Guess what Chinese government officials probably did once they concluded the deal with Nigeria; they may have joyfully popped their champagnes and toast to the victorious renminbi (Yuan), the Chinese rising currency.

Just for a second, try to put on the back of your mind the so-called $6 billion loan given to Nigeria by the clever Chinese and contemplate on what China is gaining.

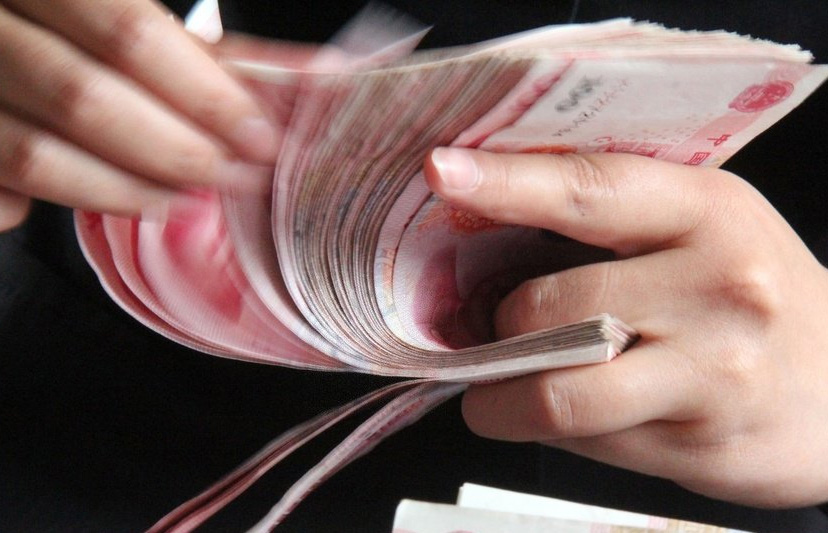

China scored a big one by engineering the currency swap with Nigeria, whereby the Chinese currency Yuan could now become more freely acceptable in business transaction in Nigeria without cumbersome of convertibility. With the concluded deal the renminbi (Yuan) will be included in foreign reserve of Nigeria and will trade in Nigerian banks. In fact, Nigeria will be clearinghouse for Yuan denominated transactions in Africa.

China being the largest manufacturing center in the world with accumulated $3 trillion foreign currency reserves by the People’s Bank of China cannot convince the world to respect and honor her currency in business transactions. The developed and industrial nations especially United States have shunned yuan because of its instability and artificial manipulations by the Bank of China.

Advertisement

China’s renminbi (Yuan) is not a match to the dominant US dollar for the whole wide world does business in dollar. It is not by accident that US dollar is the world reserve currency.

Dollar came to its dominance as a result of its stability, endurance against cyclical economic fluctuations and consistent value as US monetary policy is prudently managed with efficient and sound financial methodological tools by Federal Reserve Bank.

United States of America has been justifiably complained about the inconsistent of Yuan currency as being engineered and manipulated by Bank of China to aid in reinforcing China as the largest exporting nation. China is an export-orientated economy that substantially anchored its economy on exportation and accumulation of intimidating foreign reserves.

Advertisement

By consciously lowering the value of Yuan, China makes her products attractive and less expensive to foreigner buyers and consumers.

Since China is not making headways with United States and other industrial economies in the acceptance of its currency for business deals. China has become smarter, even more creative in going to Africa and developing economies to market her Yuan. China is incrementally succeeding, countries like Kazakhstan, Argentina are following put and now the agreement with Nigeria is positioned for the currency swap and Nigeria as a clearinghouse will attract many African countries.

The Chinese saying of “a journey of thousand miles begins with a single step,” is yielding fruits; steadily and gradually China is making inroads with its currency especially on the countries that lean on China for loans and financial support.

As for Nigeria with its $6 billion loan from China: Is it good enough? For the opening door for China to dump her products in Nigeria and fabricate few infrastructures in the country possibly with Chinese labor and inflated materials. Can we say that it is a sweet deal?

Advertisement

The agreement with China – specifically the currency swap will not put to a halt on the slumping naira neither will it re-position naira against the potent dollar. It may mildly put some pressure on dollar but it will not retard the accelerating dollar exchange rate to naira. Nigeria’s problem is not just the declining oil price but herculean mismanagement of her resources that left country unprepared to take-off as an industrial entity. How can it be an industrial nation and be producing goods for export without electricity and safety?

Can Nigeria proudly and truly beat her chest and proclaim her victory in this China deal? Nigerian officials should convey to their Chinese counterparts that the deal must be reciprocal and they can even ask them to later forgive the loan or make the loan interest free.

Additionally, let the Chinese know that Nigerian labor should be the lion share in the execution of the contracts and that the inflated price of materials coming from China is unacceptable. The Bank of China will continue to manipulate Yuan to support China’s economy. Even with Yuan as part of the mix in the country’s foreign reserve, Nigeria lacks the clout to redirect China’s monetary policy.

Chiakwelu is principal policy strategist at AFRIPOL.

Advertisement

Contact: [email protected]

Advertisement

Views expressed by contributors are strictly personal and not of TheCable.

Add a comment