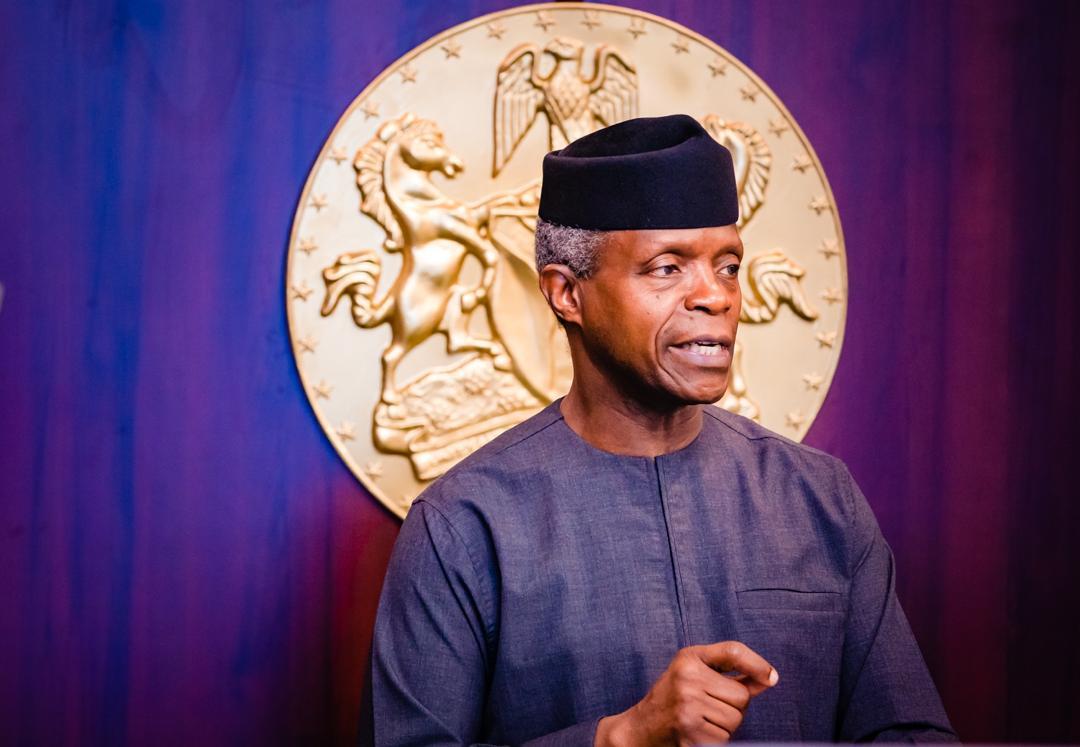

Vice President Yemi Osinbajo says there is a need for the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) to come up with robust regulations for cryptocurrencies.

Speaking at the one-day economic summit organised by the CBN, Bankers’ Committee and Vanguard Newspapers, Osinbajo said the disruption caused by cryptocurrencies will challenge traditional banking and also give room for efficiency and progress.

“Clearly, the future of money and finance especially traditional banking must be exciting as it is frightening but as we’ve seen in many other sectors disruption makes room for efficiency and progress,” he said.

“I fully appreciate the position of the CBN, the Securities and Exchange Commission (SEC) and some of the anti-corruption agencies on some of the abuses of cryptocurrencies and their well-articulated concerns.

Advertisement

“I believe their position should be the subject of further reflection. There is a role for regulation here and it is in the place of our monetary authorities and SEC to provide a robust regulatory regime that addresses these serious concerns without necessarily killing the goose that might lay the golden eggs.”

Osinbajo said Nigeria needs to be prepared for the shift that may come sooner than later.

“Already remittance systems are being challenged. Blockchain technology will provide far cheaper options to the kind of fees being paid today for cross-border transfers.

Advertisement

“I am sure you are all aware of the challenge that the traditional SWIFT system is facing from new systems like Ripple which is based on the blockchain distributed ledger technology with its own crypto tokens.

“There are, of course, a whole range of digital assets spawned daily from block-chain technology. Decentralized finance, using smart contracts to create financial instruments, in place of central financial intermediaries such as banks or brokerages is set to challenge traditional finance. The likes of Nexo finance offer instant loans using cryptocurrency as collateral. Some reserve banks are investigating issuing their own digital currencies.”

Cryptocurrencies in the coming years will challenge traditional banking, including reserve banking, in ways that we cannot yet imagine, so we need to be prepared for that seismic shift. pic.twitter.com/tbIR8eah2s

— Prof. Yemi Osinbajo (@ProfOsinbajo) February 26, 2021

Advertisement

The Central Bank of Nigeria recently directed banks and other financial institution to close accounts of persons or entities involved in cryptocurrency transactions.

The CBN argues that cryptocurrencies pose the risk of loss of investments, money laundering, terrorism financing, illicit fund flows and other criminal activities.

Advertisement

1 comments

In fact I totally agree with what our vice president is saying

The FG should just try and place regulations on these cryptocurrency of a thing because their is nothing that has disadvantage that does not have advantage