The Securities and Exchange Commission (SEC) has warned some fund managers to desist from holding on to clients’ funds and securities.

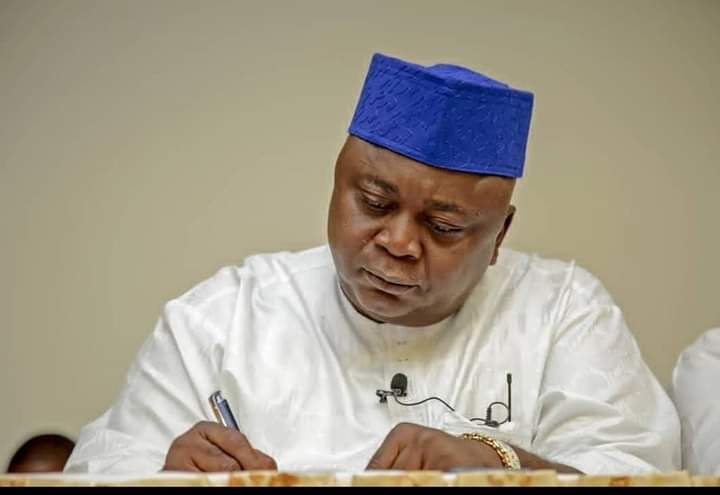

Lamido Yuguda, director-general, SEC, said this during the third quarter capital market committee (CMC) news conference held in Lagos.

Yuguda warned that there would be severe sanctions for those that persist in the act.

He said holding on to clients’ funds and securities is a clear violation of the commission’s consolidated rule 95 (1-2) and reminded fund managers that all funds and securities of clients being managed by their firms must be vested with the custodians.

Advertisement

Yuguda, who also drew the attention of fund managers to issues that arose from the commission’s recently concluded inspection of fund/portfolio management operations, said several fund managers managing discretionary and non-discretionary products and portfolios were yet to seek a “no objection” of their products and portfolios from the commission.

This, he said, is also a violation of the commission’s rules.

Speaking on the increasing importance of fintech, sustainable finance, financial inclusion and non-interest finance, the SEC boss emphasised the commission’s commitment to creating awareness, imparting knowledge and engendering public participation in these topical areas.

Advertisement

He said the minister of finance, budget and national planning has granted approval on non-interest finance (taxation) regulation, which has already been gazetted.

“This has important implications for the market towards encouraging new issuances of non-interest capital market products and services. It is expected that issuers and market operators will take advantage of this by creating more non-interest finance products,” he said.

Yuguda further expressed appreciation over the recent intervention of the house of representatives’ committee on capital markets and institutions on unclaimed dividends.

“The committee is investigating the rising value of unclaimed dividends and unremitted withholding tax on dividends,” he said.

Advertisement

“The commission expressed its readiness to provide all the necessary support to the committee to enable it to carry out its assignment.”

He added that the commission was rebuilding the e-dividend management mandate system (e-DMMS) platform, which according to him, involves having a centralised submission of e-dividend mandate forms, application programming interface (API) for banks and registrars, a revamped web interface, among others.