Lagos continues to grow as a business hub, regulatory agencies need to work closely with businesses to foster a conducive environment for economic growth and development.

Add a comment