The Securities and Exchange Commission (SEC) says it will launch a revised version of the 10-year capital market master plan to reflect the dynamism of the market and developments in financial technology.

The Nigerian capital market master plan (2015- 2025) is the blueprint for developing the country’s capital market within ten years.

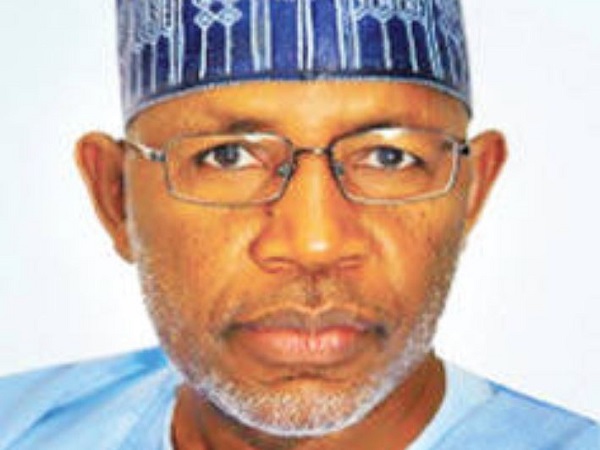

In a statement issued on Sunday, Lamido Yuguda, SEC director-general, said the commission would organise a capital market conference in 2022 to launch the new policy.

The statement added that the policy will incentivise the Nigerian National Petroleum Company (NNPC) Limited and Dangote Refinery to list on SEC-registered trading platforms.

Advertisement

As the year commences, the SEC DG expressed confidence that the results of the various initiatives implemented will begin to gradually manifest, spurring developments in many aspects of the market.

According to him, as the restrictions of COVID-19 and its variants ease up, the market will witness renewed confidence expected to introduce fresh investments from domestic and foreign investors.

“As we expect improvements in both economic and capital market activities, we must remain committed to developing the market in line with the 10-year master plan,” Yuguda said.

Advertisement

“Some of the key initiatives to be pursued in 2022 are as follows: The repeal of the Investment and Securities Act (ISA) 2007 and passing of the Investment and Securities Bill 2021 to align the enabling law with the realities and trends in capital market regulation and practice in Nigeria;

“In conjunction with the NASD Platform, provide the necessary incentives and support to attract SMEs to get listed. Already, rules on crowdfunding to encourage new funding sources for SMEs have been developed.

“The SEC will continue the enhancement of the existing regulatory framework guiding the operations of the market by keeping pace with the evolving changes in market practices, especially with the advent of financial technology and digital assets.”

Yuguda said the commission would improve coordination amongst stakeholders to create synergies.

Advertisement

He listed the stakeholders as the national assembly, Central Bank of Nigeria (CBN), National Pension Commission (PenCom), Corporate Affairs Commission (CAC), National Insurance Commission (NAICOM), Debt Office Management (DMO) and Federal Inland Revenue Service (FIRS),

The SEC boss also disclosed that the commission would carry out advocacy efforts to the relevant government agencies such as the Nigerian National Petroleum Company (NNPC) Limited and the federal ministry of petroleum resources on the listing of NNPC shares.

“The SEC will continue with the sensitisation programmes and strong capacity building initiatives on non-interest capital markets products and services to attract sub-nationals and corporate issuances to this market segment,” he added.

“We also plan to provide extra support to the registered commodities trading platforms to complement government’s renewed diversification efforts in agriculture and carry out workshops to deepen the commodities trading ecosystem.”

Advertisement

Add a comment