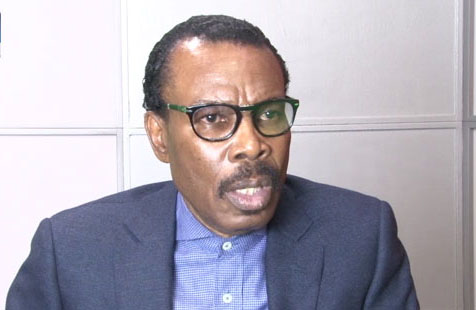

Bismarck Rewane, chief executive officer of Financial Derivatives, says Nigeria’s economy is expected to experience growth in the first quarter of 2024.

Rewane, who was a guest on Arise News on Saturday, said Nigerians will have to endure “more pain” before next year.

“The bad news is that there is pain and they will be more pain in the short run but the good news is that there will be gains in the first quarter of 2024,” he said.

“I used to think that you will get that sooner, but you will need to have your supplementary budget and recycle money into the system.”

Advertisement

In his inaugural speech as president on May 29, Tinubu announced the removal of petrol subsidy, a declaration that resulted in a hike in the pump price of petrol.

TheCable reported on Tuesday that the price had surged to N617 per litre in the federal capital territory (FCT) and environs, whilst it is sold for around N568 a litre in Lagos.

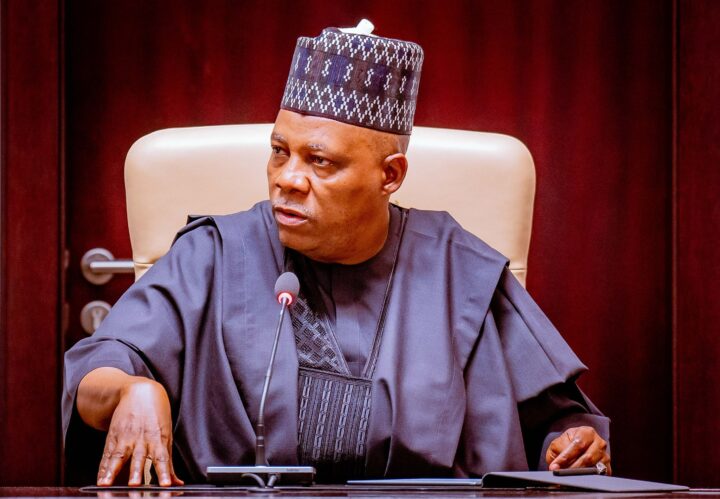

George Akume, secretary-general to the government of the federation (SGF), on Saturday, asked Nigerians to be patient while the government implements solutions to “normalise” the price of petrol.

Advertisement

The former Benue state governor described the petrol subsidy regime as regressive, adding that the annual payments were not sustainable and that Tinubu “had to act”.

Akume also said Tinubu’s actions of unifying the exchange rate and rejigging the country’s security architecture were proof of his commitment to securing the country’s future.

Commenting on the exchange rate, Rewane said: “What system is being used to keep your exchange rate from being misaligned fundamentally, I think that’s the key issue.

“The exchange rate is misaligned because there are certain things that are being done that affect it. For example, you are holding some variables constant while allowing some variables to change.

Advertisement

“In reality, no variable should be constant. Any economist who says a variable is in constant is practising partial equilibrium analysis and it doesn’t work.”

On June 14, the Central Bank of Nigeria (CBN) announced the unification of all segments of Nigeria’s FX market, and the floating of the local currency.

The policy was geared towards collapsing all FX windows into the investors and exporters (I&E) window.

Advertisement

Add a comment