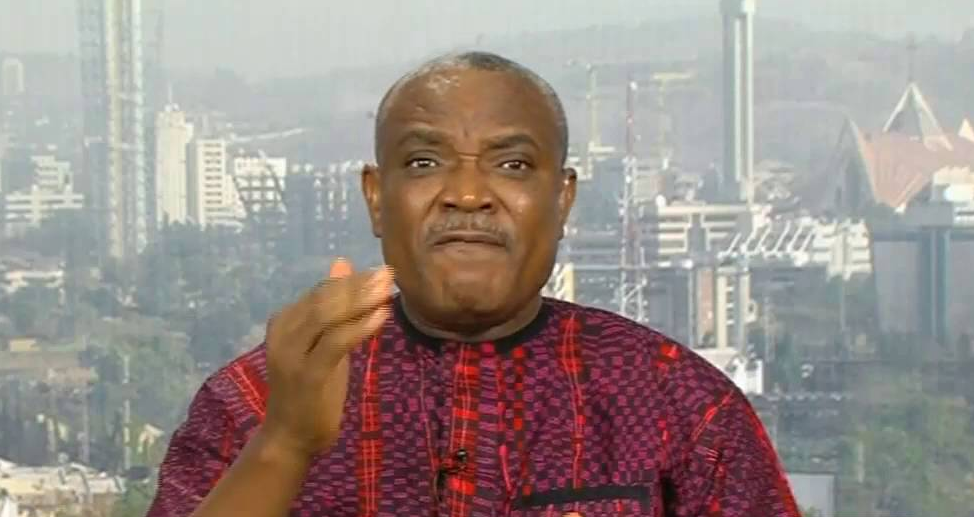

Godwin Emefiele, Central Bank of Nigeria (CBN) governor, says commercial banks must sell forex to people who are not their customers.

The CBN governor made this statement on Monday when he paid an unannounced visit to First Bank, UBA and Zenith banks offices in Abuja.

He said the visit was to ascertain banks’ compliance with the new directive by the CBN to sell foreign currencies to all customers over-the-counter.

“The essence of us being here is to make sure that the banks are able to service not just their customers, but also those who are not their customers, particularly those who want to travel outside the country,” he said.

Advertisement

“I want to seize this opportunity to let everybody know that there is dollar availability. If you want to travel, go to a bank. It doesn’t have to be your bank; whether you have an account or not, you should be attended to.

“Just walk into any bank with your travel document, show your visa and air ticket. They will ask for your BVN and once they verify it, they should attend to you on the spot.

“Nobody should go home and come back because he or she wants to buy foreign exchange. You should be attended to immediately and that’s what over-the-counter means.”

Advertisement

According to him, all banks are well stocked and whoever wants to make foreign exchange transaction should look for the “BTA/PTA counter’’ or “Bureau de Change counter’’ located in all banks’ branches.

The CBN boss said all banks were expected to display daily foreign exchange rates for major currencies so that the customer would be aware of how much he or she is paying.

“The essence of this inspection is to say that there is ample liquidity for any eligible traveller and nobody should fall into the temptation of buying BTA or PTA from a bank at more than N360 to a dollar.

“The banks are entitled to their margin, and their margin has already been built into the price so you don’t have to pay any additional charge.”

Advertisement

According to Emefiele, the CBN examiners will continue to do on-the-spot assessments at banks to find out and be sure that people who are travelling get attended to over-the-counter.

NAN reports that Nigerians travelling out of the country for personal reasons are entitled to access a maximum of 4,000 dollars every quarter, while those going for business, 5,000 dollars.

Advertisement

Add a comment