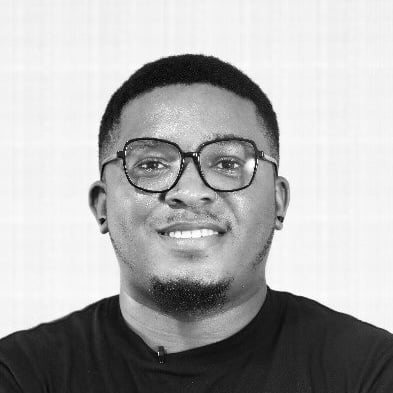

Bismarck Rewane, managing director, Financial Derivatives Company (FDC) Limited, says the devaluation of the naira will push fuel subsidy to N7.1 billion per day.

In May, TheCable had reported that the Central Bank of Nigeria (CBN) adopted the importer and exporter window (I&E) as the default reference exchange rate for official transactions.

The adoption, a move to unify the country’s forex (FX) rates, weakened the naira against the dollar by 8 percent to N410.25/$1.

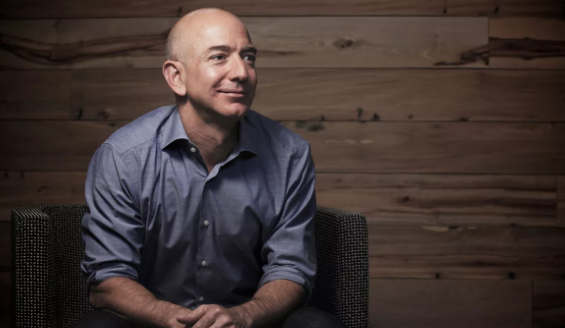

Godwin Emefiele, governor of the CBN, had also dismissed insinuations about naira devaluation, saying Nigeria still operates a managed-float exchange regime.

Advertisement

Rewane, in an economic report released over the weekend, said that with the rise in local consumption of petrol, subsidy payment could rise.

He explained that with the rise in local consumption from 57.8 million in 2020 to 93 million litres – about 60.9 percent increase, subsidy payments could rise to N7.1 billion daily from N5.5 billion in June.

The report argued that this was due primarily to the rally in global oil prices, at $76 per barrel and currency adjustment of between N410 and N411 at the investors and exporters window (I&E rate) from the previous N379/$, leading to an increase in landing costs for imported refined products.

Advertisement

“Based on this new template, the expected price of premium motor spirit (PMS) will increase to N254.90/litre from N239/litre estimated in April.

“Meanwhile, the NNPC had said that the price of petrol would remain at N162-N165/litre in July,” Rewane stated.

He noted that the daily consumption of petrol previously stood at an average of 57.8 million in the first quarter of 2020 with N5.5 billion daily subsidy payment in June.

Rewane warned that the new subsidy regime target could be worsened by the impact of smuggling and affect critical capital projects.

Advertisement

“This will lead to a further increase in petrol prices. Furthermore, higher energy costs coupled with rising food prices will continue to erode consumer disposable income,” Rewane added.

On Monday, the naira gained 0.12 percent to trade at N411.50 to a dollar at the I&E window and remained flat at N503 per dollar at the parallel market.

Add a comment