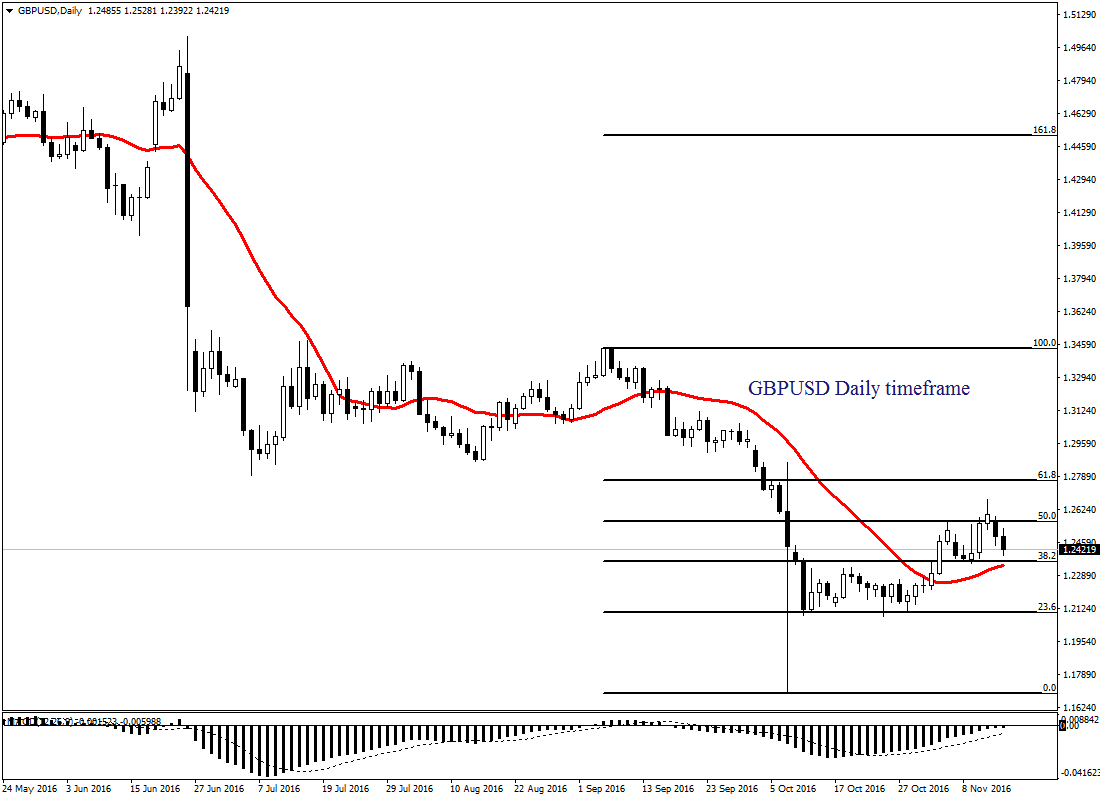

Sterling was exposed to downside pressures on Tuesday following the unexpected decline in October’s inflation figures which offered a fresh opportunity for bearish investors to send the GBPUSD lower.

Consumer price growth in the UK receded back to 0.9% last month; falling short of the 1.1% expectations with smaller price hikes in clothing and university fees acting as the biggest drag. Although this instance of cooling inflation could alleviate some pressures enforced onto the Bank of England, Sterling weakness amid the Brexit woes may ensure UK inflation to continue its positive trajectory in the New Year. The pound remains haunted by the ongoing Brexit fears with the noticeable price vulnerability attracting sellers to drag the GBPUSD towards 1.2200.

Investors may direct their attention towards the Inflation report hearing where BoE Governor Mark Carney appears before Parliament’s Treasury Committee. Discussion revolving around the ongoing Brexit developments, inflation forecasts for the New Year, economic outlooks and Carney’s term in the office could inject the sensitive Sterling with additional levels of volatility.

Advertisement

US Retail sales in focus

The Greenback was a star performer across the currency markets on Monday as the combination of inflated US rate hike expectations and optimism over rising economic growth in the States under Trump’s administration enticed bullish investors to attack.

Sentiment is firmly bullish towards the Dollar with the Dollar Index hovering around 11 month highs as speculators add bets over the Federal Reserve raising US interest rates in December. Much attention may be directed towards October’s retail sales figure which if exceeds expectations could play a key chess piece ahead of December’s Fed policy meeting. From a technical standpoint, Dollar bulls remain in full control with a breakout above 100.00 on the Dollar Index opening a path higher towards 100.50.

Advertisement

Commodity spotlight – Gold

Gold commenced the trading week on a shaky footing with prices tumbling towards $1210 as the mixture of Dollar strength and mounting US rate hike expectations soured investor attraction towards the zero-yielding metal. The weekly close below $1250 sealed the deal for Gold bears with further declines expected in the future as the unexpected Trump effect encourages sellers to install repeated rounds of selling. With the Fed futures pointing to a 90% probability of a US interest rate increase in December, Gold is caged with any appreciations considered as a technical bounce for a steeper decline lower towards $1200. From a technical standpoint, the metal may be in the process of a technical bounce with the $1250 resistance attractive sellers.

Add a comment