The Revenue Mobilisation Allocation and Fiscal Commission (RMAFC), says it will probe 22 deposit money banks in the country over the funds collected as stamp duty since January 2000.

In a statement released on Sunday, Ibrahim Mohammed, the commission’s spokesperson, said the N33 billion remitted so far by the banks are below expectations.

Mohammed said the commission hopes to recover N100 billion from the probe.

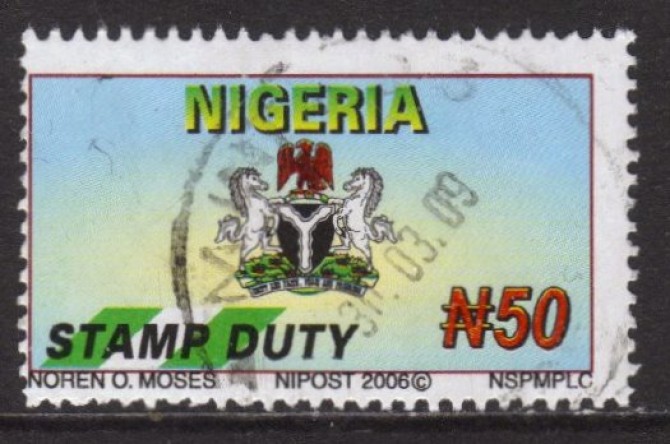

Stamp duties are charges collected on legal documents such as cheques, receipts, military commissions, licences and land transaction papers.

Advertisement

Customers are charged N50 for every transaction worth N1000 and above.

“To this end, the commercial banks had been deducting the sum of N50 on every deposit with a value of N1,000 and above since January 2000,” he said.

“At the moment, the total sum of N33 billion had been realised through the collection of stamp duties which falls far below the expectation of stakeholders.

Advertisement

“It is expected that at the end of the exercise, over N100 billion would be recovered.”

According to Mohammed, the commission will engage forensic audit firms to carry out the probe which will cover stamps used on cheque books prior to the introduction of electronic transactions.

Mohammed said that in a similar development, RMAFC had also embarked on the reconciliation exercise of signature bonuses and other miscellaneous revenues from the oil and gas industry to enable the commission to engage other stakeholders.

This, he said, was with a view to reducing revenue leakages and enhance remittance into the federation account.

Advertisement

He added that the commission, therefore, seeks the support of stakeholders, especially the Department of Petroleum Resources (DPR), the Federal Inland Revenue Services (FIRS) and the Central Bank of Nigeria (CBN) to enable it to succeed in the exercise.

RMAFC was established to monitor accruals into and disbursement of revenue from the Federation Account, review from time to time, the revenue allocation formula and principles in operation to ensure conformity with changing realities.

Add a comment