After two years of recovery and growth, Skye Bank is headed for another drop in profit in 2014 based on the third quarter growth rate. Two major developments on the bank’s income statement are responsible for undermining its growth momentum this year. One is provisioning for credit losses, which is up by 62% and the other is a decline in gross earnings, both of which have led to loss of profit margin and an increase in the cost-income ratio.

The bank’s management has succeeded in putting costs under control since last year and that remains its answer to the problem of declining revenue this year. Interest expenses dropped by almost 15% at the end of the third quarter and operating expenses also went down marginally. The only major cost out of control is the loan loss expense that has claimed a significantly increased share of gross income.

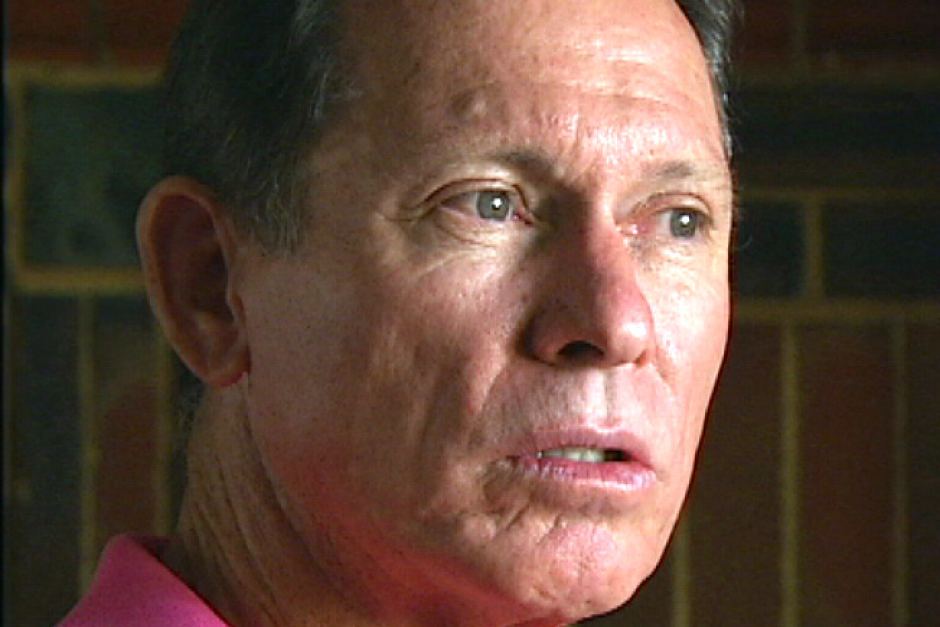

Mr. Timothy Oguntayo, group managing director/chief executive officer of Skye Bank, faces the challenge of how to grow the bank’s revenue and keep loan loss provisioning down. Revenue weakness is persisting for the second year after a slight decline last year and still below the revenue peak attained in 2009. The revenue weakness is worsened by rising credit losses this year and Oguntayo faces the possibility of reporting a drop in profit in 2014.

The bank closed third quarter operations with gross earnings of about N97.13 billion, which is a decline of 4.8% year-on-year. Interest income accounted for the decline with a drop of 8%, countering a growth of 15.3% in investment and other operating income. The net lending portfolio remained virtually static at N576 billion, just 4.8% up on the closing figure last year.

Advertisement

Based on the growth rate in the third quarter, full year gross income is projected at N132.2 billion for Skye Bank at the end of 2014. That will be a moderate improvement of 3.8% over the full year revenue figure of N127.34 billion in 2013. Revenue performance has been weak since last year, having declined from N127.73 billion in 2012.

After tax profit amounted to N9.87 billion at the end of the third quarter, which is a drop of 15.3% year-on-year. Based on the current growth rate, the bank is expected to close the current year with an after tax profit of N13.4 billion. Despite a step up from the second quarter growth rate, the full year outlook still indicates a likely drop of 16.4% from the peak profit of N16.02 billion the bank posted in 2013. Should loan loss provisioning moderate in the final quarter, the full year profit outcome might be better than forecast.

The anticipated drop in profit this year is indicating that the profit recovery/growth process that began in 2012 isn’t going to be sustained. The bank had lost nearly one-half of its prior year profit in 2011 while a strong recovery followed in 2012, reaching a new peak in 2013.

Advertisement

Profit growth this year is undermined by rising loan loss expense, which at N7.52 billion in September, rose by a clear 62% year-on-year. With the decline in gross earnings, the provision claimed 7.7% of gross earnings against 4.5% in the third quarter of last year. Inability to grow revenue also contributed to the bank’s profit weakness.

Apart from credit loss provisioning, the other main expense lines of the bank are virtually under control. Interest expenses dropped well ahead of interest income at 14.8%, which prevented a possibly wider decline in net interest income. The decline in interest expenses is against a marginal decline in deposit liabilities, indicating the lowering of average cost of funds for the bank.

Management held operating cost tight, resulting in a slip of 0.6% at the end of the third quarter. This is reckoned as a feat accomplished in a rising cost environment. Total operating expenses margin nevertheless increased from 46.2% in the same period last year to 48.3% at the end of the third quarter. The lowest cost-income ratios in the banking industry come from Guaranty Trust Bank with operating cost margin of 34.2% and Zenith Bank with 41% at the end of the third quarter.

The cost-income relationship of the bank at the end of the third quarter resulted in a loss of profit margin. Net profit margin has declined from 11.4% in the same period last year and from 12.6% in December to 10.2% at the end of September. It has however improved from 9.1% in the second quarter.

Advertisement

The bank earned 75 kobo per share at the end of the third quarter, down from 88 kobo in the same period last year. Earnings per share is projected at N1.0 for Skye Bank at full year, an anticipated drop from N1.21 earned in 2013.

Skye Bank Plc: 3rd Quarter Earnings Report |

|||

| Sept 2014 | Year-on-Year Growth -% | Full Year Projection Nb | |

| Gross Earnings – Nb | 97.13 | -4.8 | 132.2 |

| Asset Turnover | 0.09 | – | – |

| After Tax Profit – Nb | 9.87 | -15.3 | 13.4 |

| Net Profit Margin – % | 10.2 | – | 10.1% |

| Earnings per Share – Kobo | 75 | -15.3 | 100 Kobo |

| Dividend per Share (2013) | 30 Ex Div | – | – |

| NSE Closing Price 25/11/14 – N | 2.46 | – | – |

| Share Price Year-to-Date – % | -44.1 | – | – |

2 comments

I knew Skye Bank will be having many financial issues some months back, that was why I sold all my share in Skye Bank..

I expect them to perform better from 2016

I believe Skye Bank will bounce back before the end of Dec 2013 with the current spate of transactions. However, thier acquisition of Mainstreet BAnk may result into reporting negative PBT at the end of the year