A federal high court sitting in Port Harcourt has reportedly dismissed an application by the Federal Inland Revenue Service (FIRS) seeking to stop the Rivers state government from collecting Value Added Tax (VAT).

Kelvin Ebiri, special assistant to the governor, in a statement, quoted the court as saying that “granting the FIRS application for a stay of execution would negate the principle of equity.”

Last month, the court issued an order restraining FIRS from collecting VAT and Personal Income Tax (PIT) – directing the Rivers state government to take charge of the collection.

The landmark judgment prompted FIRS to file a stay of execution and advised the public to maintain a status-quo on the payment of the taxes.

Advertisement

“Justice Stephen Dalyop Pam, in his ruling, noted that the “Rivers state government through the State Assembly has duly enacted Rivers State Value Added Tax No. 4, 2021, which makes it a legitimate right of the state to collect VAT,” the statement reads.

“According to the judge, every court in the country is constitutionally mandated to obey every legislation enacted by both the National and State Assembly.

“He explained that the Rivers state government law on VAT remains valid until set aside by a court of competent jurisdiction.

Advertisement

“Justice Pam stated that since FIRS was ab initio acting in error by collecting VAT in Rivers state, and has a huge burden of refund of those monies, there was no need to allow it to incur further liability.

“The judge declared that the FIRS application is refused and dismissed because all subsisting laws concerning the collection of VAT stand in favour of the Rivers state government.”

Mark Agwu, counsel to Rivers state government, said the state is still entitled to collect VAT within its jurisdiction.

“Today, the court has delivered its ruling dismissing the said application for stay of execution, though without cost. In fact, the court’s reason is that if it should grant a stay, it is more or less like over- ruling itself,” Agwu said.

Advertisement

“And then, since the court is empowered to recognize all laws enacted by the National Assembly or the State Houses of Assembly, therefore, that law (Rivers) stands, it is a substantive law.

“Therefore, the issue of collection of VAT as it stands today, Rivers State Government is still entitled to so collect. That is where we are today.”

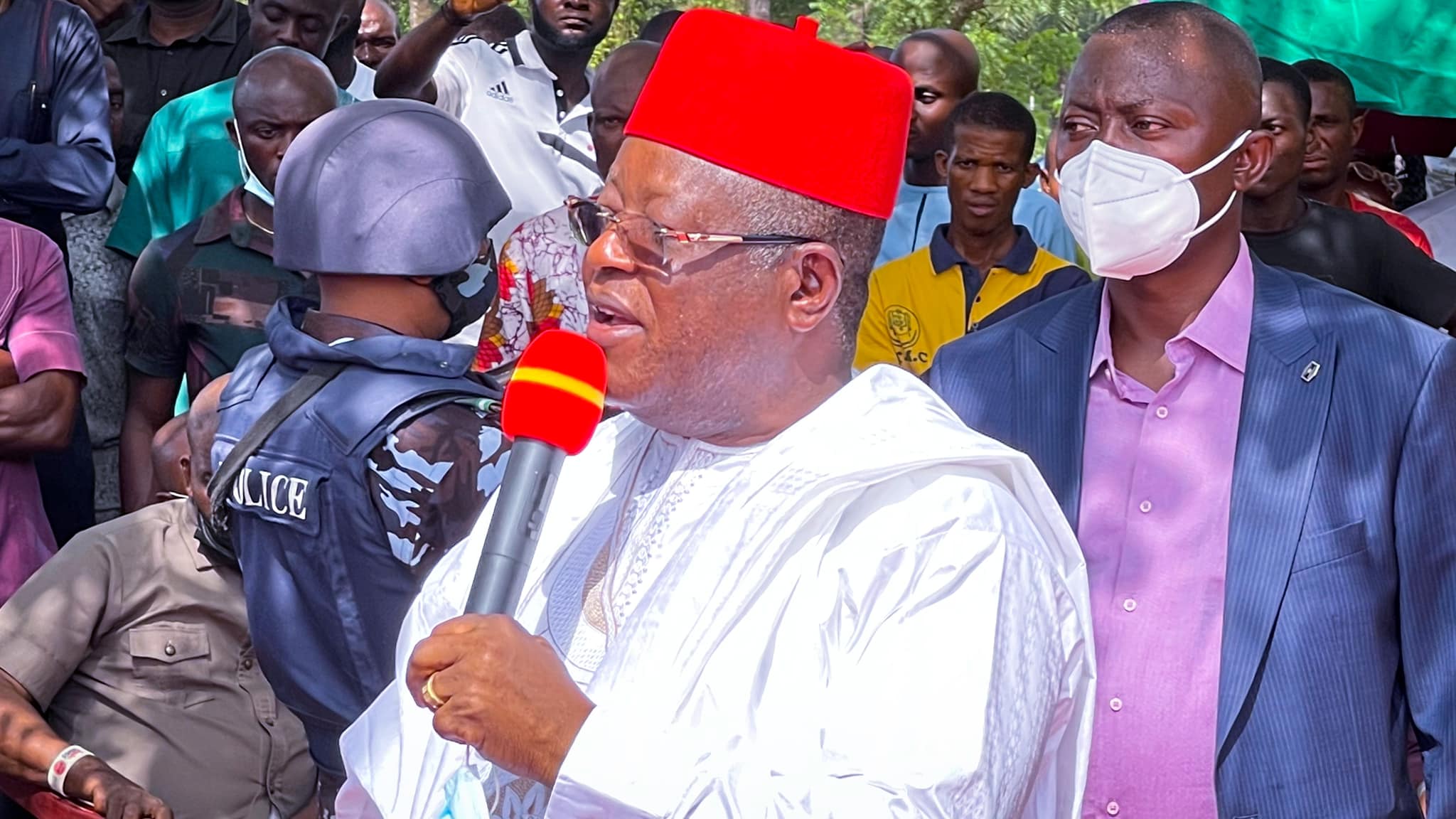

In his reaction, Isaac Kamalu, Rivers state commissioner for finance, budget and economic planning, said the decision by the Lordship confirmed the position, both constitutionally and legally, that Rivers State has the authority to collect Value Added Tax (VAT).

“Well, first we need to thank God. Second, we need to thank the Judge for their courage. If you recall, the court had already declared that it is the Rivers state government that has the constitutional responsibility for the collection of Value Added Tax.

Advertisement

“Following that decision of the High Court, which is binding on all parties and institutions, the Rivers State Government and the State Legislature has the Value Added Tax Law of Rivers State No. 4 of 2021 in force too.

“I think the decision by the Lordship this morning is to confirm the position, both constitutionally and legally that the state has the authority to collect Value Added Tax (VAT).”

Advertisement

TheCable has not been able to independently confirm the court ruling.

Abdullahi Ismaila Ahmad, FIRS spokesperson, has been contacted for comment.

Advertisement

Add a comment