Nigeria's CBN governor.

Godwin Emefiele, governor of the Central Bank of Nigeria (CBN), says the Nigerian economy may plunge into recession in 2016.

Speaking after the Monetary Policy Committee (MPC) of the CBN in Abuja on Tuesday, Emefiele highlighted reasons why such development could occur.

“The committee noted that liquidity withdrawals following the implementation of the treasury single account, elongation of the tenure of state governments’ loans as well as loans to the oil and gas sectors could aggravate liquidity conditions in banks and impair their financial intermediation role, thus affecting economic growth, unless some actions were immediately taken to ease liquidity conditions in the markets,” he said.

“Having seen two consecutive quarters of slow growth, the committee recognised that the economy could slip into recession in 2016 if proactive steps were not taken to revive growth in key sectors of the economy.”

Advertisement

Emefiele listed slowing growth, inflation and continual depleting of the foreign exchange in defense of the naira, as the main factors that could lead to the 2016 outlook.

SLOWING GROWTH

“The committee noted that growth had come under severe strains, arising from declining public and private expenditure. In particular, it noted the non-payment of salary at the state and local government levels, as a key dampening factor on domestic demand,” Emefiele said while admitting slow growth.

Advertisement

The economy has undoubtedly experienced slow growth in 2015 relative to 2014.

According to the National Bureau of Statistics (NBS), the real gross domestic product (GDP) grew by 2.35% in the second quarter of 2015, decreasing from 3.96% in the previous quarter.

The GDP growth experienced is also a 6.54% drop from its values in the second quarter of 2014, as job creation in the same quarter dropped by 69.9%.

INFLATION

Advertisement

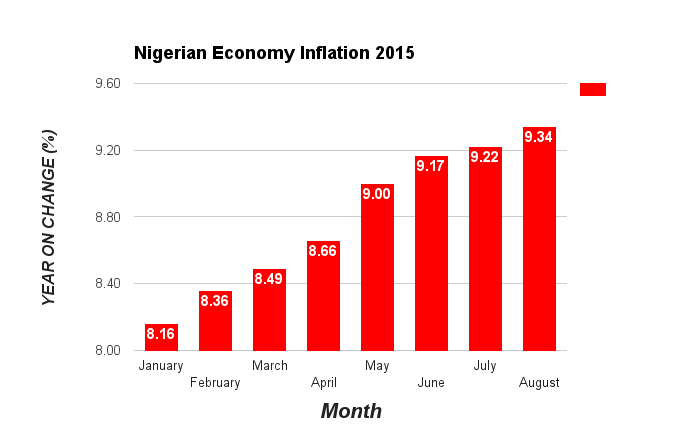

“Yea-on-Year headline inflation, continue to trend upward, although the month on month measure moderated,” Emefiele added as the MPC agreed that headline inflation must be stemmed.

The inflation of the economy stabilised at 9.2% in June and July 2015, only to rise slightly to 9.3% in August 2015, away from the 8.5% value in August 2014.

Further inflation would hinge the country closer to an economic recession.

Advertisement

FOREIGN EXCHANGE IMBALANCE

President Muhammadu Buhari revealed in France last week, that his government and the CBN would not further devalue the naira, regardless of the position of crude oil prices on the international market.

Advertisement

This would mean the CBN would continue to defend the naira at N197 to the dollar on the interbank market and also continue to sell dollars to Bureau De Change (BDC) operators to keep a slim gap between the official and black market value of the naira.

This has already reflected in the nation’s foreign reserves as the gross official reserves dropped from $31.20bn at the end of July to $30.63bn on September 17, 2015.

Advertisement

“Demand pressure on the foreign exchange market remained significant as oil prices continue to decline,” the governor said, hinting a further decline in reserves if proactive measures are not taken.

“The committee further observed that the impact of the persistent decline in global crude oil prices on the fiscal position of the government continues to reflect in rising credit to the government”.

Advertisement

MEASURES

As the MPC expects the robust farm produce harvest in the fourth quarter to reduce pressure on food prices, Emefiele said there is need for synergy between monetary and fiscal policies.

The MPC therefore reduced the cash reserves requirements (CRR) for banks from 31% to 25%, while retaining monetary policy rate (MPR) and liquidity ratio at 13% and 30% respectively.

Also at the press briefing, governor of the apex bank went on to clear the air regarding the TSA drain from the financial system; he said the amount moved was less than speculated.

“The truth is that the amount that was moved was less than what has been speculated in the media,” he said.

He added that the removal of 41 items from list of government sourced foreign exchange has begun yielding results.

“The impact is, as far as we are concerned, positive. We began to see people who before now, closed their factories as a result of the competitiveness of their products compared to the prices of imported items, now opening shop and employing more people, thereby boosting the business in the environment.”

Add a comment