Nasir el-Rufai, former governor of Kaduna, was in the news all weekend over the debt profile of the state after his eight-year tenure.

During a town hall meeting in Kaduna on Saturday, Uba Sani, governor of the state, said he inherited a debt burden of $587 million, N85 billion and 115 contractual liabilities from the administration of el-Rufai.

The Kaduna governor said due to the rise in the exchange rate, the state is paying back almost triple of what was borrowed by El-Rufai.

He said N7 billion of the N10 billion federal allocation to the state in March was deducted to service the debt.

Advertisement

El-Rufai handed over to Sani, his ally, on May 29, 2023.

Sani’s comments on the debt profile elicited varied verdicts on the stewardship of el-Rufai in Kaduna.

While some backed el-Rufai for using the loans to execute infrastructure projects, others argued that he created problems for his successor with excessive borrowing.

Advertisement

JONATHAN VERSUS EL-RUFAI

Amid the debate over Kaduna’s debt profile, previous social media posts of el-Rufai criticising former President Goodluck Jonathan over debt, began circulating on social media.

A persistent critic of the Jonathan administration, el-Rufai was critical of the federal government over the loans obtained, which increased the country’s debt profile.

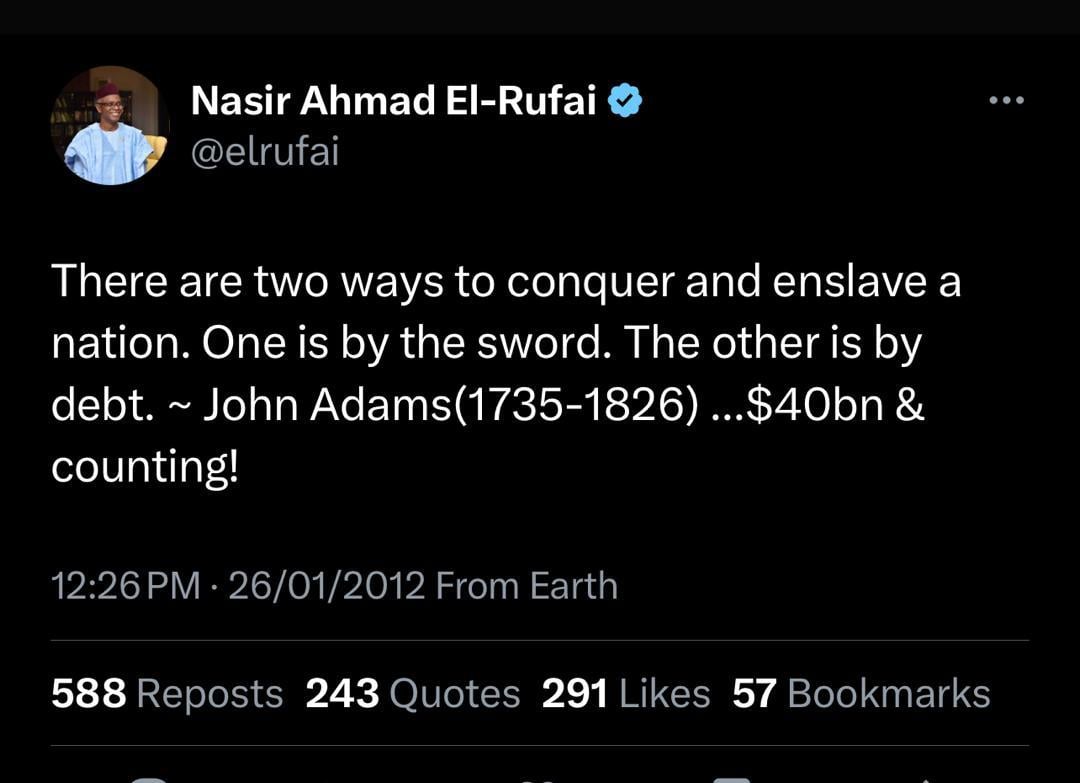

In posts published on his X (formerly known as Twitter) accounts in 2012, El-Rufai criticised Jonathan for borrowing at the expense of the country’s future.

Advertisement

The former Kaduna governor quoted John Adams who stated that sword and debt are the two ways to “conquer and enslave a nation”.

NIGERIA’S DEBT PROFILE UNDER JONATHAN

Advertisement

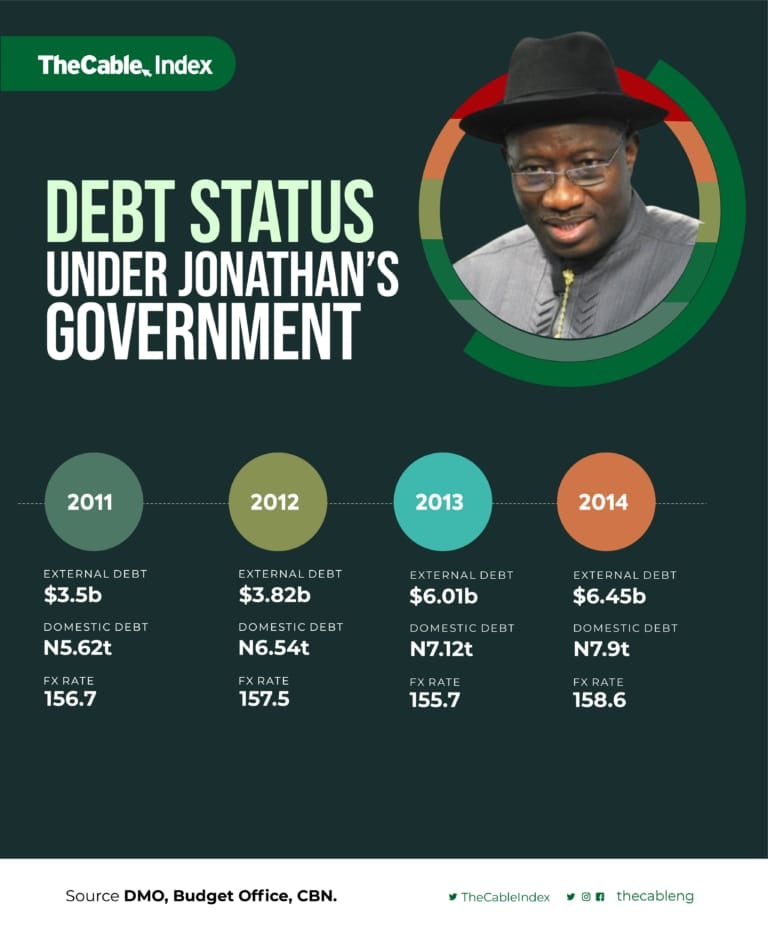

A report on the debt profile of the Jonathan administration as published by TheCable in 2021, showed that the federal government accumulated debt to the tune of N6.17 trillion at the beginning of Jonathan’s tenure in 2011.

Advertisement

Analysis of the debt figure showed that local debt amounted to N5.62 trillion while foreign debt stood at $3.5 billion (about N548.65 billion, using the exchange rate of N156.7/$1).

By the end of 2015, the foreign debt component hit $7.3 billion, while domestic debt increased by N8.4 trillion. The country’s exchange rate was at N197/$1.

Advertisement

Add a comment